[#77] The future of fintech in India: How do we approach monetization in the age of DPI?

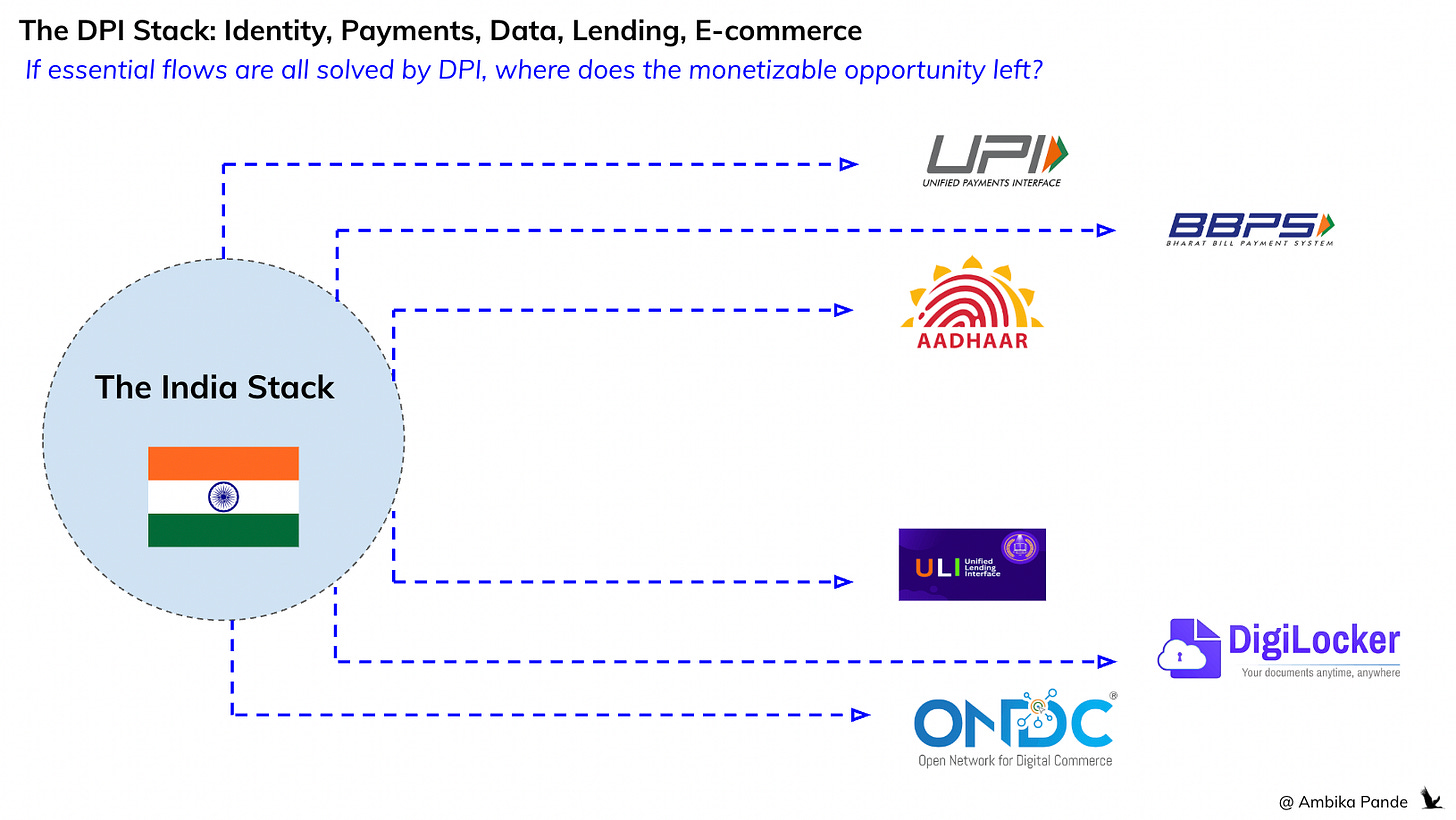

With DPI in India heating up (UPI, and offerings such as AA, ONDC, ULI etc), core offerings being positioned as a "free good," what is the monetizable opportunity in fintech going forward?

As India’s Digital Public Infrastructure (DPI) stack expands, we’re seeing open rails emerge across nearly every fintech and fintech-adjacent category, payments (UPI, BBPS), identity (Aadhaar, eKYC), data sharing (AA), e-commerce (ONDC), and now lending (ULI). This is an unprecedented moment: few countries have built such a comprehensive digital foundation.

Edit (Dec’25): To read the 2025 edition of the IIPP state of DPI report, click here

On one hand, these rails are transformational. Strong, interoperable public infrastructure is what separates developing economies from truly digital-first nations. India has leaped ahead by making foundational financial services cheap, real-time, and universally accessible.

But on the other hand, this raises an important question: what does the future of Indian fintech look like when more and more layers become commoditised? How do open, standardised rails impact innovation, business models, and the quality of financial products we ultimately receive? Do DPIs unlock a burst of new innovation - or do they constrain what private players can build on top?

This is how things are playing out right now

A core tension in India’s DPI story is that these rails are positioned as free public goods (UPI, BBPS, Aadhaar/eKYC, DigiLocker, AA, ONDC, ULI). This creates an expectation that core infrastructure should have zero or near-zero cost.

For fintechs building on top of these rails, this means a massive GMV / MTU TAM, but extremely small revenue TAM. User adoption is high, but willingness to pay is very low. And core margins come from volume, not product differentiation.

As a result: Companies prioritise distribution over monetisation. Players undercut on pricing just to gain scale. The overall revenue pool shrinks, even as usage explodes.

This leads to a structural reality: the core product on the rail is rarely profitable. Fintechs eventually recognise they need to expand beyond the rail to make money. Hence the rise of the full-stack fintech, which is something I’ve covered a lot in multiple editions of this newsletter. Essentially, firms add adjacent revenue lines (wealth, lending, cards, insurance), and profitability only appears when companies reach full-stack scale.

But this creates a new problem: Entry barriers rise - new players can’t survive long enough to scale. Competition reduces, and power consolidates among incumbents. Innovation slows because the market becomes structurally hostile to newcomers, AND there is no incentive to innovate on core rails because of the lack of monetization opportunity.

Meanwhile, RBI continues to expand the DPI footprint. New rails (like ULI) overlap with existing private solutions in identity, underwriting, data exchange, and orchestration. Public-sector rails may or may not be better, but they will set the benchmark price often zero or near-zero.

The end result?

✅ Building on DPI drives adoption, but compresses margins.

✅ The economics push players toward diversification, not focus.

✅ Innovation becomes harder in a market where the infrastructure is free, but the business is not

All this eventually leads to a narrative every fintech operator has discussed at some point:

👉 Indian customers aren’t willing to pay (or aren’t habituated to paying for digital financial services)

👉 Margins are thin → revenue potential is low → products commoditise quickly

leading to an inevitable race to the bottom

👉 Newer players find it extremely difficult to break in because CAC is high, monetisation is weak, and incumbents cross-subsidise heavily

👉 RBI is increasingly absorbing core fintech value propositions

whether through policy, rails, or direct product interventions

👉 So the real question becomes: what next?

And if you look at recent announcements and moves across the ecosystem, this direction feels more real than ever.

Theme 1: Full stack fintechs are winning and it shows in profitability

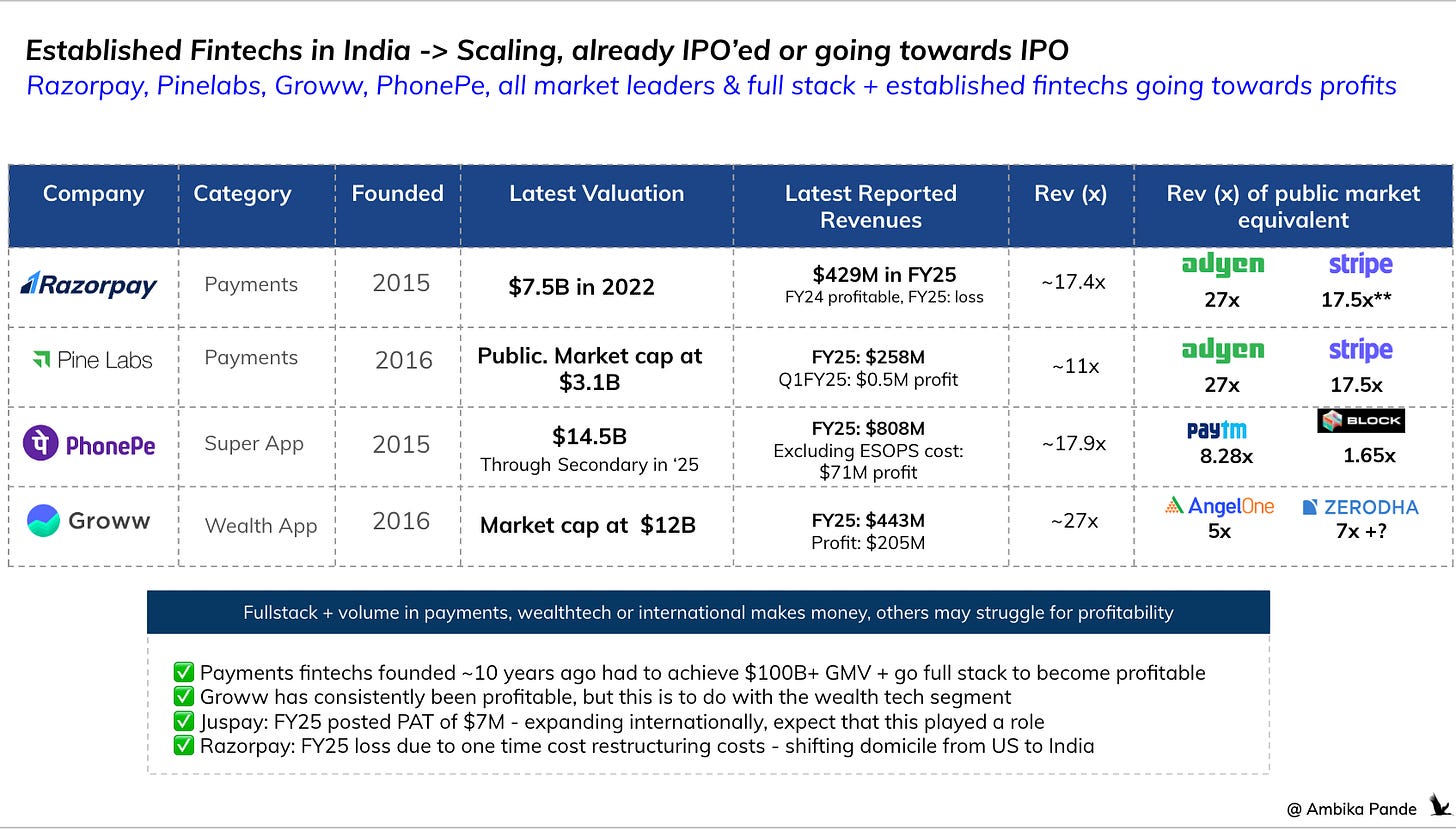

The larger fintechs, which are the ones now preparing for IPOs, or which have already IPO’d have all quietly converged on the same strategy: become full-stack. That means owning payments, credit, distribution, compliance, infrastructure, and increasingly SaaS. And that bet is finally paying off. Once you control multiple layers of the stack, unit economics start to bend in your favour: acquisition gets cheaper, cross-sell increases, and infra revenues smooth out volatility. This is why the biggest names- whether it’s the publicly listed players or Razorpay-scale fintechs are now turning operationally profitable. Not because they cut back, but because scale + full-stack = leverage. In a market where standalone fintech products struggle to survive on thin margins, the full-stack approach is becoming the only path to sustainable business.

PhonePe raised $600M from General Atlantic in Oct 2025, largely through a secondary transaction, at a $14.5B valuation. GA, already an investor, doubled its stake from ~4.4% → ~9%. This kind of pre-IPO stake consolidation usually signals strong investor confidence ahead of a public listing. PhonePe is widely expected to target a 2026 IPO, though timelines will only be confirmed once the DRHP is filed.

📊 2025 Valuation Snapshot

2025 Revenue: $808M (at INR 88 = $1)

2025 Valuation: $14.5B

Revenue Multiple: 17.93×

📊 2024 Valuation Snapshot

2024 Revenue: $575M

2024 Valuation: $12B

Revenue Multiple: ~20.85×

There’s a mild multiple compression from 20.85× → 17.93× YoY, which is consistent with broader fintech re-ratings globally. So then why did General Atlantic pay a premium? If you take the $808M revenue and apply PhonePe’s 2024 multiple (~14.8×), the “fair” valuation looks closer to $12B. So the $14.5B price does imply a premium of ~20%.

But there are several reasons why this premium makes sense:

1. Market leadership in UPI:

PhonePe holds ~52% UPI market share, which in India essentially means owning the consumer payments market itself. Dominance at this scale usually commands premium multiples - similar to Adyen’s historically high multiple due to sheer market strength. Here is where the scale and volume point I had made above comes in

2. Strong merchant-side distribution (PA):

PhonePe’s merchant presence and growing payment acceptance (PA) stack adds another high-moat channel. Distribution is becoming a major differentiator in Indian fintech. Scale and volume strength again here.

3. Profitability, depending on how you look at it:

PhonePe reported a $198M (INR 1727 Cr) loss in 2025. However, after stripping ESOP-related expenses, they are profitable by ~$71M. For many public-market investors, adjusted profitability (ex-ESOP) is a real signal, and it lines up with how companies like Groww have been evaluated as well (more on this later, but Groww is currently trading on the public markets at a revenue multiple of 27x!). And it’s gotten to this profitability because of its scale.

What really stood out to me was Juspay. The company turned operationally profitable in FY25, posting ~INR 62.5 Cr in profits a sharp turnaround from a ~INR 97 Cr loss in FY24. Juspay may have pioneered UPI integrations in India, but like every player building on free public rails, it eventually hit the ceiling on margins. UPI is massive in volume but thin on profitability. So Juspay did what most resilient fintechs are now doing: expanded the stack.

From UPI → Payment Orchestrator

From India → Europe, SEA, LATAM

From software layers → Full-stack acquiring, including its recently announced HSBC partnership

My view is that these international pushes + deeper stack plays are what unlocked its FY25 profitability. The orchestrator and global acquiring business has far better unit economics than UPI rails and Juspay seems to have executed this shift exceptionally well. If you want a deeper dive into how this fits into the broader “license aggregation” trend in fintech, I’ve covered it in detail in: All Roads in Fintech Lead to License Aggregations: Part 6 (link below)

[#74] Do all roads in fintech lead to license aggregation? (Part 6): Multi-license fintechs are driving profits and IPOs

Hi folks, and welcome back to this edition of: Do all roads in fintech lead to license aggregation?

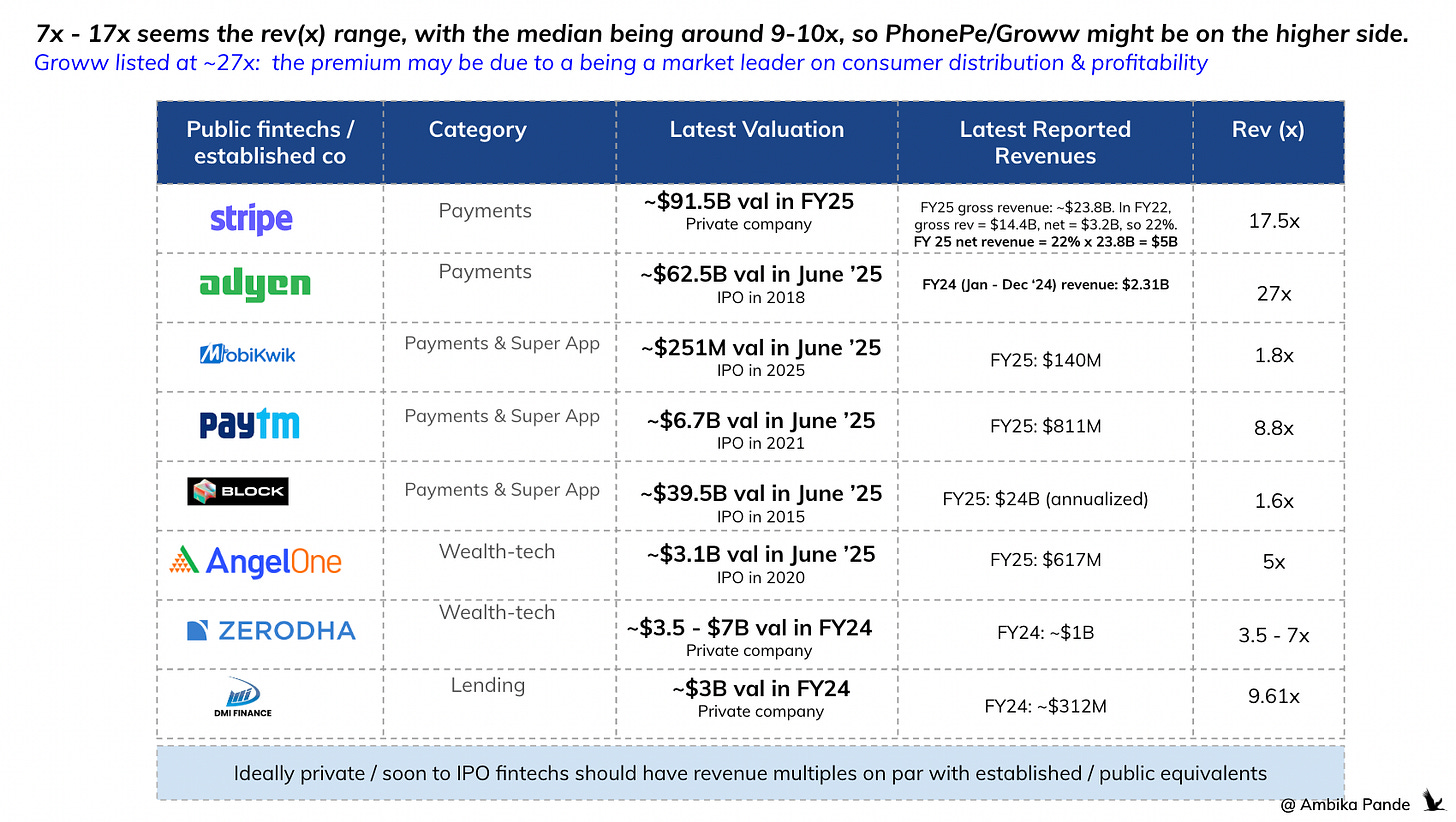

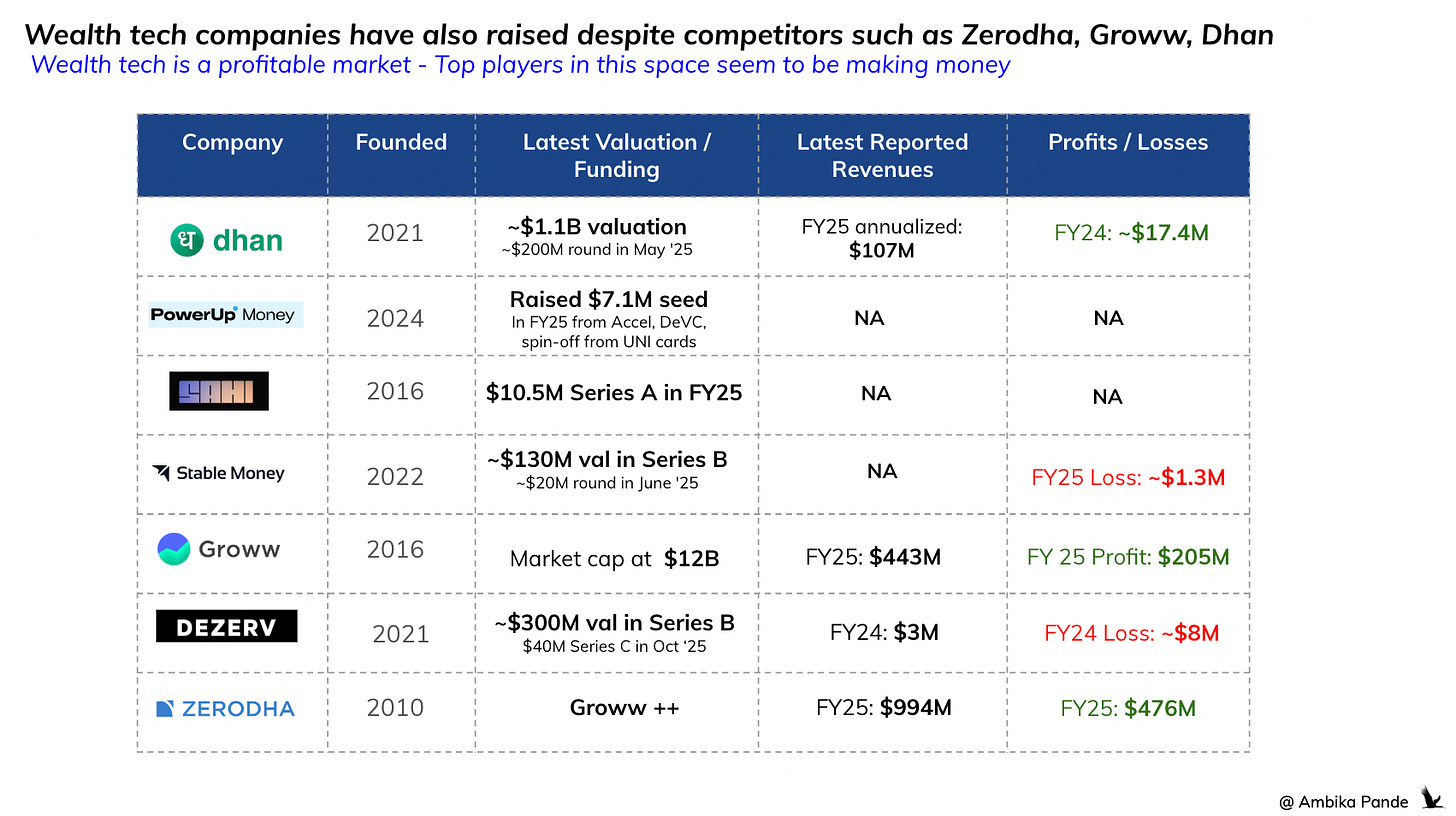

Theme 2: Wealth-tech is emerging as a profit pool and markets are rewarding it

Wealth-tech has quietly become one of the few fintech segments in India with clear monetization and real profitability. Public markets are rewarding both market leadership and the ability to monetize, which is why valuation multiples in wealth-tech (ex: Groww) look meaningfully stronger than in low-margin spaces like payments (ex: Pine Labs). As a result, we should expect more entrants and more capital flowing into wealth-tech. It’s one of the rare fintech categories where revenue potential isn’t capped by DPI rails.

Groww: Raised ~$200M in a pre-IPO round from GIC and Iconiq Capital in June 2025, at a valuation of ~$7B. It’s a market leader in the broking space. It’s a leader in the broking space, and is also trying to get into wealth management, with the acquisition of Fisdom. Stats:

📊 2025 Pre-IPO Valuation Snapshot

Revenue: $443M

Valuation: $7B

Multiple: 15.79x

📊 2024 Valuation Snapshot

Revenue: $296M

Valuation: $7B

Multiple: 23.61x

Here’s how it played out: Pre-IPO fundraise in FY25: Slight correction in valuation multiple here in 2025, the valuation has not moved from 2024 to 2025. Again, Groww is a market leader, reportedly has ~50M active users on its platform. It’s also profitable, and in March 25, it reported a net profit of $205M (INR 1824 Cr).

IPO premium: In November, Groww IPO’ed at a whopping $12B valuation, which is a revenue multiple of 27x. This is much higher when compared to public market equivalents

Groww has clearly outperformed expectations. While most global and public comparables trade in the 8x-15x revenue multiple range, Groww is getting priced at the upper end and my view is that this is driven by a mix of fundamentals and market psychology.

My hunch is:

1. Groww is a massive consumer brand:

With ~50M active users, Groww has become a daily-use product for a large chunk of India’s retail investor base. That consumer-level visibility matters. Even anecdotally, like during the Ashes (where England got absolutely destroyed by Australia) Groww’s branding was everywhere on screen. Consumer mindshare drives investor confidence.

2. The first consistently profitable fintech to IPO

This is a huge differentiator. Paytm IPO’d while still loss-making. MobiKwik was loss-making for years and only turned a sudden profit right before IPO (FY24: INR 14.08 Cr profit vs FY23: INR 83 Cr loss). Post-IPO, they slipped back to a INR 29 Cr loss in Sep ’25 quarter. Groww, on the other hand, has shown consistent, multi-year profitability, which the market rewards with higher multiples and higher trust. And this is probably also because this is one of the segments where DPI does not cap revenues.

3. Pent-up demand for a strong, consumer-facing wealth-tech IPO

Investors have been waiting for a clean, profitable consumer fintech story and wealth-tech fits that perfectly.

Zerodha, the category-defining giant, is still private at a reported $7B valuation, with FY25 revenue of INR 8843 Cr ($1B) and profits of INR 4237 Cr ($481M) - more than 2× of Groww’s numbers. You can check out Growws DRHP here

After Groww’s listing, I expect public markets to value Zerodha materially higher whenever it decides to list.

Dhan also hit unicorn status at a $1.2B valuation in Oct ’25. According to reports, it is tracking $100M ARR and ~$17.5M profit for FY25 - an 11–12x multiple, which fits neatly into the same valuation band.

4. Wealth-tech and broking simply make money

This is the core reason for premium valuation. Unlike payments, where margins are structurally thin, broking + wealth-tech have multiple monetization layers:

F&O brokerage (Groww charges INR 20 per order)

Margin funding

Distribution revenue

AMC economics (Groww acquired Indiabulls AMC in May 2023)

Credit income through its NBFC (gross loan book $123M as of Jun ’25)

This stack gives Groww a wide, high-margin revenue base that scales with trading activity and AUM growth, not just user growth. You can check out my deep dive on the Next Wave in Wealth Management in India below:

[#61] The Next Wave in Wealth Management: Acquisitions, niche TGs & consolidated net worth

There's been activity in the investing and wealth management space lately

I’d be remiss if I didn’t mention the other big fintech IPO that happened in November. Pine Labs IPO’ed at an expected revenue multiple of 11-12x, which is in line with global multiples.

Pine Labs also IPO’ed recently, targeting a $2.9B valuation. With FY25 revenues at $258M (INR 2,274 Cr) and a net profit of ~$0.5M (INR 4.8 Cr) in Q1 FY26, it came to market with steady fundamentals. At listing, Pine Labs debuted at a ~10% premium (~$3.1B). Unlike Groww, which clearly beat expectations, Pine Labs landed exactly where my broader thesis has been: Indian fintechs generally trade in the 9x –10x revenue multiple range. And this makes sense when you look at the business.

Pine Labs is a clear market leader in merchant payments and, much like Groww, is now fully diversified across the stack:

PA (online and offline)

PA-CB

Account Aggregator (via Setu)

PPI

Consumer payments (Fave)

But the nature of the payments ecosystem, especially in India puts a tight ceiling on monetization. Payments, particularly UPI and now AA, are increasingly seen as public goods. And when something is positioned as a public good, the default expectation becomes: free, or close to free.

This has two consequences:

The revenue pool itself becomes structurally small, no matter how large the volumes.

Monetization is constrained by policy and public expectations, not just market dynamics.

So while Pine Labs has executed well, grown sensibly, and delivered a profitable quarter, its valuation is naturally limited by the economics of the payments category, unlike wealth-tech, where monetization is both clearer and richer.

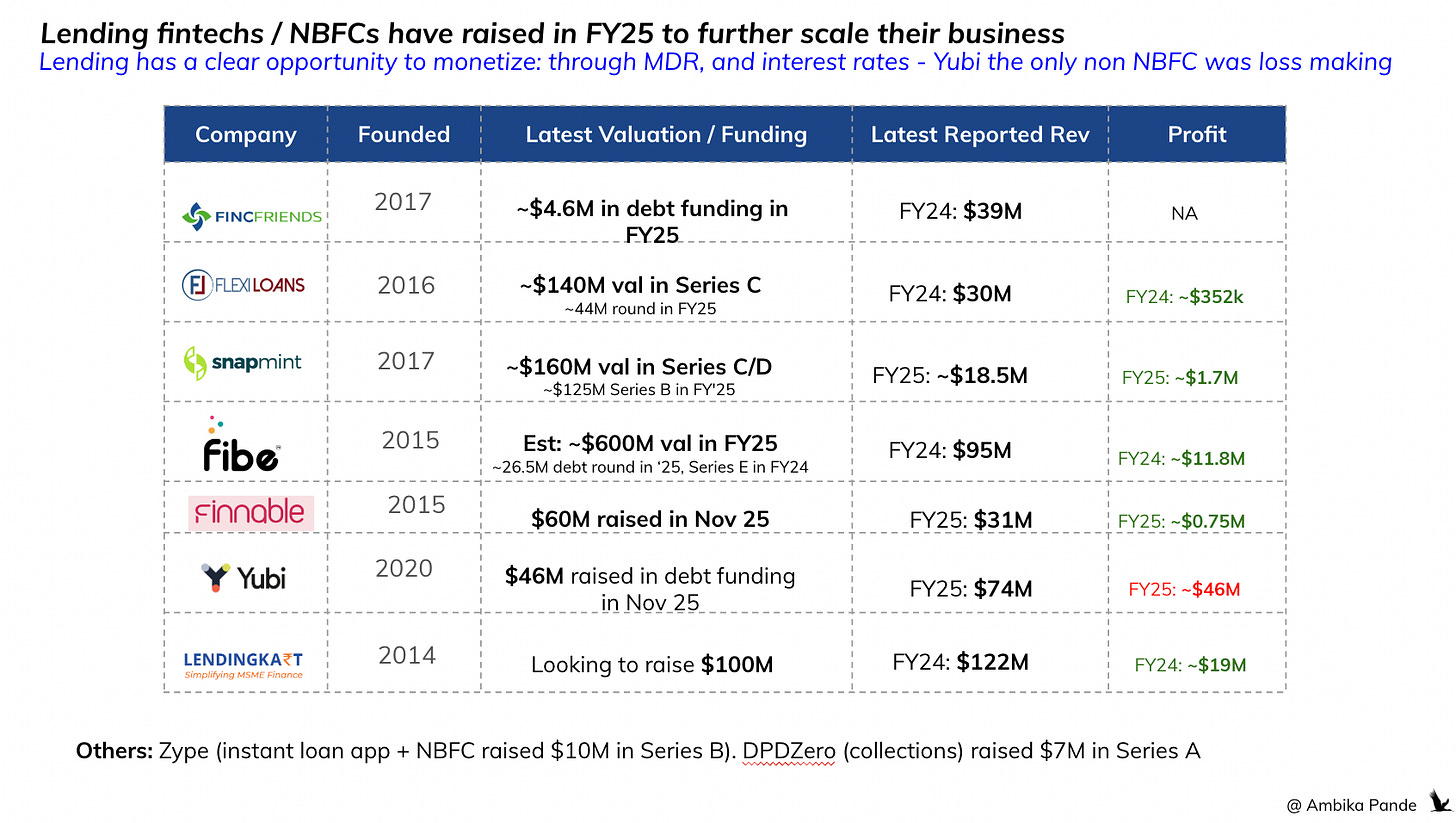

Theme 3: Funding is concentrated in lending and wealth-tech - because these are the segments that actually make money

In FY25, a lot of non-IPO funding activity clustered around lending and wealth-tech. And the pattern is obvious: Lending makes money, through spreads, fees, cross-sell, and credit adjacencies. Wealth-tech makes money, through broking, F&O, distribution, AMC economics, and margin funding. These two categories have clear, proven monetization, unlike most other fintech segments where margins are structurally thin. That’s why investor attention (and capital) has flowed disproportionately here.

✅ Lending:

FincFriends: NBFC, founded in 2017. Raised INR 41.5 crore in debt funding in FY25 to target borrowers in underserved markets in Tier 2 and 3 segments. Reported revenues of INR 349 Cr ($39M)

Snapmint: Raised $125M in Series B in October 25, is a NBFC that looks at BNPL, Credit on UPI segments

Flexiloans: MSME lending platform, raised INR 375 Cr ($44M) in Series C in June 2025

Fibe: Formerly called Early Salary, gives instant personal loans to young professionals and the working population. Raised INR 225 Cr ($25M) in July 2025 as venture debt.

Finnable: Founded in 2015. Raised ~$60M in November ‘25. Offers secured and unsecured loans for salaried professionals. Reported $31M (INR 278.49 Cr) revenue in FY25, and $0.75M (INR 6.74 Cr of profit) in FY25

Yubi: Raised 411 Cr ($46M) in November ‘25 to fund AI and global expansion. It is a debt marketplace, not an NBFC. Revenues of $74M (660 Cr) in FY25, and losses of $46M (INR 416 Cr)

Lendingkart: Looking to raise INR 850 Cr ($100M) from existing investors in FY25. It got a majority stake recently acquired by Fullerton Financial - a Singapore based investment firm that invests in emerging markets. It is a NBFC, and lends in the MSME and working capital segments. FY24 operating revenue of $122M (INR 1090 Cr), and PAT of INR 174 Cr ($19M).

Yubi is not a NBFC and is the only player in the above list that is loss making, everyone else is a “tech enabled” NBFC. So then, maybe one learning here is: Standalone lending TSPs plays are tough, and unless it is a very lean sort of operation may not work. You need a NBFC.

✅ Wealth tech:

Dezerv: HNI wealth management platform. Raised ~ INR 350 Cr ($40M) in its Series C in October ‘25, and reported revenues of $3M and losses of $8M for FY24. For a company that has ~ INR 10k Cr ($1B) in AUM, this is surprising to me. I expect FY25 numbers to be much better.

Stablemoney: Raised a $20M Series B in June ‘25. Super app focused on FDs, and is now also launching FD backed cards

Sahi: Stock trading start-up founded by Swiggy’s ex CTO. Raised $10.5M in Series A funding in June ‘25

Powerup Money: Building ways to make mutual fund investing easier for Indians. Raised $7.1M in seed funding in June ‘25

Zerodha: They conservatively valued themselves at $3.5B a few years ago (they have ~$994M in revenues, and $476M in profits in FY25). However, looking at Groww’s IPO, with its rev X of ~27x, and profit (x) of 60x, just basis math, they could be valued at much higher, closer to ~$27B.

A point worth calling out here is the recent Signzy-Powerup acquisition - a telling signal of the pressure standalone TSPs are facing

Powerup Money began as an in-house initiative at UNI Cards, then spun out as its own startup. Similarly, PowerEdge, another UNI incubated card management product, also spun out and even raised INR 8.5 Cr (~$1M) in May from White Ventures and DeVC. And yet, within months, PowerEdge has now been acquired by Signzy - a global identity verification and fraud platform. In many ways, this acquisition perfectly illustrates the broader trend: operating as a standalone TSP in India is becoming nearly impossible. Margins are thin, competition is high, differentiation is hard, and DPI rails set expectations of near-zero pricing. The only viable outcome for most TSPs is either:

scale extremely quickly,

show sharp differentiation, or

get bundled into a larger fintech’s full-stack offering.

The PayU–Mindgate deal is the most prominent example, a pure infra play getting absorbed into a larger full-stack strategy. And now Signzy’s acquisition of PowerEdge points in the same direction.

Meanwhile, the one area where fintechs are still seeing meaningful revenues is cross-border. Cashfree, Juspay, and a handful of others are placing big bets here because international payments and global acquiring have significantly higher monetization potential. Unlike domestic DPI rails, cross-border isn’t free, and that opens up real economics.

The takeaway is clear: TSPs as standalone businesses are dying, especially in sehments that don’t make money. TSP capabilities as part of full-stack fintechs are thriving.

In this phase of fintech in India, the monetization opportunity is KEY to sustain - growth and “hoping” that at some point monetization will come in is not enough

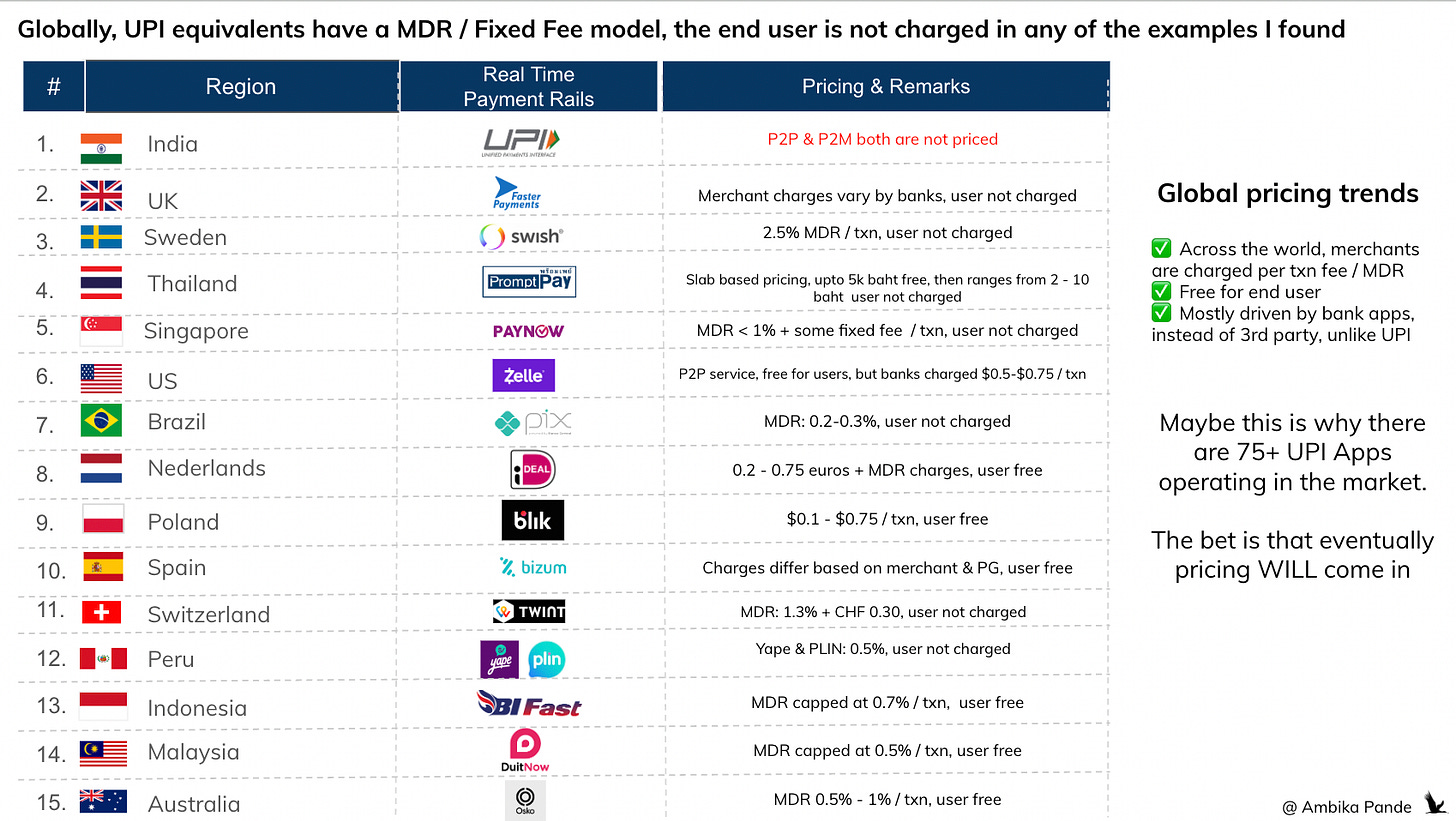

In this phase of Indian fintech, monetization is the strategy. Not a “later problem,” not a “phase two,” not a “once we get enough users” milestone. If your core business doesn’t make money today, it will not survive the DPI era. We’ve already seen this play out in domestic payments and consumer apps built on UPI. The industry kept hoping that monetization would eventually show up, the same way it exists for real-time payment rails globally. Everywhere else, RTP systems have some fees built in so the ecosystem can sustain itself.

But India went the opposite way: UPI became completely free. And when a rail becomes free, every business built directly on top inherits that pricing logic. This is exactly why the idea of capping UPI market share at 30% per app is nearly impossible to execute.

So then who going to pay for growth in a zero-pricing ecosystem? Only the top 3-4 players: PhonePe, GPay, Paytm, CRED, or companies backed by massive platforms like WhatsApp, Supermoney, or now Pop (via Razorpay). When the revenue pool itself is tiny, only players with deep pockets or broad product stacks can afford to subsidize the ecosystem. The only companies that make it through are the ones with real monetizable adjacencies - lending, wealth-tech, SaaS, platforms, cross-border, infra.

Everyone else is effectively running on borrowed time.

In fact, with ULI and a host of other building blocks the RBI is pushing, it increasingly feels like regulators are setting up “shadow fintechs” - public digital utilities that directly compete with established fintech entities. On one hand, these rails drive inclusion and adoption through free or near-free offerings. But on the other hand, they compress the monetization bandwidth to a point where only 2–3 large players can survive sustainably.

These are the DPI rails, the India Stack and they now span four layers:

👉 Digital Identity:

Aadhar - biometric identity (fingerprint + iris + face). This also includes Aadhar based OTP for verification.

eKYC (UIDAI + CKYC + PAN-based). This is whenever you’ve done fully digital KYC, or Aadhar XML / Offline KYC. This also includes CKYC, and PAN verification APIs

eSign: when you sign online using Aadhar authentication

Digilocker: this is a vault where you store all your digital documents, and can be used to verify who you are, instead of having to re-upload your documents

👉 Payments layers

All your UPI, BBPS etc sits here. I’m assuming the eRupee also sits here, but where this will end up is anyone’s guess. As I have mentioned in previous articles, stablecoins are much far ahead in this use case

👉 Data layers

Account Aggregators are the most well known here, but the government is also trying to build stuff around health and credit

👉 Marketplaces

This is the newest, boldest ambition: build “UPIs” for multiple sectors. ONDC: UPI-like network for ecommerce, unbundling the marketplace model so that buyer apps and seller apps can interoperate, and ULI (United Lending Interface): the equivalent of ONDC for lending.

ULI, if implemented the way it is envisioned, could make lending look like UPI:

Merchants integrate with ULI → pass customer details → pick the best lender → fetch data → get underwriting → complete documentation → trigger disbursal → all via standardised APIs.

In theory, this eliminates the need for intermediaries. In practice, TSPs will still be needed for workflow orchestration, compliance, and tech plumbing, but if RBI insists the service must be free, what is the incentive for TSPs to participate?

And this loops back to the larger point: the more the regulator builds free public rails, the smaller the monetizable surface area for private fintechs. Only players with scale, capital, or multi-product synergies will survive; standalone TSPs or thin-stack fintechs are going to find it increasingly unviable.

Now, just to clarify - I’m not against DPI. In fact, I think DPI is one of India’s greatest strengths. It’s essential for financial inclusion, and centrally driven rails are the only way you can ensure that banks, networks, and other ecosystem stakeholders actually participate and move in one direction.

My issue is not with DPI, it’s with the assumption that giving everything away for free is sustainable. When you build massive public infrastructure but don’t design a viable monetization model around it, someone somewhere is still footing the bill. “Free” is never actually free.

To draw a parallel from another domain I follow very closely: the Indian sports league ecosystem.With the exception of cricket, almost every league has struggled to survive. Why? Because apart from the central federation, nobody else makes money. Franchise owners bleed tens of crores annually. The structure simply isn’t sustainable. And that’s exactly the risk with fintech.

When the RBI steps in and makes services free for the end customer, with the logic of “let’s drive adoption now, we’ll figure out monetization later” the burden quietly shifts to the private ecosystem. And that makes it extremely difficult to build a durable business. In the early days, around 2015–2016, the first wave of fintechs didn’t fully grasp this. DPI was still evolving, UPI was just emerging, and everyone was betting on future monetization. But now, nearly a decade later, UPI has demonstrated very clearly that margins inevitably race to the bottom when a public rail is free and the cost of participation is pushed onto private players.

We’re now in a market where founders, investors, and operators understand this. There is far more realism. You can’t just build for scale and hope monetization magically appears later. The industry has learned, and often painfully, that unless the economics are designed upfront, entire categories become unviable.

In fact, with ONDC and ULI, we’re entering a new phase where the government isn’t just building rails - it’s effectively building competing products to what already exists in the market.

And that raises a fundamental question: if everything eventually becomes something that RBI or another central entity will provide, how do fintechs build sustainably going forward?

To be clear, fintechs will always build better than a central body. The innovation velocity, UX, experimentation culture, and customer-centricity are simply unmatched. That isn’t the issue. The real issue is the economics. We’ve already seen what happens with DPI: once the government builds a service and offers it for free (or near free), two things happen:

You’re forced to build on top of it because these systems are more stakeholder-aligned - for example, UPI requires banks, settlement systems, and compliance infrastructure, so you can’t bypass it.

Even if the DPI product competes directly with market offerings, the “free” price becomes the industry benchmark. Fintechs may offer superior experiences, richer features, and better reliability but when the reference price is zero, margins collapse instantly.

This is where quality gets hit. If you’re benchmarked to a free offering, even when the market is willing to pay for something better, the pressure on margins is so intense that you can’t sustainably build the superior product you’re capable of. And this becomes a systemic problem: innovation slows down not because fintechs can’t innovate, but because they simply can’t afford to at those price points.

This is the core tension emerging with ONDC, ULI, and the next wave of DPI:

public rails are essential, but public products offered free reshape the entire pricing logic of the market.

So if we assume that many of the essential fintech services - identity, payments, data flows, verification, lending workflows will eventually be shaped, absorbed, or centrally directed by the RBI’s long-term vision of DPI, then we have to ask the obvious question:

What is the future of fintech in India?

Because if core rails and core workflows are all moving towards some version of “public infrastructure, free, and standardized,” then the scope to build a profitable business narrows dramatically unless two conditions are met:

You are a full-stack fintech, meaning you own multiple layers: acquiring, issuing, lending, data, identity, orchestration, consumer app, and platform layers.

You operate at massive volumes, so even thin margins (or cross-subsidies) work out at scale.

This is exactly why every major fintech in India is now consolidating and aggregating aggressively: Razorpay, PhonePe, Pine Labs, Groww, PayU, Cashfree, all are assembling broader stacks. They’re effectively building “mini banks” or fintech conglomerates because that’s what the economics now demand.

And because they’re expanding horizontally across licenses, infra, and products, the bar for new entrants is getting impossibly high. If your CAC is rising, margins are thin, and your core API layer is benchmarked to “free,” then the right to win as a standalone player becomes very small.

This is also why the Signzy example matters. Signzy was built on top of existing identity rails like Aadhaar, Digilocker, CKYC, PAN verification which are all DPI components. Surviving purely as a standalone “identity TSP” is getting harder because margins on these rails compress over time. So what does Signzy do? It expands into card management by acquiring PowerEdge, a space where banks actually make money, where infra is sticky, and where the revenue TAM is real.

And that leads directly to the heart of the problem:

If every essential layer: identity, payments, data, lending workflows is becoming “public infrastructure,” and if all value accretive fintech layers eventually get pushed to free, then where exactly is the monetizable surface area left?

This is the DPI conundrum.

The rails are necessary, no doubt. But when these rails also compete with the private sector, and set the price expectation at zero, it shrinks the economic space for innovation, forces consolidation, and leaves very few viable business models for new or standalone fintechs.

The DPI conundrum

So if you’re a company primarily building around DPI rails, the first requirement is a dose of realism around TAM and revenue potential. We are firmly in a post-UPI world now, the phase where optimizing for distribution and hoping that “monetization will eventually come” is no longer a viable strategy. UPI has shown us exactly what happens when you build on a rail that is intentionally kept free: margins collapse, differentiation evaporates, and only the largest distribution engines survive.

So the real question becomes: How do you actually make money on top of DPI?

To answer this, I break it into two lenses: (1) raw rails vs differentiated value and (2) willingness to pay for differentiation

❓Are you just offering raw APIs without a scrap of differentiation, or are you able to give value additions on top of it?

Most DPI infrastructure (identity, payments, document rails, data flows) looks the same at the base layer: UIDAI, CKYC, Digilocker, UPI, AA, etc. If all a company is doing is wrapping these into clean developer APIs, then that works but only for a while. Every fintech eventually converges into the same experience: same KYC flows, same payments rails, same UPI handles, same AA flows, same document fetches.

Differentiation becomes marginal and short-lived.

UPI apps are the clearest example: Rewards can change behavior temporarily, but switching costs are near-zero because the underlying rail is identical for everyone.

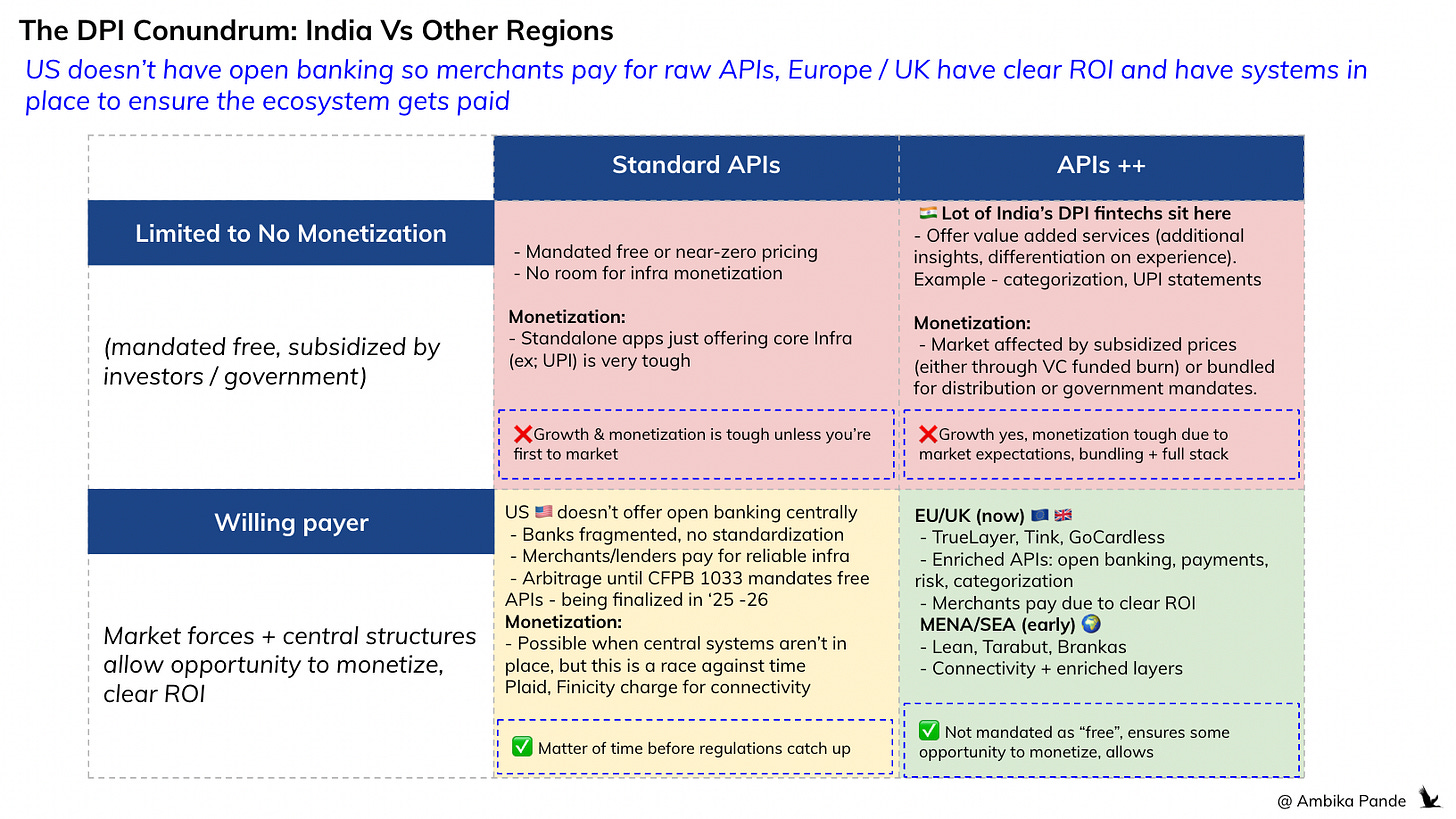

In global markets, there is at least a small mandated charge on instant transfers, which creates economic headroom for intermediaries. But India sits in the “free” bucket, which means pure API providers end up in a race to zero.

Other regions: LATAM (Pix), Europe, the UK, MENA, SEA, even when they are adopting DPI-like models still allow minimum pricing. That tiny pricing layer is the difference between a sustainable ecosystem and a subsidized one.

❓Can you actually charge a premium for differentiated offerings, or is the expectation still to give it for free?

This is the bigger problem. You may build a better orchestration layer. You may offer intelligent workflows. You may deliver higher reliability, fraud tooling, or analytics…

But if the market expectation is:

“The underlying rail is free, so the experience should also be free,”

your ability to charge a premium collapses.

This is exactly what India has seen:

Fintechs spent years optimizing for growth over monetization.

They built massive distribution at zero cost to the user.

Now, these same players have both the scale and the capital to keep pricing at zero.

Any new player, no matter how good gets priced out of the market before they even start.

In regions where regulators mandate a minimum pricing floor, like Brazil’s Pix (0.3% MDR) the ecosystem remains economically viable. In India, the regulator has gone the other way: mandated 0% on UPI, and likely the same for other DPIs.

This is my mind map of where countries seem to sit.

🇮🇳 India, which has DPI, but going by UPI and others atleast, has positioned it as “free” offers limited potential to monetize on the core infrastructure. And even with value added services, while there is opportunity to differentiate basis offerings, experience and so on, lots of fintechs have adopted the strategy of growth over monetization now - the focus is to use this to grow distribution. How early UPI apps came in, and acquired customers through VC funded cashbacks is a classic example. What is clear is: sitting here as a pure play TSP is very tough, this has to be part of a larger bundled or fullstack play, which is why we’ve seen so many acquisitions happen.

🇺🇸 US: Doesn’t really have a DPI system in place - an example is open banking. Open Banking is driven by players like Plaid, but nothing is set up at a central level. As a result, merchants pay for basic standardization, and connectivity. However, this is changing. Section 1033 of the Dodd–Frank Act empowers the Consumer Financial Protection Bureau (CFPB) to mandate that: Banks must give consumers access to their own financial data through standardised, secure, and free APIs. Implementation is being finalized in 2025 - 26, so somewhere, players will have to start differentiating to monetize.

🌍 EU / UK (today), and MENA / SEA in the future have multiple players in this space. There is a mandate centrally to offer DPI services through standardized APIs, but there is opportunity to differentiate, because 3rd party players that provide this service, have to pay some fee to the banks, or other financial institutions for processing payments, fetching data, or anything else.

So then finally, what can you do? The way I see it is follows:

Stage 1: APIs → Utility rails. These are the foundational, cheap (or free) rails everyone uses. If the rail is provided centrally (Aadhaar, UPI, CKYC, AA, Digilocker), great, then adoption accelerates. If not, private players step in to standardize, aggregate and abstract away complexity and get paid early on.

But eventually, this layer gets commoditized.Stage 2: Differentiation via value added infrastructure: This is where players try to escape commoditization: Enriched APIs, better reliability, UX, orchestration, bundling services that create clear ROI for enterprises, investing deeper in the stack for control (settlements, issuing, fraud, infra), and competing on price only to build scalable distribution. The players who win here adopt a “full-stack + bundling” strategy, because individual rails don’t make money, but bundled experiences can.

Stage 3 (Endgame): Full stack distribution and customer ownership. When margins collapse at the rail level, the only durable advantage left is owning the customer. This is where the ecosystem is heading: The biggest winners become full-stack fintech platforms that acquire customers at scale, bundle multiple products, and monetize across the lifecycle. At the end of the day, four things always win: Regulation, compliance, user trust and customer experience

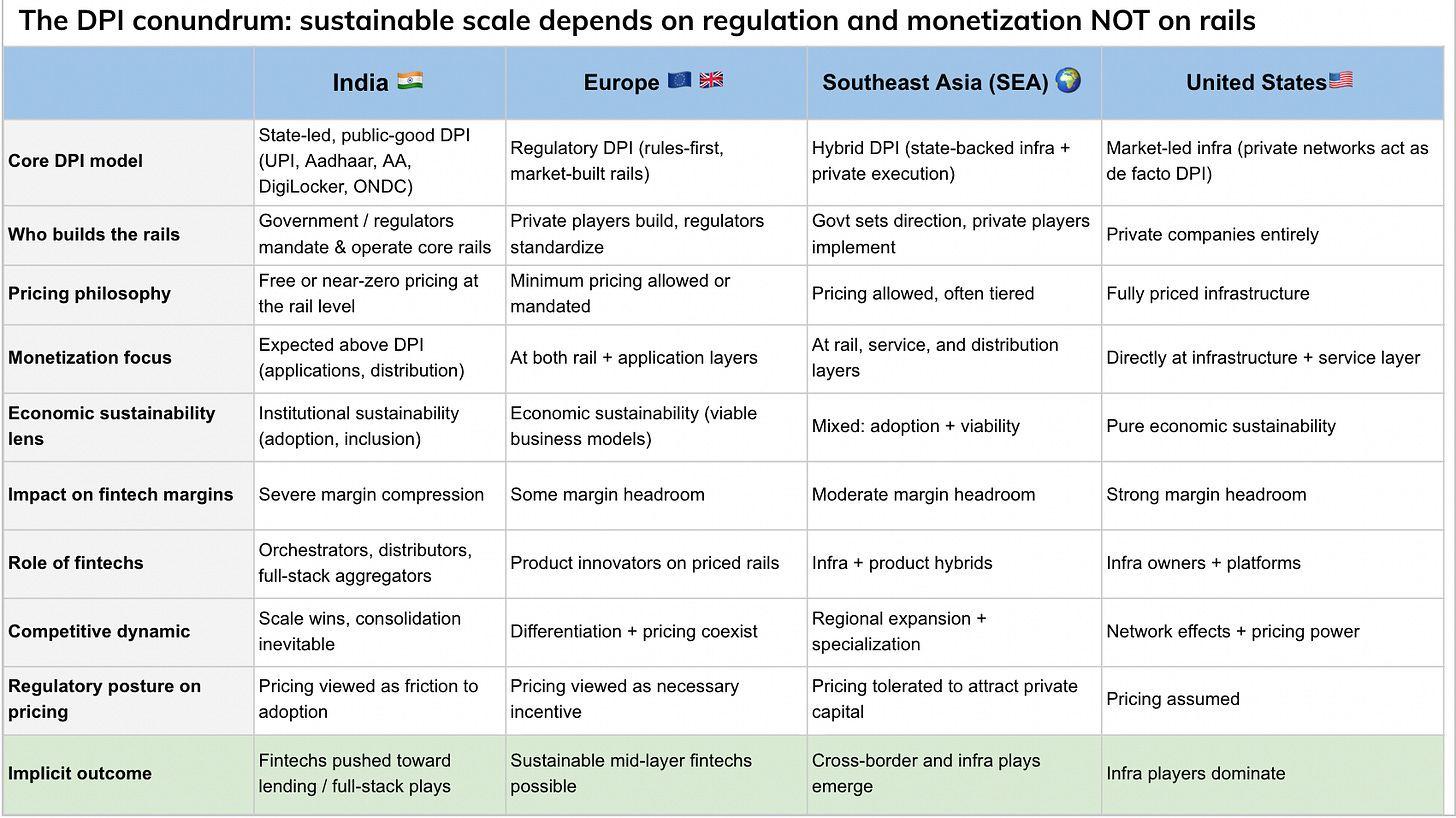

This is what I expect from fintech, atleast in India, in the near future as compared to the world

While India will continue to see consolidation and full stack plays coming in, because of a “survival lens” and margin pressure, players in Europe and SEA, where pricing has been left to the market, along with some price floors, the lens is more strategic.

There still may be consolidation here: Tink (open banking player based in Stockholm, Sweden was acquired by Visa in 2022), GoCardless (open banking players based in the UK) which was profitable in Q4 FY25, was acquired by Mollie, a Dutch payments player, quite recently, in December ‘25. But this is more strategic, and not survival mode. And there is breathing room, and possibilities for infra only players to exist, unlike in India.

And in India, DPI will continue to reshape the entire fintech ecosystem

1️⃣ Lending: Credit demand never dies. But lending TSPs as standalone businesses will struggle, because much of the lending journey sits on DPI rails, identity, data, CKYC, AA, eSign. To survive, they must either go full stack, find a niche, or attach to a larger financial player.

2️⃣ Wealth segment: The only fintech segment consistently rewarded by the markets.

Players like Sahi, PowerUp Money and others are still raising because unit economics work, there’s clear consumer willingness to pay, and niches still exist. This category will likely see more entrants and more consolidation.

3️⃣ Building on top of DPI rails - Payments, identity, KYC, document rails, AA — these markets are now scale-driven, with razor-thin margins. To win here, you need one of the following: 1) massive volumes, 2) full-stack ownership, or 3) strategic consolidation. This is why payments players (PhonePe, Razorpay, Pine Labs) and even identity players (Signzy → PowerUp Money) are going full-stack.

I expect this consolidation to accelerate across all DPI-linked segments

Note: Crossborder is something that will continue to grow, both through existing full stack players, and standalone XBorder players, while stablecoins in India need regulation to catch up with them. If you want to check out my deep dive on them, click here: [#65] Stablecoins: Driving innovation where CBDCs fall short, while regulation catches up

![[#74] Do all roads in fintech lead to license aggregation? (Part 6): Multi-license fintechs are driving profits and IPOs](https://substackcdn.com/image/fetch/$s_!-NHD!,w_280,h_280,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F8ef12c80-9de7-4961-b9e8-5f8d6c9929f0_1996x1118.png)

![[#61] The Next Wave in Wealth Management: Acquisitions, niche TGs & consolidated net worth](https://substackcdn.com/image/fetch/$s_!D5-U!,w_280,h_280,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F943e6ab4-1a60-4fef-baf6-465ed60b4ecc_1574x890.png)

Incredible read.... to understand current Fintech space.