[#65] Stablecoins: Driving innovation where CBDCs fall short, while regulation catches up

$5.5T in volume, global adoption, and programmable money at scale. Stablecoins succeeded where central banks stalled. Now regulations need to catch up.

About six months ago, I wrote about how stablecoins could power the future of payments in what I called a “Finternet” world. That vision still feels spot-on, but now I see the Finternet as more of an ideal, a seamless ecosystem where centralized authorities like the RBI and decentralized systems like blockchain rails coexist and connect through a unified, interoperable layer for money, identity, and data. We may never reach that utopian world, but we’ve already started envisioning, and building out parts of it.

If you’re new to cryptocurrencies or blockchain, I highly recommend reading the article below first. It breaks down the basics and highlights the key challenges with today’s payment systems.

The concept of the Finternet is straightforward: eliminate friction in transferring money and value. No intermediaries, no multi-day settlement delays, no fragmented systems, just a single, seamless global layer. In this vision, digital currencies act as programmable money, able to move instantly across this new financial internet. That’s exactly what Central Bank Digital Currencies (CBDCs) were meant to achieve.

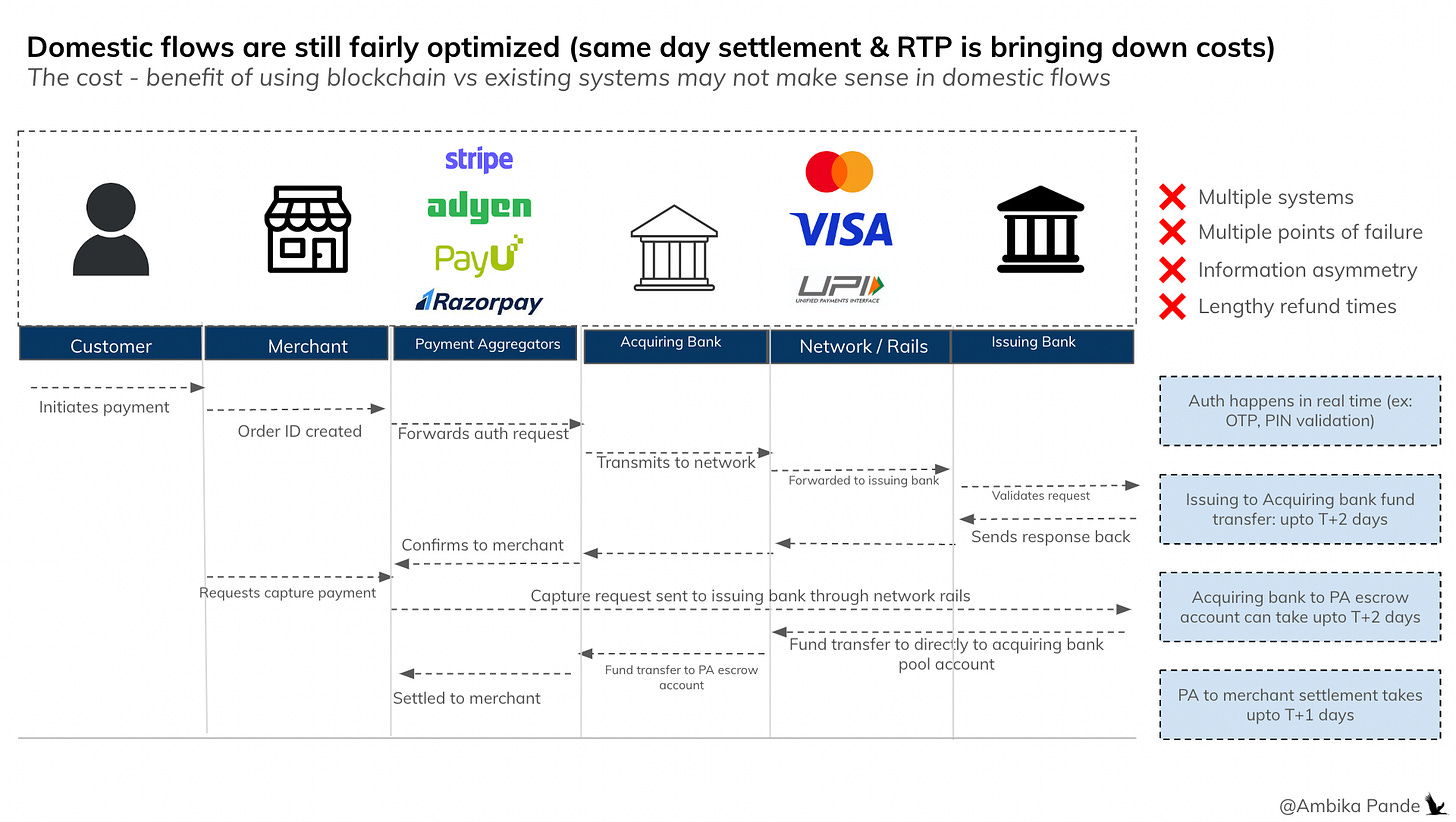

Unfortunately, CBDCs haven’t gained much traction so far, largely due to challenges with vision and execution. The real game-changer for instant payments especially in regions adopting Real Time Payments and same-day settlements. is cross-border use, not just domestic transfers. But many CBDCs launched focusing first on domestic use cases without a clear plan for cross-border interoperability. This has left both users and merchants confused. Speaking as a user, I still don’t see what clear advantage the e-rupee offers over regular rupees. I’ve tried to explain the issues in the current systems, both domestic and cross border below:

Domestic payment flows: speed of settlement and low pricing exists, so a blockchain rail may not add significant value here

The blockchain based approach actually isn’t really needed for domestic payments. Will it help? Sure. It’ll definitely make things such as recon + settlements faster. But the effort here may not be worth the payoff. A lot of PA’s in India offer T+1 / 2 settlement, and will probably move to same day settlement soon - I think some players offer this already. So from a cost to implement vs benefit of a blockchain based approach may be skewed, and existing players may prefer to stay within current systems, even if there is inefficiency.

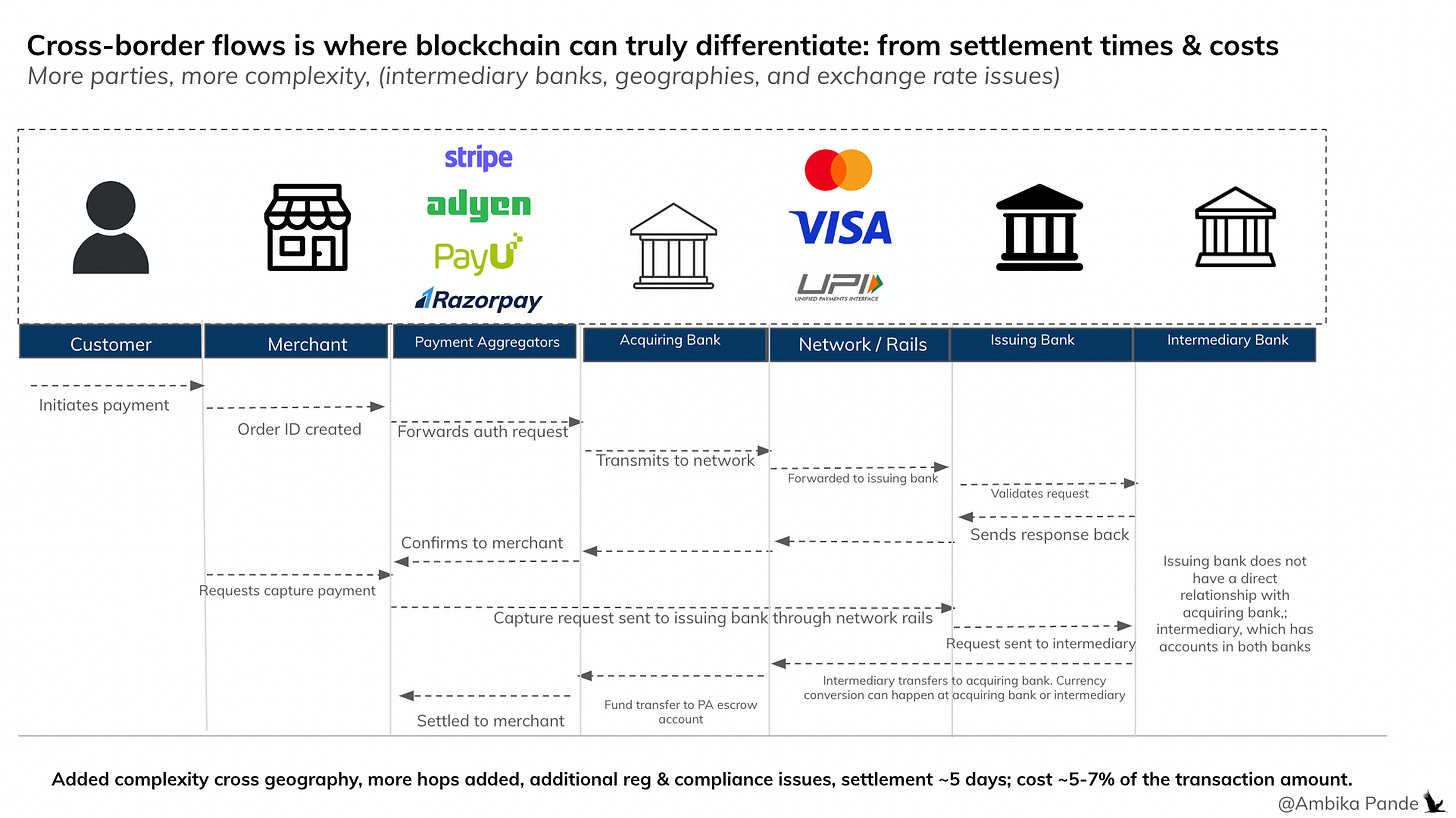

The xborder flow is expensive, heavily regulated, and requires multiple hops: this is where a blockchain based approach can add serious value

There are additional regulatory hurdles, currency conversion requirements (if the customer is paying in one currency, but it needs to be settled in another currency to the merchant). In some cases, the issuing bank may not have a direct relationship with the acquiring bank, where the payment needs to be settled, so the payment needs to be routed through an intermediary bank. And that’s where CBDC’s failed: in my opinion the concept launched before we were clear on what the actual use case & the segment being targeted was.

Take a look at the flow below:

With a blockchain based system, the time & the cost can be reduced significantly. The first problem being solved: speed of settlements & reduction of complexity. Cross-border payments settlements can take multiple days. On the blockchain this can take seconds. With the blockchain, because now everyone is plugged into the same rail, and there is no information asymmetry, money transfer can take seconds and minutes rather than days. There is no need to conduct extra checks at your end. Settlements are instantaneous. Reconciliation as a function could possibly cease to exist because of the distributed ledger based technology (where every system plugged into the blockchain has a copy of the ledger, so that all the payments / transactions are recorded).

And this is where stablecoins were able to come in, innovate fast, and create an alternate payment rail built on the blockchain, to faciliate all this

Another key advantage of blockchain-based payments and something stablecoin providers quickly leveraged to boost adoption is cost. Today, moving money across borders can cost as much as 7% of the total amount transferred. Blockchain technology has the potential to reduce those fees dramatically, often bringing costs down to less than 0.5%. The table below illustrates this difference more clearly.

Right now, the easiest way to do crossborder transfers using stablecoins is the structure that Bridge has set up (which was then acquired by Stripe)

The customer does a one time onboarding on Bridge and creates a wallet (Bridge is the stablecoin rail)

The customer transfers fiat money into the wallet

Bridge takes this fiat money and locks in the exchange rate with a crypto exchange for stablecoins

The fiat is exchanges for stablecoins, and transferred into the wallet

The merchant (who has also done a one time onboarding on Bridge) receives the stablecoins in their wallet

Bridge then again communicates with the crypto exchange to exchange stablecoins for fiat

The merchant can then transfer the fiat from the wallet to the bank account.

The image below illustrates this better:

There are some additional steps that a customer & merchant need to do: onboarding on the stablecoin rails, wallet creation, and maybe an additional step of KYC

1) Once at payment initiation → to give approval to initiate the transfer

2) Once at fiat → stablecoin conversion: to confirm on any fees, conversion rate, and estimated stablecoin amount that will be received

3) Post stablecoin → wallet transfer, to authorize currency transfer to the receiver wallet.

It’s possible that for smaller amounts the stablecoin conversion consent and transfer consent can be bundled. But for larger amounts you’ll need to take user consent at each step of the payment process. Not that that’s much different from today. That’s really the most important thing to drive adoption: making the experience seamless, or if not seamless, then have minimal hops to the end customer. Otherwise this will never take off.

While there is an element of currency conversion, the costing on average is still much lower than traditional flows

$USD - USDT conversion fee: 0.05% - 0.2% (depending on market spread and liquidity)

Bridge platform fee: 0.2% - 1.5% (depending on the transaction)

Gas Fees (price of performing a transaction on blockchain, think of this as network fees): ~$0.001 – $0.10

USD payout fee: (this is when the stablecoin is converted back to fiat and transferred to the receiver’s bank account). This depends on the biz structure. In most cases, either its paid by the receiver, or the business / tech player absorbs it for a smoother experience (example Stripe)

So the cost structure here could be ~0.25% to 1.7%. With gas fees being < $0.10. That’s still way lesser than regular cross border transactions, and much faster!

For merchants, that’s massive. It improves working capital, reduces chargebacks, and cuts FX volatility. For users, blockchain means faster payouts. Stripe, for instance, uses USDC payouts on Solana, letting freelancers in Argentina or the Philippines get paid in near-real time, bypassing banks entirely.

A common rebuttal I hear against stablecoins is that 1) CBDCs will eventually take over and that 2) there is too much regulatory uncertainty around stablecoins

The regulatory uncertainty point is a fair one. Stablecoins still operate in a grey zone. There isn’t really regulation that provides authority to some body and grants them oversight. Whatever regulations that stablecoin issuers submit to are voluntary. An example is reserve audits. No global consensus exists on reserve requirements, redemption rights, or consumer protection.

For example, some questions that I have in my mind are:

Who ensures KYC/AML compliance?

Who audits reserves?

Who does a merchant or user file a grievance with?

Who takes the blame in a fraud or loss scenario?

These are all very valid questions, and need to be answered. In some of these cases there are no answers YET.

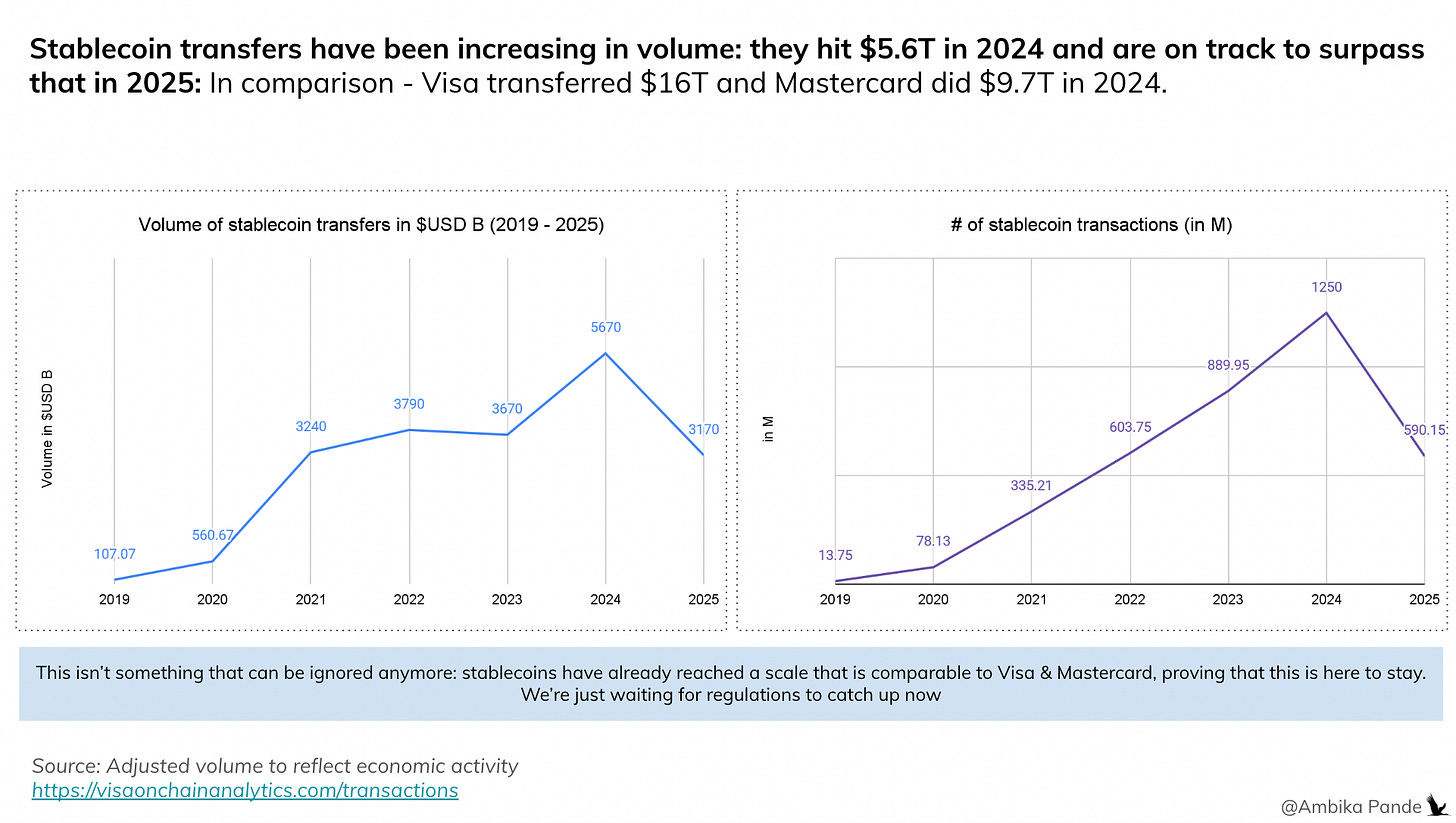

And that’s logical. But somewhere, stablecoins seem to have gained that trust of customers. Look at the volumes being transferred through stablecoins - in 2024 this hit $5.5T!

This is a source from Visa On Chain Analytics. Adjusted stablecoin transfers in 2024 hit $5.6T! This is comparable to what Mastercard & Visa did in 2024, with Mastercard hitting $9.7T and Visa hitting ~$16T in volume.

And by the way, this is just half the story. This data source only tracks blockchain activity on public blockchains such as Ethereum, Solana, Tron, Polygon and Avalanche. This source does not include private blockchains for example: So in a hypothetical case, let’s say a government operates a private CBDC ledger, that is not tracked in this source. It also cannot track enterprise blockchains, which are usually another form of a private blockchain, where data is encrypted, and you can join only after pre-approval. So it’s very possible that actual stablecoin transfer is much higher than the $5.6T number in 2025.

Note: Adjusted volumes are reflective of actual economic activity and hence I’ve used that metric. T filters out self/ internal transfers, and synthetic balances. (Example: if there is a transfer within lets say Binance, then Binance may actually not shift the money, but just update ledger accounts, and only transfers stablecoins at the time of

What has happened here? Even though they aren’t really regulated, how are people trusting this medium enough do billions in # of txns, and trillions worth of value?

Well the easiest and most obvious answer is that they are solving a need. A dire need clearly, which makes merchants & customers more willing to put up with the uncertain regulations. But I’d say the answer is also more nuanced.

1) Trust is being manufactured by platforms.

A lot of the players who are getting into stablecoin infra, and issuing / building their own liquidity pools for fiat backed currencies are established payment entities. They are licensed to operate in multiple countries and a lot of them have played a role in innovating on payment processing and money movement within the existing systems: players like Stripe, Revolut, Visa, Mastercard, and even banks such as JP Morgan.

And maybe that’s how something like this will gain trust, and gradually get regulated around. It’s your existing regulated players that will actually innovate on how merchant KYC, regulations, money movement, fraud etc will work in a payment system on the blockchain, and that’s when regulations will come in and build around it. And that will set the stage for smaller / newer start-ups to come in and specialize in this.

Examples below of regulated players building in stablecoins:

Stripe is regulated as a money transmitter in multiple jurisdictions.

Revolut has a UK FCA license, an e-money license in Lithuania, and operates across Europe.

Visa and Mastercard already handle billions in payments and bring brand trust and global dispute resolution frameworks.

These platforms wrap stablecoins in compliance, turning an unregulated asset into a product users and merchants can trust. And once trust is built, and regulations come in recognizing this as a legal way to move money, it sets (and some would say) has already set the stage for smaller start-ups building for stablecoins, not just as another payment rail, but as the core focus.

2) It’s not that there are no regulations. They still have to catch up with the stablecoin growth, but that doesn’t mean no movement has happened. We’re starting to see emerging answers:

EU: MiCA (Markets in Crypto-Assets Regulation)

Passed 2023, enforcement begins mid-2024. EU-based stablecoin issuers must register, get audited, disclose reserves, and meet capital requirements.

Introduces legal categories: "e-money tokens" (like USDC) and "asset-referenced tokens" (like gold-backed coins).

Requires licensing for issuers, reserve audits, and full transparency.

Caps daily transaction volumes unless authorized as an e-money institution.

Applies strict consumer protection and reserve requirements

In the U.S, no bills are passed yet, but there are multiple under discussion. Clarity for Payment Stablecoins Act (2023–2024): bipartisan draft allowing regulated issuance by licensed entities like banks or fintechs.

Federal Reserve wants oversight of non-bank issuers.

SEC & NYDFS continue to scrutinize reserve backing, KYC, and transparency (e.g., Paxos BUSD shutdown in 2023).

Circle (USDC) aligns with regulatory expectations; Tether is viewed cautiously by US agencies.

Platforms like Circle and Paxos have voluntarily embraced transparency, but it’s uneven.

Note: A key aspect of regulations is reserve requirements. When I say reserves are audited, this means that checks are done to make sure that 1) the issuer of the stablecoin has enough fiat reserves to do a 1-1 transfer. It’s not that they’re issuing fiat pegged stablecoins, without having the fiat reserves to back it and 2) the reserves are of a permitted asset class. Example: reserves can be in cash, treasuries, or money market funds. They can’t be in crypto assets or some sort of unregulated holdings. USDC (by Circle) is relatively transparent, reserves are audited monthly and held in cash/T-bills. USDT (by Tether) has long been criticized for opaque reserves and inconsistent disclosures.

Eventually, when regulations come in, and every stablecoin issuer has to adhere to the minimum standards of transparency and reserve requirements, this will become a commodity, and choice of stablecoin will depend more on which chain you’re operating on, the liquidity and user experience.

Innovation doesn’t chase regulation. It’s the other way around. Regulation chases innovation

Innovation doesn’t chase regulation. It’s the other way around. Take BNPL in India for example. Before ZestMoney, Lazypay, Simpl, Axio came in there was no concept of short term loans that mirrored revolving credit. And there was no regulation around it at that point.

It took new players to come in and reimagine how short term pseudo revolving credit looks like, and after this built scale, and a use case & market need was established was when the regulations came in, and things such as DLG (DIgital Lending Guidelines) came in - to legitimize this further. Yes, they did scupper some existing business models (Slice & Jupiter struggled for a bit) but that is always a risk when you’re at the cusp of innovation. I had written a piece on this, you can check it out here.

The same thing is happening with stablecoins. There has been widespread adoption, and now, stablecoins are just too big to ignore. It’s only a matter of time before regulation comes in and takes this from something that operates in the “grey” to something that is a legal & authorized way to move monetary assets. And this has already started happening

CBDCs: Implementation mirrors current systems, with its existing inefficiencies, which takes away from the value, and hence CBDCs have not taken off

Governments move slowly. Central banks even more so. Around the world, many are piloting Central Bank Digital Currencies (CBDCs). The concept sounds promising: a digital currency issued by a central authority, but in reality, most of these implementations simply replicate existing banking systems with a digital overlay. There is little real change, just digital bureaucracy.

Most CBDCs have struggled to scale because they carry the same limitations as the systems they aim to improve. Layers of approvals, restricted access, domestic-only use, and very limited interoperability remain major challenges. Many CBDCs do not feel programmable or borderless in the way blockchain-native alternatives do. Those two features, programmability and cross-border capabilities, are exactly what make stablecoins appealing.

Take India’s Digital Rupee. Although launched by the RBI in 2022, it remains in pilot mode two years later. It is available only through a few public and private banks, and even then, only certain branches and apps support it. From the user’s perspective, there is little incentive to switch. UPI is already fast, free, and seamless. What additional value does the e-rupee provide? At this point, that is not clear. Fintech companies, which could help drive innovation and adoption, have been kept on the sidelines.

And this problem is not unique to India. China’s e-CNY is distributed through state-owned banks and monitored centrally. Ghana’s e-Cedi and Nigeria’s eNaira follow similar models where banks or mobile money providers serve as intermediaries and control user access. These implementations lack openness, interoperability, and the transformative potential many expected.

The real promise of CBDCs lies in cross-border payments, but that is still far from reality. If these systems remain centralized, for Country A to transact with Country B, their CBDC infrastructures will need to be integrated directly, a process that is complex, slow, and fraught with geopolitical hurdles. The alternative of a shared global chain or interoperability layer is still a distant idea. Even real-time domestic payment rails face challenges. India’s UPI is connected to just six countries today: Singapore, UAE, Nepal, Bhutan, Mauritius, and Sri Lanka, with a target of about 30 countries by the end of 2025. This is progress but nowhere near global interoperability.

Meanwhile, stablecoins are quietly doing what CBDCs have not yet achieved. They enable real-world, cross-border, programmable money flows with or without central bank approval.

Stablecoins: seem to be the best of both worlds and the scale at which they are operating will force the regulatory authorities hand:

And stablecoins offer a compelling middle ground:

They are digitally native, yet pegged to real-world currencies like USD or EUR. So it’s not like your cryptocurrencies that are created out of thin air, and have no underlying asset that gives them value

They can be settled globally in seconds, without the need for correspondent banks or FX intermediaries.

They offer programmability, which opens up use cases like escrow, recurring payments, and automated compliance. This essentially means that you can create complex financial workflows, lock transfer behind smart contracts, and embed rules within the blockchain to handle transactions, reconciliation and other activities. In the age of AI especially this will be a reality.

And crucially, the world seems to agree. Everyone, from fintechs to payment networks to large banks, is building or buying their way into the stablecoin stack.

Stripe acquired Bridge, a stablecoin infrastructure startup, for $1.1B. Bridge had processed over $5B in USDC payments and partnered with the U.S. government, SpaceX, and others.

Edit: July 2025: Stripe made it’s second crypto / blockchain acquisition after Bridge. It acquired a wallet infrastructure start-up called Privy, in June 2025 which enables developers to integrate cryptocurrency functionality without requiring users to leave their applications or manage external wallets. So Bridge handles stablecoin rails and Privy handles wallet complexity - seems like Stripe is going all in - into stablecoin and betting big here

Visa partnered with Bridge to launch stablecoin-linked Visa cards in LATAM.

Mastercard is working with MoonPay and others to enable USDC spending via its network.

JPMorgan, via its Onyx division, uses JPM Coin to settle ~$1B daily in blockchain-based interbank payments.

Revolut, regulated under the European Central Bank’s e-money license via Lithuania, is exploring its own stablecoin issuance while offering crypto wallets globally.

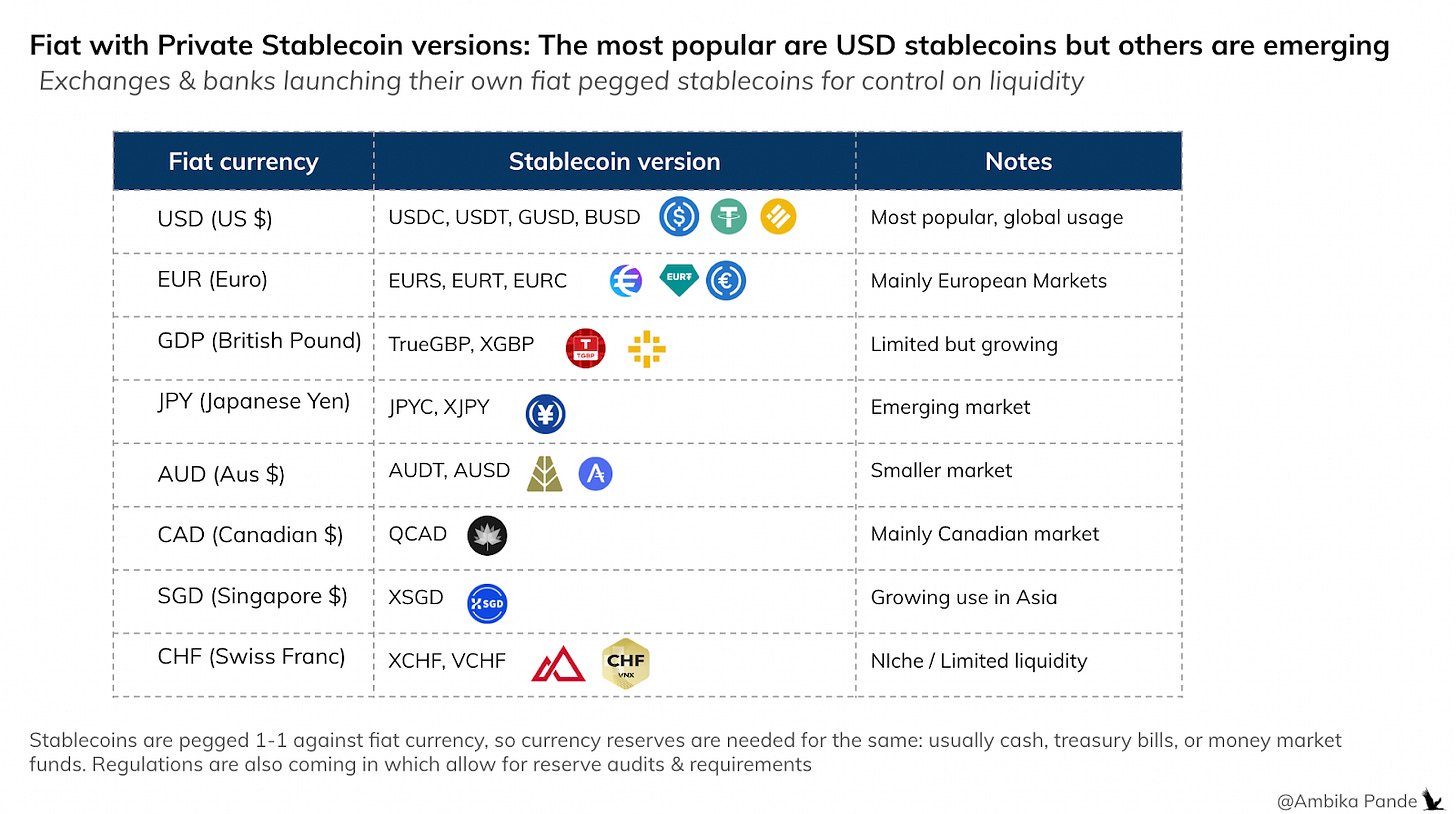

As stablecoins pegged to more currencies emerge, the use cases & applicable corridors will expand. USD pegged stablecoins are the most popular, but others such as GDP, JPY, & SGD are growing use cases for UK, SE Asia and Japan.

Opportunity for start-ups and crossborder players to build for corridors which have currency volatility, and high remittance flow

1. USA →← Latin America (especially Mexico, Brazil, Colombia). Huge remittance flow. Stablecoins like USDT and USDC are widely used for fast, low-cost cross-border payments. Crypto adoption is high in remittance-dependent countries.

2. USA →← Asia (Philippines, India, Vietnam). Large migrant worker populations sending money home. Stablecoins offer cheaper alternatives to traditional remittances. Regulatory frameworks vary but crypto use is growing.

4. Within Asia (Singapore, Hong Kong, South Korea, Japan). Growing intra-Asia stablecoin transactions, especially for trade and payroll. Singapore and HK act as crypto hubs facilitating these flows.

5. USA →← Africa (Nigeria, Kenya, South Africa). Rising crypto adoption as a hedge against local currency volatility. Stablecoins used for remittances and business payments.

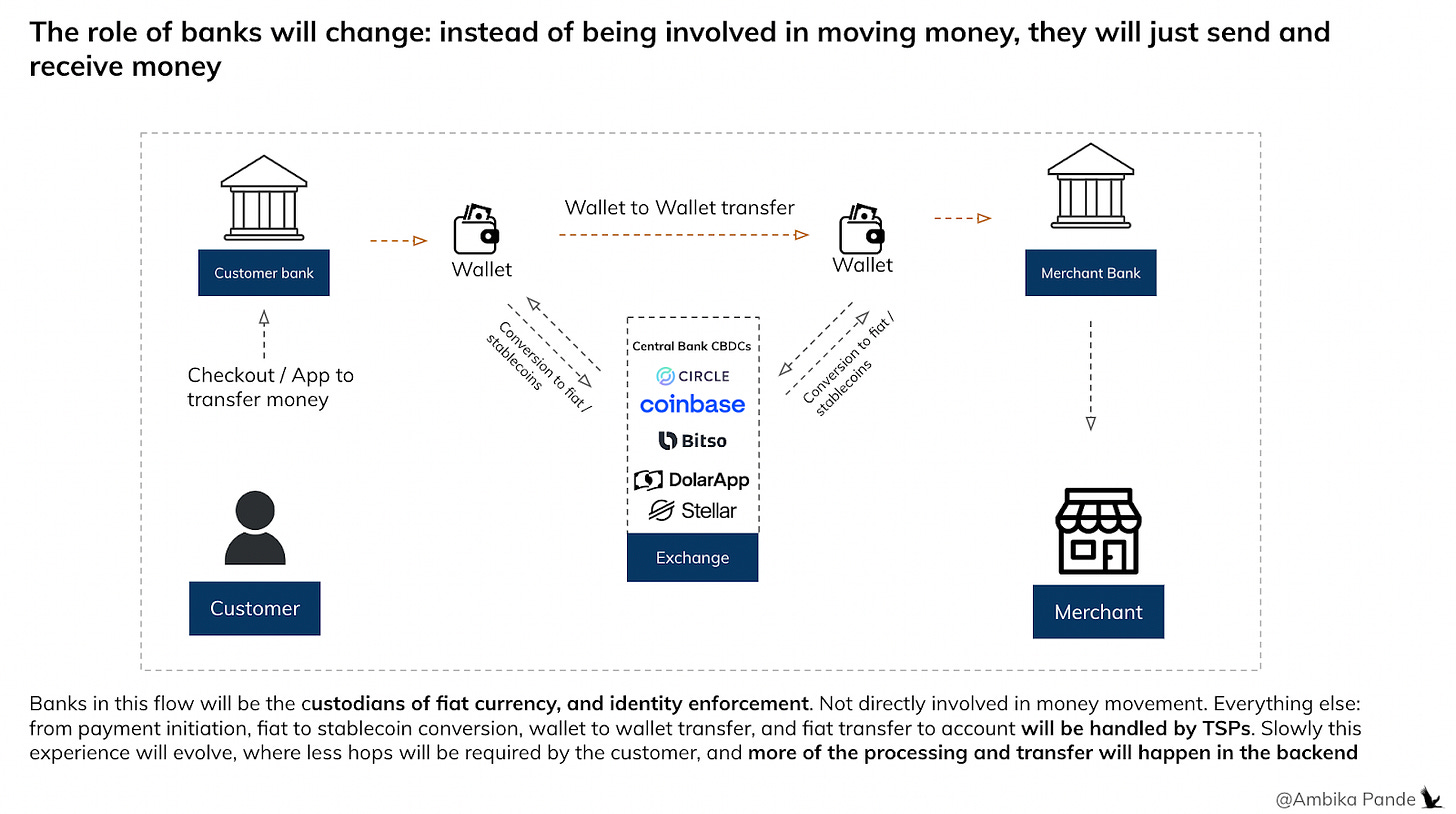

In this new flow, banks become custodians and enforcers, but not directly involved in the money movement flow

Today, banks move money, acting as clearing agents, processors, and endpoints. In a stablecoin world, the rails are on-chain, and money moves peer-to-peer. Banks simply hold or receive funds at the start or end of a transaction.

Custodians of assets: So, to issue stablecoins, you need to have fiat reserves. In the the case of Circle, which issues stablecoins such as EURC, and USDC, BNY Mellon holds the fiat currency on Circle’s behalf

Acting as KYC enforcers and on/off ramps for regulated stablecoin platforms. To convert fiat to stablecoin or stablecoin to fiat does require interaction with a bank, and this usually also needs strong merchant & customer KYC

This shift also unlocks new opportunities for tech-first banks and TSPs to build infrastructure around fiat-to-stablecoin transfers, blockchain-native identity, and next-gen payment rails. It's already happening. As I’ve written before, this is exactly where Mastercard and Visa are focusing, not just enabling banks to issue their own stablecoins, but also defining the foundational standards for identity, privacy, interoperability, and security on the blockchain. These aren’t just experiments, they’re the early architecture for how regulated digital money will move.

For stablecoins to become mainstream, trust will be its foundation

Stablecoins might be the future of cross-border transactions. But the real currency is trust. That trust won’t just come from code or coins, it will come from:

Platforms with licenses,

Transparent reserves,

Accountability systems, and

Interoperable identity layers.

Banks won’t disappear but they’ll evolve. Regulators won’t stop innovation but they’ll shape it. And users? They’ll follow whoever gives them speed, affordability, and security, all at once.

![[#39] Is the future of payments in the "Finternet" era powered by blockchain?](https://substackcdn.com/image/fetch/$s_!6Kv_!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ff2116cbd-f4a6-4bff-8a28-ca3a4c49a85f_1644x922.png)

Great article on stablecoins... again!! I think one aspect that is interesting is how transacting in stablecoins is helping companies that have branches in multiple countries. (essentially helping them free up their balance sheet). OpenFX is one startup that is working in cross-border B2B payments for first-party transfer.

Hi Ambika,

Reckon this would interest you, in case you havent come across this already - After Bitcoin, BJP’s National Spokesperson now weighs in on stablecoins and India’s fintech future

https://indianexpress.com/article/opinion/columns/as-stablecoins-gets-greenlit-in-the-us-indias-chance-to-lead-this-fintech-space-10128067/