[#26] Will the convenience of UPI eventually eat credit cards?

By Ambika Pande

According to the RBI website, there were 101 million outstanding credit cards in March 2024. And in 2023, ~16M cards were added as compared to ~12M in the previous year. Credit cards have historically been premium products, and are also more convenient to use as compared to cash. And for a lot of folks who use credit cards, convenience trumps everything else.

But now, UPI is the most convenient way to pay. I’ve had the chance to speak to many folks who primarily use credit cards, and slowly but surely, there is a shift. While they’ve taken time to adopt UPI, more of this base is shifting the majority of their spending to UPI as compared to credit cards. That’s what Rupay is banking on: the fact that it is the only card that can be linked to UPI. And that is what start-ups such as Kiwi and Rio Money are banking on as well. They offer credit cards linked to UPI.

But there is a prestige factor regarding cards, which may limit the adoption of Rupay. While I want convenience, I want access to golf clubs, premium lounges etc. Rupay is not on par with these perks that other major card networks offer. And thus the innovation with the Rupay add-on on your existing MC / Visa card, that banks have now rolled out. Which allows me my “fancy” card, and allows me to utilize the UPI facility also. And this also solves the tracking problem - for example savings accounts, I keep seeing UPI debits of very small amounts, which makes it hard to track my expenditure.

What are the credit card usage trends in India over the last few years?

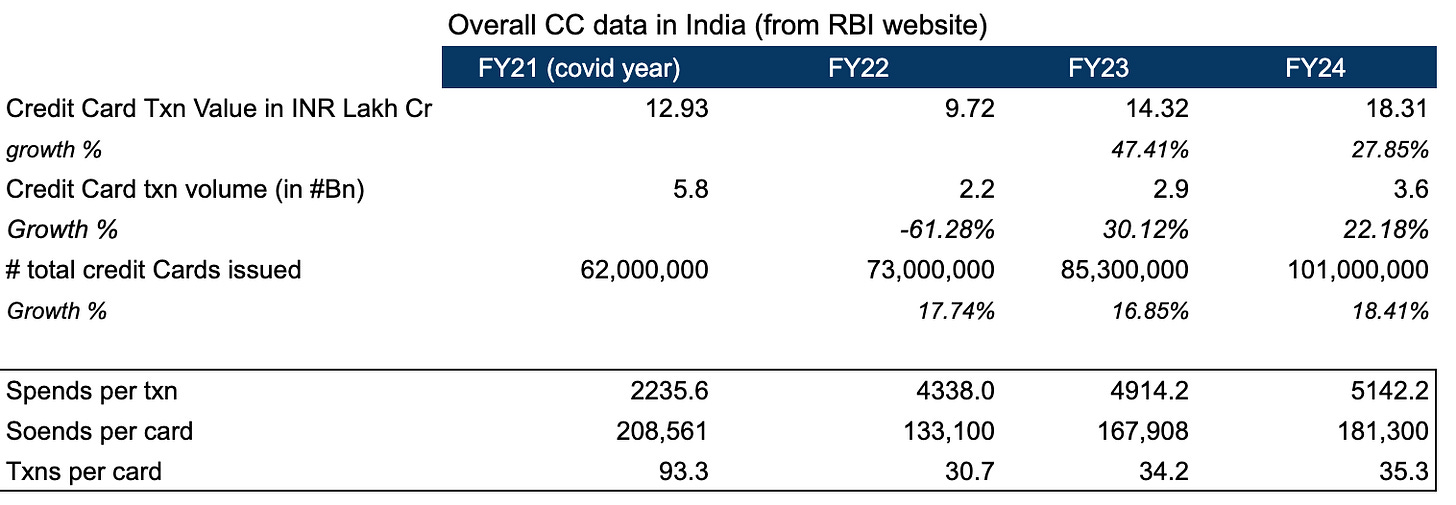

Credit card spends, and transaction volume on credit cards are increasing no doubt. In FY24, the CC spends and volume were INR 18 Lakh Cr & 3.5B txns, compared to FY23 spends and volume which were INR 14 Lakh Cr & 2.9B txns.

But there seems to be slowing growth. The spends from FY22 to 23 grew by 47%. And from FY23 to 24 by 28%. And this is despite the increased number of credit cards in circulation, which over the last 3 years has grown consistently at ~16-17% YoY.

(of course, some of it could be spiked growth in FY2021 due to covid, and subsequent degrowth in 22, and normalization).

So. Spends are increasing, the number of transactions are increasing, but growth has slowed. Credit cards in circulation are increasing. What can this mean?

This could be a result of a combination of three levers below:

1. More new-To-Credit customers who have high potential

These could be students who may not have a credit score, but will get one by virtue of their other credentials, which makes them a good bet (ex: educational institution etc). This base is increasing, and that could be one reason why the credit cards issued are increasing. These customers may not have the limits that prime customers have, and so it is possible that this is why the spending and transaction growth on credit cards is slowing.

2. A bigger % of the original subprime base has been given a credit card.

Both of these bases can be solved for either Rupay - through which banks reportedly give cards with lower limits. Or co-branded cards, which are jointly issued by merchants and banks, and usually use some sort of alternate data from the merchant to be able to underwrite more customers. Again, similar to the above, more customers have cards, but they don’t have the limits or the spending power. Some examples of these co-branded solutions are: Swiggy, Zomato, Flipkart

3. The slowing growth is due to credit card customers moving from credit cards as a primary mode of payment to UPI.

And if the above reasons are true, then the following will be required:

1. Credit infrastructure will have to change

The same model that existed for credit cards that existed may not work. Banks may need more flexible systems to be able to give lower limits, and handle the increased load on the system, especially if the hypothesis works, and convenience trumps cards. New age credit card management systems are also seeing an opportunity: in India - Hyperface, Falcon, M2P all provide these solutions. And this is a theme we can see in regions such as LATAM & SEA, which have Pomelo & Pismo - new age Credit Card Management Solutions (CCMS) and Nubank (LATAM), and Kakaobank (Korea, SEA) which are neobanks, with banking licenses in their regions of operations, which also issue cards on top of the neobanking service.

2. To keep the usage on credit cards high, banks will be forced to look at opening up bases of customers that they did not consider before

If the premium customer doesn’t really use the card for transactions, but more for access, then banks will have to increasingly look for those customers in the new-to-bank / new-to-credit segment. And these are bases that they probably have not looked at before. And previously if these customers have been considered, but rejected, then what is new this time? How do you know that the new customers you’re giving out cards to are good?

The answer seems to be “alternate data.” A buzzword that is thrown around a lot when you talk about lending fintechs in India. What is alternate data? It’s data from non-traditional sources, so it could be transactional data, such as spends on specific merchants, or on specific payment methods. It could even be browser history, apps installed, app activity etc. And we hear this all the time: “So & so will use its proprietary data models to find the profitable customers.”

But we’re already seeing this play out. Co-branded cards are one example. The Flipkart Credit Card. Or the Amazon Pay ICICI Credit Card. Merchants and banks are working together to create co-branded cards for their customers, and they probably use the transactional data (cue: alternate) that merchants have about customer behaviour to either underwrite new customers, or give existing customers higher limits.

3. And then if point 2 is correct, then the following need to be solved for:

Solving for collections risk: In initial days, and even when going to the new base, collections risk will become what needs to be solved for. Companies such as SalarySe are trying to solve this through a stack focused on integrating with employers, and salary accounts.

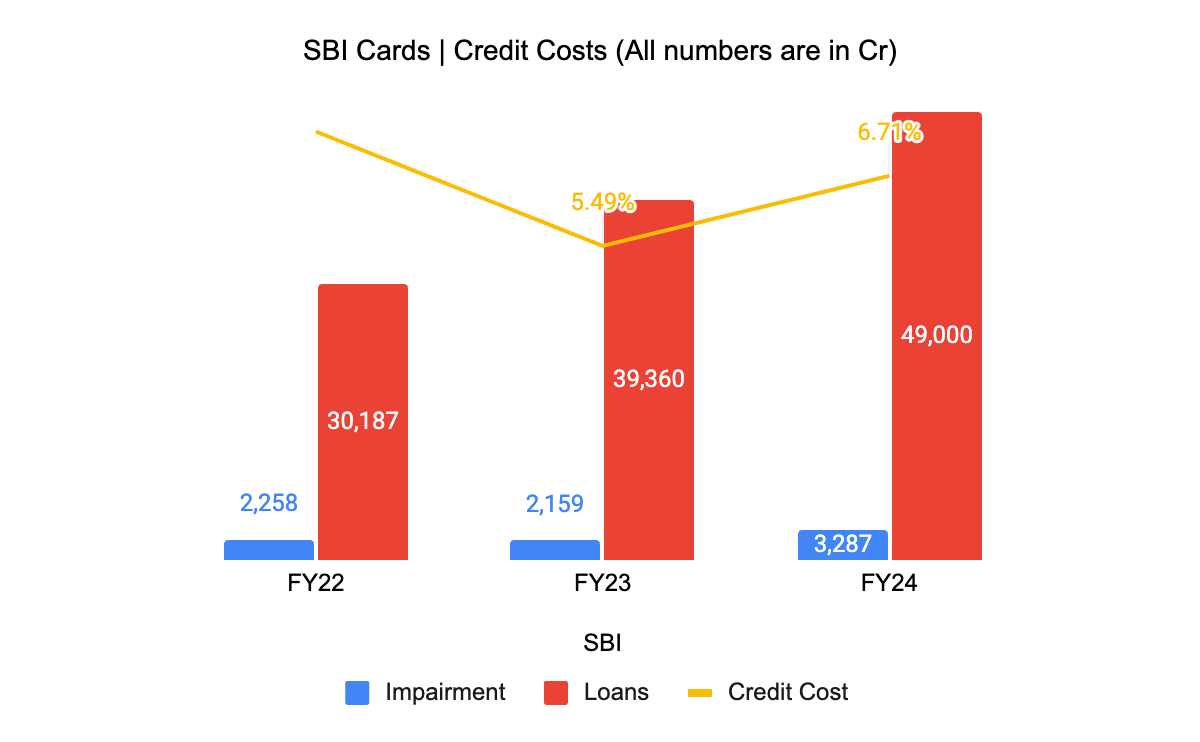

Monitor the credit losses of the co-branded card segment: SBI Cards annual reports show that credit loss (calculated as impairment of financial instruments / loans) is between 5.5% - 7% for SBI cards. (For ease of analysis, have looked at the SBI cards annual reports, since they are a separate entity).

And SBI has a bunch of co-branded card deals. Some examples are OLA Money SBI Card, SBI Tata Titanium Card, and even Paytm SBI Card. But this is a metric that will explode if this doesn’t work. And that is an interesting metric to track, even with the credit cards portfolio: just how the co branded cards portfolio for different merchants are doing. It will also help build an understanding of which merchants provide better data for giving credit: For example, is it something like amazon, which may have 2-3 transactions per month? Or is it something like an Uber / Ola / Zomato / Swiggy, which is more of a daily usage app.

In the medium and long term, it is possible that transactional data works. Despite being slow to adopt it, transactional data actually works. So then co-branded cards or lines become really big, where every merchant with transactional data works with banks to underwrite a higher % of their base. And this becomes a branding and affiliation game.

No perfect solution currently that solves for convenience, & rewards / perks

Co-branded cards solve for some of this. And while Rupay, which reportedly gives lower limits, and rewards that are not on par with other networks, will solve for some of the new credit users, other customers who have options, may prefer MasterCard / Visa / Amex for the perks that they offer (not including rewards). So you have Rupay, with less perks, but lots of convenience because of UPI & QR, and you have Mastercard & Visa who have the best rewards, but are limited as compared to UPI. And while the access that premium cards give are a hook, redeeming rewards points still takes additional steps, and it’s a broken process, where either you log into your bank’s reward portal, and buy using points as a currency, or you exchange the points for a gift-card, and then redeem it at your choice of merchant.

So the credit user base will be split: convenience first will stick to UPI, despite having a premium credit card, and the rewards junkie / deal oriented customer will want & use a card that gives the best points. How do we stitch these two stories together?

So I see several things playing out to continue strengthening UPI.

1) All card networks will eventually be linked to UPI: While RBI now has only allowed Rupay to be linked to UPI, eventually it will allow cards of all networks (MC, Visa, Diners, Amex) to be linked to UPI. This will push the rewards junkie base to also use UPI for majority transactions, and not just the “convenience” base

2) Cards as a form factor may be less relevant: Credit on UPI, along with underlying infrastructure, becomes an even more important play. If UPI is convenient, and everyone has adopted that as a payment method, then cards as a form factor are not needed anymore. And across the world (ASEAN, LATAM) Scan & Pay has shown more resonance with customers over Tap & Pay. All you need is a credit account that can be enabled on UPI and a smartphone. And as compared to credit cards on UPI, it removes the number of players, and additional costs, leading to a bigger piece of the pie for existing players of the ecosystem. So the credit on UPI story becomes even more important

3) Rewards segment innovation: Fintechs innovating in the rewards segments will play a big role, by smoothing the process of being able to redeem rewards points at the time of transaction. This then also acts as a hook for the premium customers to use credit → why would I use something if I know I am never going to avail of the benefit? We’ve seen that in the case of gift-cards & vouchers, they don’t act as a hook, even in the case of affiliate marketing because it’s tough to keep track of where these gift vouchers are and if they can be redeemed. (Innovations such as a Google Wallet version in India, which allows automatic addition of cards / rewards points to one wallet, and at payment allows a customer to check what cards / points can be redeemed as discounts is something that could work.)

4) Alternate Data: Bigger entities will all launch their own co-branded credit cards / lines. Which has already started happening. Only time will tell how this will play out, and monitoring the credit losses of co-branded cards specifically will help in this.