[#4] What lies ahead for Live Sports in the OTT streaming era?

With no IPL streaming rights in FY2023, the Hotstar paid subscriber base fell by 4.7M paid subscribers. That is ~7% of the total paid subscriber base, or a total revenue of close to Rs 100 Cr per year. (ARPU of Rs 250 x 4M users). For a platform that’s still making losses of -343 Cr a year, a revenue loss of this magnitude could increase losses by ~30%.

Sources are projecting that this non-renewal will result in an overall dip of 25-30% of the total paying subscriber base, and close to a 50% overall ad revenue drop in 2023.

The problem here is that while platforms are able to acquire users, by licensing the rights of live sports events, they aren’t able to retain them. Hotstar had the IPL rights for 5 years, from 2018 to 2022. It had 5 years to build out a retention strategy for the platform. The story they probably told themselves, and what new platforms (cue: Jio) are now thinking, is that these mammoth licensing deals are basically customer acquisition costs - once customers are acquired, then they’ll get them to stay by luring them in with other types of content, and by cross-selling & up-selling other products. But that’s not what’s happening according to the numbers. Users are loyal to the sport, not to the platform.They come in to watch the content, and if the content shifts house, so do they, as we saw with Hotstar and Jio.

You can see it over other OTTs also: Last year, SonyLiv saw an increase in viewership and subscription thanks to the India tour of Australia that started November end. When the tour ended, the viewership declined once again. The stats haven’t been declared yet, but it’s a safe bet to say that the French Open live telecast caused an increase in the SonyLiv subscriptions and average daily views as well. Now that it’s over, and Djokovic has won his 23rd Slam, the subscriptions are probably going to drop off again.

If you compare the cost of this sports licensing, with the fact that there’s no guarantee that the user acquired through this strategy will actually stay, financially this doesn’t seem to make sense. How it seems to be working is: users come in, subscribe for a month, watch the content that they want to, and then drop off.

So then - are these sports licensing deals really consumer acquisition costs, or rather, drawn out marketing campaigns that bring in users while it lasts, but when the smoke clears, you’re left with no users and mounting costs? Seems to be the case.

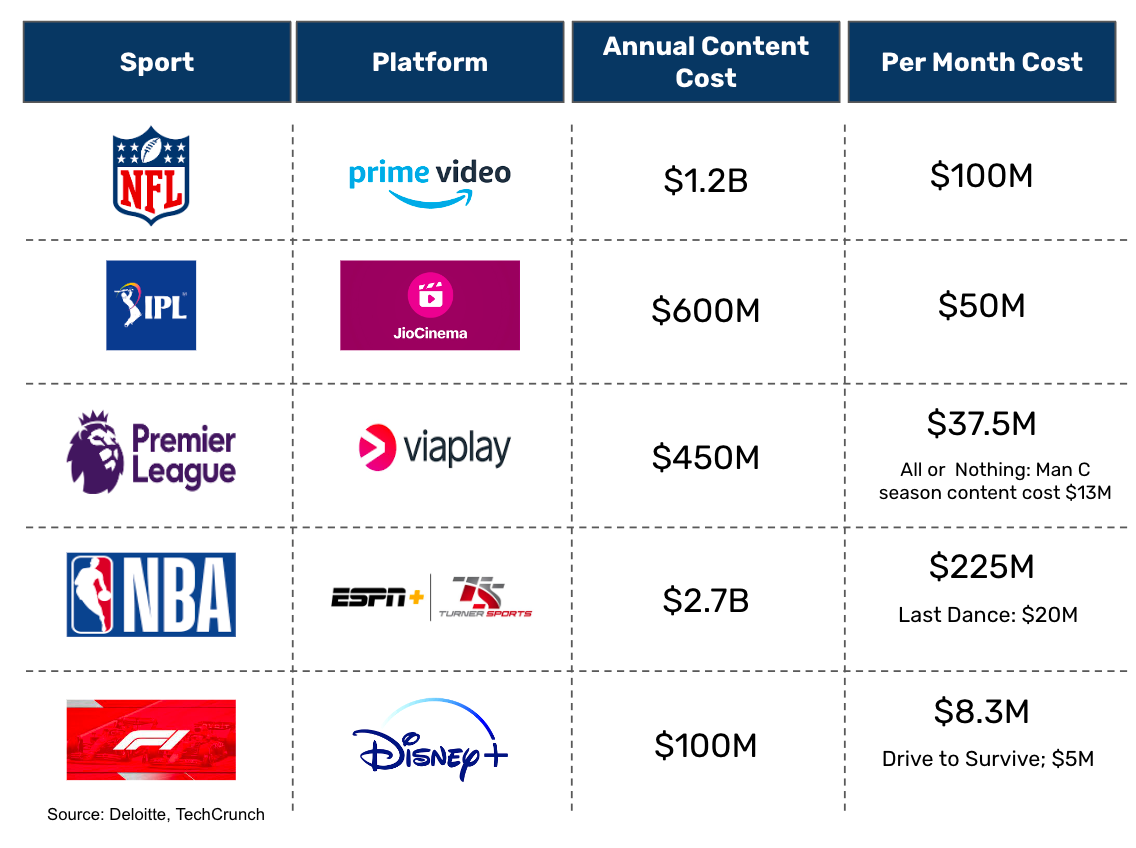

Take a look at the image below. It’s a snapshot of the total live sports content costs that platforms are paying for some of the bigger sports events in the world.

Live sports streaming seems to be anywhere between 15 - 35% of the total video content expenses budget of a platform. Amazon spent $16.6B on original content expenses in 2022. Out of this, $7B was spent on video content such as Originals (think of the widely panned Rings of Power), live sports, and licensing 3rd party content. ~14% of this is just the cost of streaming NFL. Disney has annual content expenses (in 22) of $33B. 33% of this just goes into live sports streaming.

That's a huge budget allocation to content, especially a type of content whose user persona has absolutely no platform loyalty. So it brings in the question: if live sports doesn’t make sense from a platform strategy perspective, what should platforms do?

The Documentary Strategy

Netflix & Prime Video both, but especially Netflix have adopted the “sports documentary” strategy. Instead of licensing out live sports, they’re building original content around sports. Some notable examples in the last few years are:

Last Dance (Basketball): Netflix apparently paid $20M for content costs of The Last Dance (note: in this analysis cost of production is not included, but assumed to be the same across most sports episodes). Compare that to the per year NBA licensing costs from 2014 - 2024, which were reportedly $2.7B per year. Even if we look at this from a per month basis (assuming that an average subscriber would watch a sports show like The Last Dance within 1 month), the cost of live sports is more than 10x more than making a wildly expensive sports show. ($225M per month vs $20M per season).

All or Nothing (Football): This is currently streaming on Prime Video. Man City was the highest paid team, being paid approximately $13M for one season. Compare that to the per year EPL streaming costs, which come to $450M per year, or $37.5M per month. The EPL streaming costs ~3x greater cost per month

Drive to Survive (F1): Netflix reportedly paid salary costs to the F1 teams of about $5M per season. The F1 streaming rights cost $100M per year, a per month cost of $8.3M, which is ~1.6x greater than the cost of Drive to Survive.

And there is an added nuance to this. Live sport watching is a community event - people like to go watch in sports bars or community events, or even host watch parties. So it is quite likely that even if you bring in the view that a sports documentary is watched in 1 month (and gets in 1 months subscription revenue) versus an F1 season for example that goes on for 8-9 months (and thus subscription revenue of 9 months), there’s a good chunk of the overall audience who might not even be paying for this.

Creating sports shows around live sporting events seems to be a strategy that streaming platforms are increasingly adopting to make up the “ OTT sports gap,” and it seems to be working from a cost perspective.

Other notable examples of sports shows created around live sports events are:

Tour De France: Currently on Netflix. (Cycling)

Full Swing: Currently on Netflix. (Golf)

Break Point: Currently on Netflix. (Tennis)

The Test: Currently on Prime Video: (Cricket Australia)

Welcome to Wrexham: Currently on Disney +. (Football (Tier 5 League))

This is similar to the YouTube strategy: leverage live sports events/content on other platforms, to increase viewership to their own content, and it’s one that seems to be working.

What is the way forward?

There will always be live sports fans. These are some of the most loyal fans, and they will go wherever the sport goes. But building a sustainable strategy through acquiring really expensive sports licenses, and then hoping to convert the user into a loyal “platform” user is clearly not working.

So what will happen next?

Live sports is shifting to a pay per view model on independent streaming platforms: Eventually, it is possible that sports licensing deals become too expensive for platforms to buy, and it is possible that this goes what I call the “UFC” route. A pay per view model could be set up for every match/event, and this could be done either independently by the event organizers, or in partnership with a streaming platform, but eventually this could move away from pure-play licensing deals, with very limited platforms getting into this. This has already started happening.

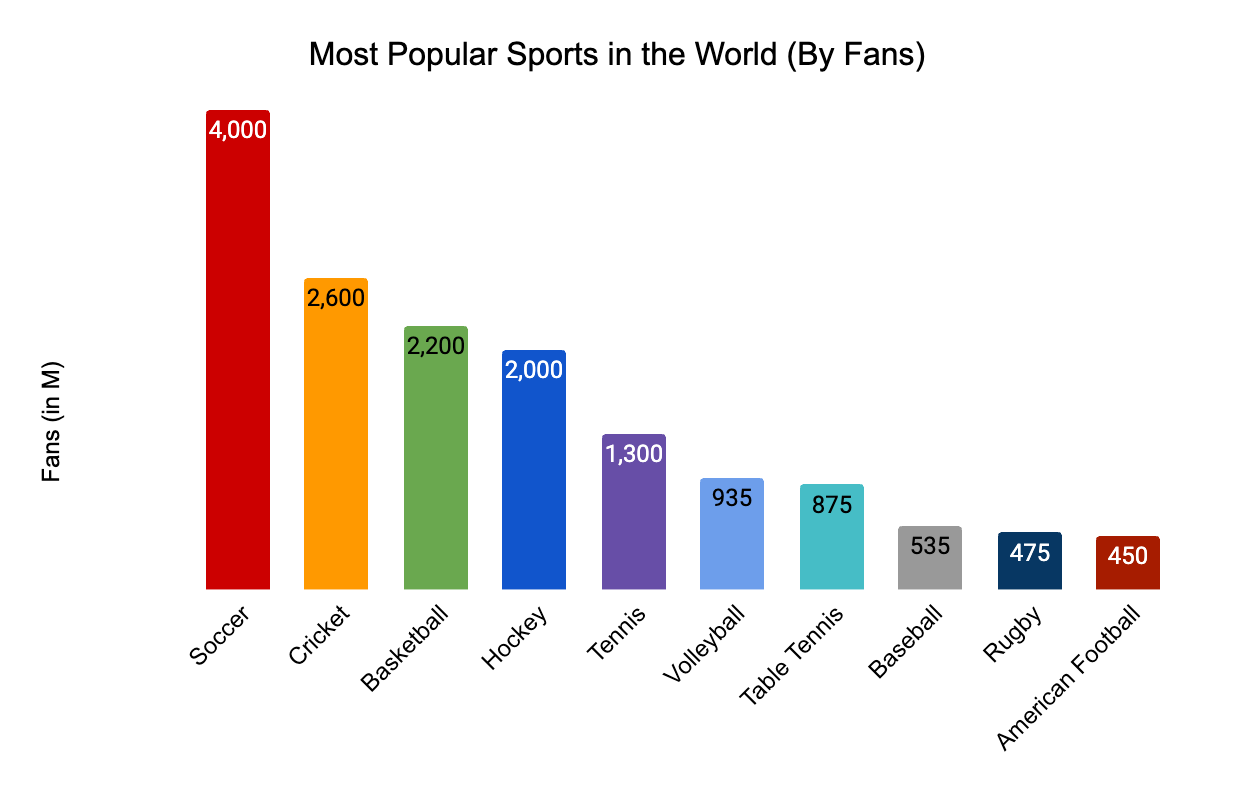

Original content around sports will grow: If you see the image below, it is a snapshot of the 10 most popular sports in the world, by fans. A sports fan will consume everything around the sport that they follow - which is why the original shows have seen so much success. We’ve already started seeing this in football (denoted soccer in the graph below to avoid confusion with American Football), with the All or Nothing Series profiling various teams, and the documentaries coming out on superstars such as Messi & Neymar. Untapped sports with global appeal, such as basketball & volleyball could also see a boost in the coming years. And for streaming platforms this makes sense, because the shelf life of shows like this is much longer than live sports, which is gone after 1 season.

The image below is of the most popular sports in the world, by fans, which are possible avenues for OTT platforms to explore making sports content around.Licensing out behind the scenes content will become an integral part of the strategy for sports leagues & teams: The benefits this yields goes two ways - F1 has been very vocal about how Drive to Survive gave a dying sport a boost, giving it access to a new fan base. ESPN reports that after Drive to Survive, total viewership of live F1 increased by ~70%. Event organizers of other sports will actively look to license out rights to “behind the scenes” content to make this a part of each season’s strategy going forward.

Content streaming deals as a marketing play: Welcome to Wrexham is a poster child of this strategy. Just for background: Wrexham is a team at the bottom of the National League (which is a 5th tier league in the UK, EPL is the first tier), which was bought over by Ryan Reynolds and Rob McElhenney. In 2 years they’ve secured promotion to the EFL League 2. Wrexham FC has a global fan base, which is unheard of, for a club of their standing, and the show that was created around this team: Welcome to Wrexham is responsible for this. I’ll give you the numbers: Wrexham FC has ~1M followers on Instagram. Forest Green, the team that finished at the top of the EFL League 2 in 2022 as ~66K. And a big part of this is because of the show.

One thing is for certain. The “behind the scenes” content shows are here to stay. They have great traction among fans. Platforms see that this sort of content has greater shelf life as compared to live sports, and has lower costs compared to sports licensing. And it’s great for the sport itself.

As a fan, I cannot wait to see what’s next.

Sources: Moneycontrol.com, Techcrunch.com, Inc42, Netflix & Amazon 10K reports