[#8] The Indian podcast landscape - and what we can learn from it

According to CEO of PocketFM, Rohan Nayak, Audio series is a new entertainment category and has immense potential globally. But if you look at it, podcasts, which are considered ‘new age’ and disruptive, are actually the earliest form of storytelling. A voice telling you a story - it’s what our grandmothers used to do.

The listener base in India grew from about 4M in 2016 to an estimated 90M in 2022 at an 86% CAGR. In 2023, in India, The podcast industry is still nascent and most of its growth really happened during covid times in India when we turned to other ways of consuming content that didn’t result in severe eye strain. While some of this might be borrowed growth (due to covid) , since some reports estimate that the growth going forward will be 30-35%, there’s no doubt that audio content as a medium to consume not just music but as a long form story format, is here to stay.

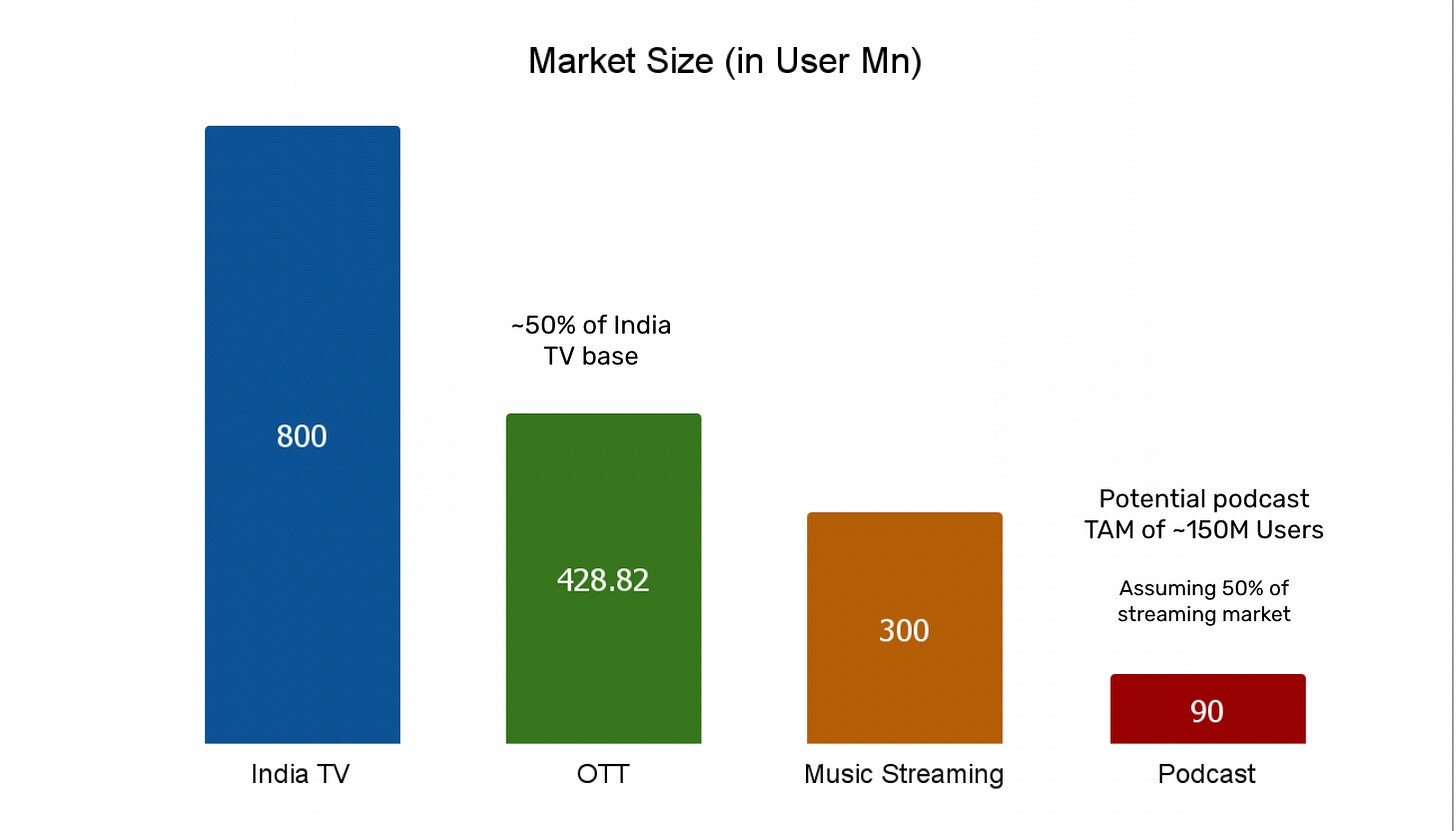

In the below graph is a snapshot of the podcast market & how it compares to the music streaming, OTT and TV market.

*these are 2022-2023 numbers

While Indian TV still has the highest penetration %, its growth has stagnated due to digital distribution channels. OTT currently is at 50% of the Indian TV base. Using that same assumption, and estimating the podcast TAM using the music streaming market gives us a current TAM of ~150M users for podcasts. In reality, this market probably has the potential to be bigger than the music streaming market in India due to the nature of content it hosts. Podcasts are poised to grow - It is predicted that in 3-4 years, there will be around 464M podcast listeners and the podcasting industry will be worth approximately $4B by the end of 2023 (an audience to rival that of OTT). The type of content podcasts can support is probably most similar to YouTube in terms of diversity, length, and the concept of “low commitment content” that we’ve talked about in our article here.

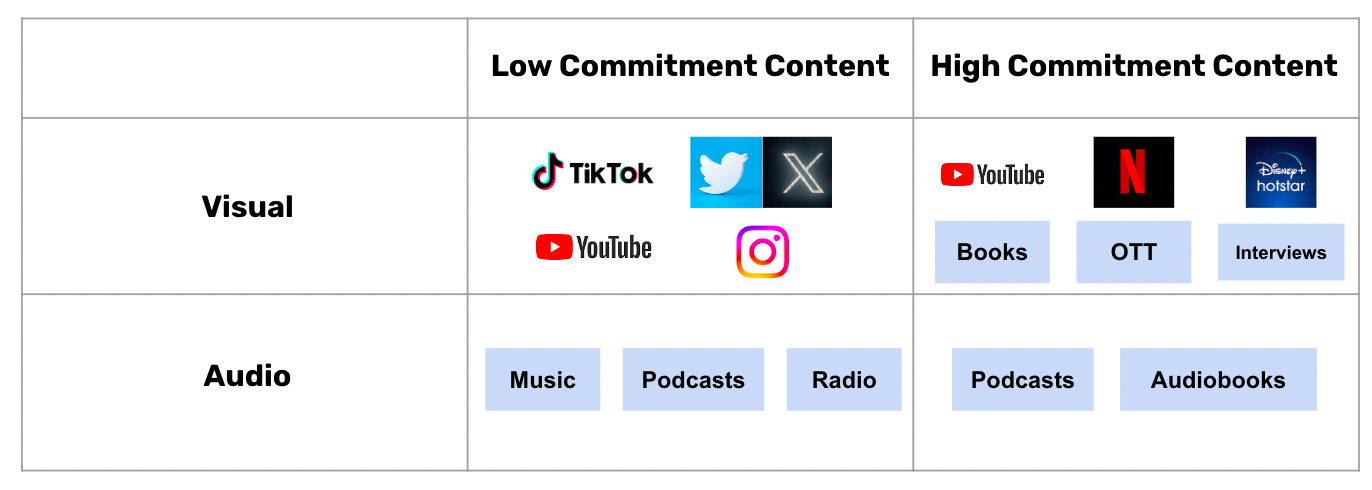

If we map the content types across commitment & audio/visual content, we see that podcasts & YouTube both fit into the low commitment & the high commitment bucket. In fact, this is exactly what the OTT market is struggling with right now - that they only have high commitment content, and which is why YouTube has pulled ahead.

In terms of the effort required for consumption, podcasts require even less effort than a YouTube video, which requires some visual engagement. It’s a content type that allows a consumer to multitask. Podcasts are created solely for audio consumption, and thus the creation and the energy of all the content is created taking this into account, which on average (and this is a personal view) leads to better content overall. The 2x2 below illustrated this well.

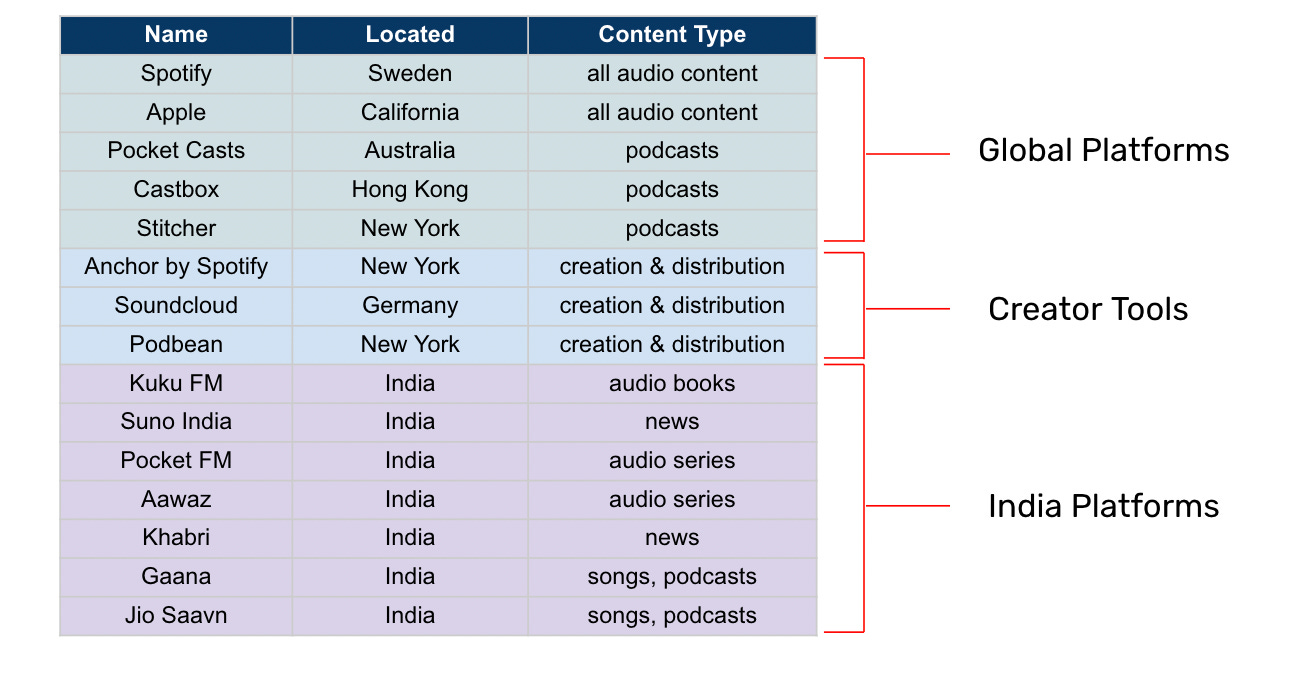

The popularity of this content platform has grown rapidly, and global players such as Spotify, and Indian players such as PocketFM and Jio Saavn have been quick to capitalize on this and add podcast content to their own platforms. Indian companies like Hubhopper build products and tools to democratise the audio creation and consumption process across emerging markets.

Podcast Market in India

While Jio Saavn have expanded from their song streaming offerings to podcasts, there are also pure podcast content platforms in India, some of them being called out above. All these platforms have been founded around 2018 - 2019, so they are still fairly new.

These platforms are still nascent, and while they have focused on specific types of content (audio series, audio books etc), they are yet to reach significant scale (Kuku FM has ~1M paying subscribers according to several reports).

Global platforms such as Apple & Spotify focus on exclusive content, and are unable to tap into the regional levers, so for a lot of these young Indian platforms, acquisition by a global player is a very possible outcome. While bigger platforms may be able to sustain it is likely that the rest of the market is headed towards consolidation.

Consumer POV

We also had a chance to speak to some avid podcast consumers to better understand why & when they consume podcasts and other audio content, and got some interesting insights.

1. Listen to podcasts while doing low-effort tasks: The users we did speak to said that they listened to podcasts while doing tasks that may not require too much focus, such as driving, walking, cooking, and even before sleeping. It also allowed them to multi-task, and served as an alternative to music listening.

2. Content quality on average was better due to no video: On average they found the quality of content in podcast interviews better as compared to video interviews. The consumer hypothesized that the interviewee's inhibitions are less because there is no video and thus the depth of insights are more. They also found that in a lot of video interviews, or even KT videos on Youtube, the video did not add any value to the content per se.

Both these points speak favorably towards podcasts as a medium for consumer content and for podcasts as a way for brands to optimize their marketing spends.

Monetization Opportunities - Ad & partnership revenue is a big piece

For any platform, the monetization opportunities are two fold - either go the ad revenue way or the subscription way, which is why the current content market is in flux. We’ve mentioned in a previous article, that the way forward for many OTT platforms is through going after the ad-based free consumer. In India, getting the mass audience to pay might be difficult, but the opportunity to monetize through ad revenue is massive. There are several reasons for this:

Ad & Partnership Revenue

1. Higher loyalty to podcast content: Podcasts are perceived to give a more personalized experience to customers, and the connection & loyalty consumers have to podcasts tends to be higher than what consumers would have to video content.

2. Ads are naturally integrated with the content, and it doesn’t feel jarring like a YouTube ad might feel, so consumers are more likely to engage with it, rather than tune it out, leading to higher conversions and lower CaC for brands. This was echoed by the podcast consumers we had a chance to speak to.

3. Engagement & Conversion: Several studies have been conducted on audio advertising (source). The Nielsen study concluded that audio advertisements were up to 25% more effective than the other forms of ads. The Podcast Trends Report for 2019 found that 59% of people spend more time listening to podcasts than browsing social media and that over 55% of respondents in their study said they purchased an item after hearing about it on a podcast.

Pay Per View / Micropayments as an alternative to subscriptions

in Tier II, Tier III cities, people are willing to pay for content, as long as it is divided up into bite-sized amounts. In the Indian landscape, shows are being priced-per-episode, which allows the user to choose and pay for exactly what they want to watch, which is a strategy adopted by PocketFM. According to the Hindu Business Line, with the introduction of micropayments, PocketFM registered 10 times the growth.

Content for the long tail - both language & genre

1. This is a massive penetration opportunity for Tier 2 & Tier 3 cities, and podcast providers focusing on regional content, which is how existing Indian podcast platforms are looking to grow, by providing content in multiple languages, aimed for the regional audience

2. According to market research, the audience enjoys comedy, stand-up, and long form storytelling, like Yakshini and Amrapali (very popular podcasts on PocketFM). The discussion based podcasts, like Seen and the Unseen, are popular in urban cities. Podcasts like Bound are tapping into a niche in India, by creating compelling audio-narratives around books and writers.

Looking Ahead

There are market and model leavers which will enable podcast growth: apart from the intrinsic nature of the content, levers like internet penetration, becoming more cost effective (a problem that OTT is struggling with right now), and the rise of AI are enablers to this growth.

1. Smartphone & Internet penetration: An IAMAI report said that the current internet penetration in India is ~692M in 2022, projected to grow to ~900M by 2025. This growth will enable digital audio adoption especially in tier 2 & tier 3 cities.

2. More cost effective than other forms of content: The costs of producing podcasts are significantly less than the costs of producing videos. The business model is possibly more sustainable than a video content platform, and due to the tools available now to the public for creation & distribution, there will also be growth in the supply of content.

However, from a content studio perspective, podcasts uploaded on Spotify offer too little in terms of monies. Currently, Spotify offers 3 paise per stream to a creator. In terms of returns, for a content studio that is investing in a podcast cannot rely on returns simply on streaming revenue for adequate returns. For content studios, podcasts only make sense if they’ve been pre-sold, or are co-produced by the audio platform itself. This is where the partnership & ad revenue angle will come into play

3. AI & Creator Tools: PocketFM for example has high priorities for Natural Language Processing (NLP) and text-to-speech technology and have been implementing multiple projects to strengthen their language processing aspect. The ease of creating and distributing podcasts will result in more content, which will appeal to more audiences, and lead to podcast growth.

4. Rise of ancillary tools: As this medium grows, the rise of tools: creator enabling, analytics, collaborative, and for payments/monetization which are podcast focused will continue to grow and evolve, and could be where the next wave of investments from an investor angle will be focused on.

While podcasts may never see the virality that visual content has, the concept of the podcast audience, while niche, and small, has higher engagement & retention, and has solved for loyalty and trust, things that content platforms are still trying to find solutions for.