[#34] Real Time Payments 2.0: What will the next wave of innovations bring?

A few months ago, I had written about how real time payments (RTP) is working around the world, and how countries, especially those with high dependence on cash, and limited banking penetration first moved to digital wallets, and now to RTP Account to Account payments. (RTP -A2A)

You can check it out below:

[#22] How is the world (not just India) innovating on real time payments?

We’ve all been reading about how UPI is taking over India, and the world. Recently the news came that India’s NPCI has inked an MoU with Lyra Network in France, and another MoU with UAE, to allow UPI to be used for international payments in these countries. And this news article

Developed countries have RTP payments, but for those countries with high penetration of banking in the population (70%+), this is more in the form of wallets that store card details, and allow 1 tap payments through NFC, or through biometrics, such as entering a PIN. Examples of this are Google Wallet, Apple Pay, and MobilePay (Vipps) in Denmark, Finland and Norway. For those countries with high cash dependence, and less penetration of banking services is where digital wallets (to store cash), and now RTP A2A payments have really taken off - countries that come to mind are India, SEA region, and LATAM.

And another interesting trend that I noticed was that RTP has evolved in the following ways:

Model 1: Driven by banks / banking apps

Bank / central authority driven, such as Zelle US), FedNow (US), Pix (LATAM), Twint (Switzerland), Osko (Australia), Bizum (Spain) are accessible through respective bank apps, instead of separate 3rd party apps. Example: To pay through Pix, a user logs into their bank app, redirects to the Pix section of the app, and pays through that. Zelle is actually housed in a fintech institution called Early Warning Services, which is controlled by a group of organizations that includes Wells Fargo, Bank of America, Chase, U.S. Bank, PNC, BB&T, and Capital One, and again is not a separate app, but can be access through mobile banking apps.

Model 2: Driven by 3rd party apps

This is usually catering to both P2P & P2M, such as Venmo, which started out as a P2P App (users could connect their bank accounts to Venmo and facilitate payment through the app to their friends), and after building up a loyal base, and being acquired by PayPal in 2013 for a whopping $800M, launched P2M payments in 2016.

While rails are developed by central authorities, 3rd party apps have been able to innovate and drive customer adoption. Example: UPI in India, with PhonePe, Paytm, and GooglePay. While bank apps have this capability as well, 3rd party apps came in fast, and drove user acquisition through offers, and best in class experience. You’ve also got Swish (Sweden), Tikkie (Nederlands)

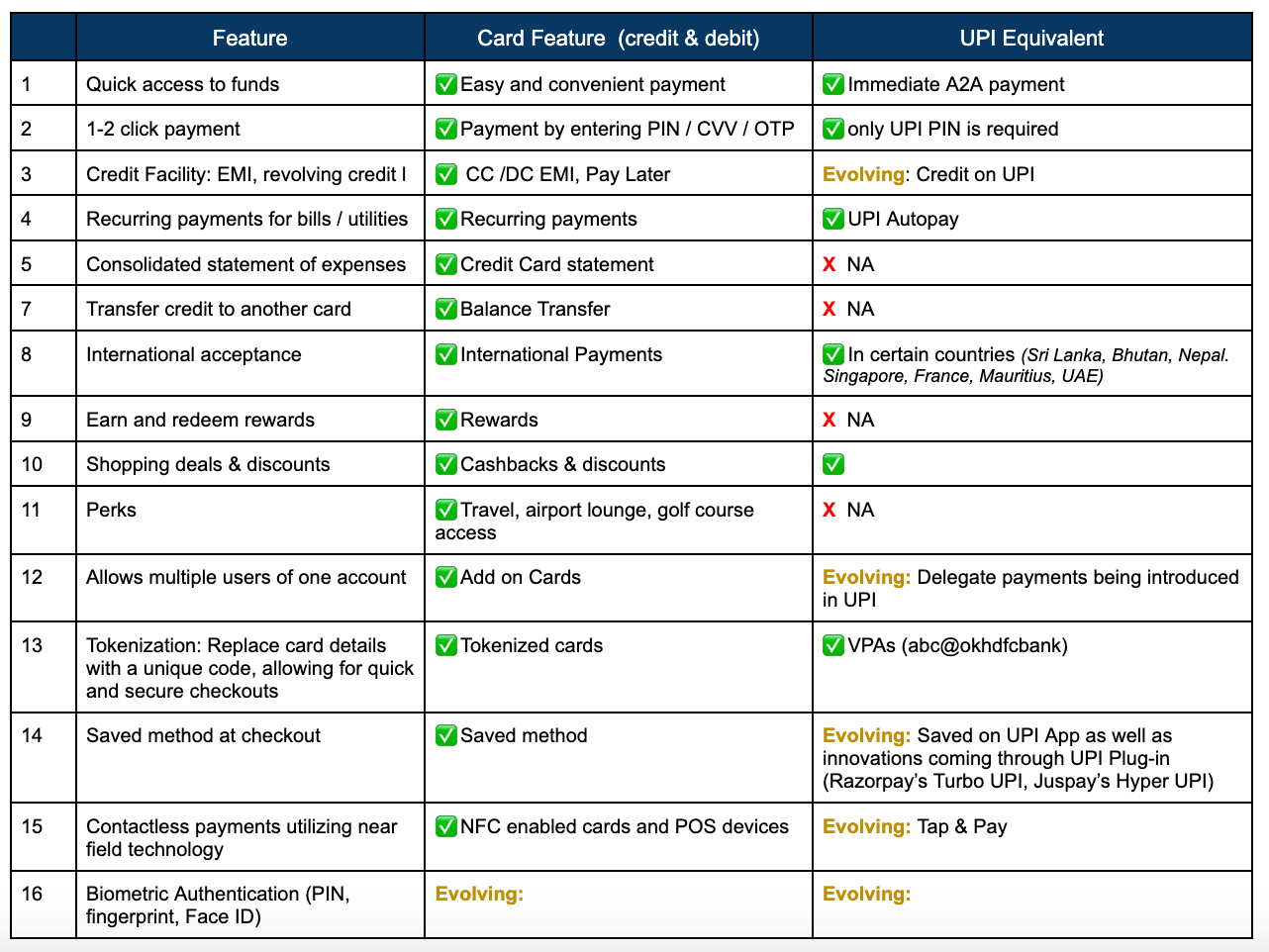

It’s pretty clear that RTP is what is driving innovations in payments. 2/3rd of Brazil’s population has done a Pix transaction, and UPI is projected to power 90% of India’s payments by 2028. So, RTP is here to stay, for sure. So what is the next disruption on top of this? Well, one way to think about it would be the addition of all features that are existing on payment methods today, brought upon RTP rails. There is an easy way to map this, by comparing them to existing features of card payments:

So then are the features of debit / credit cards where we can expect RTP innovation?

So then what is Real Time Payments 2.0?

1) Well, first, it’ll just be enabling a lot of these features that currently exist on credit / debit cards.

Ex:

Credit on UPI

Bring a consolidated statement of expenses just for RTP

Balance transfer from one credit account to another

Rewards on UPI

Perks (lounge access, golf courses etc)

Allow multiple users of one account

Saved RTP methods at checkout (similar to how cards are saved)

Contactless payments (Tap & Pay)

Biometric authentication

And it will require a lot of ancillary features to be able to support the scale and speed that UPI systems bring, mainly around back-end systems & servers to process these transactions. Some of these are already coming in as called out. Things such as Credit on UPI, Delegate payments (for multiple users of one account), and contactless payments will continue to evolve.

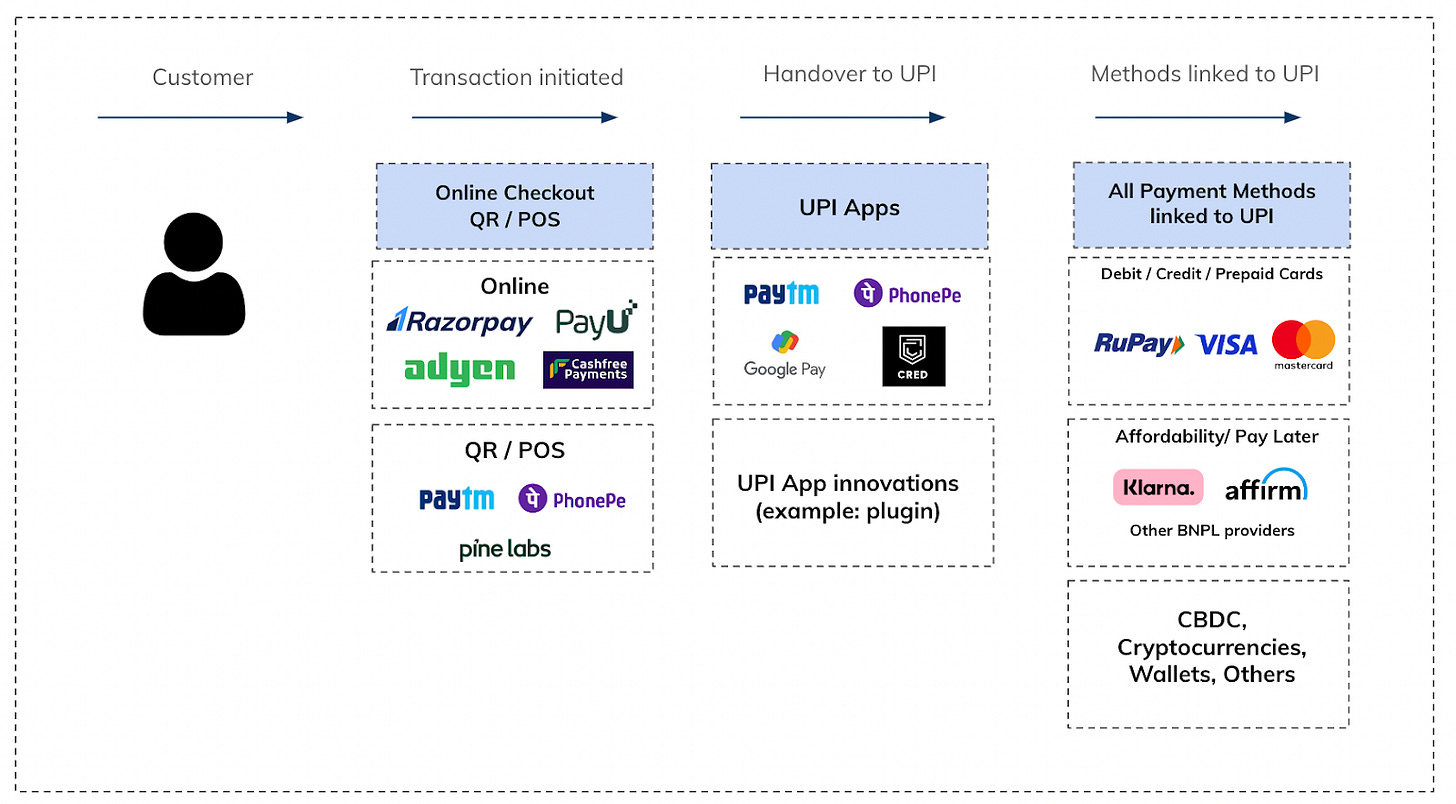

2) Widespread push to link all methods on UPI, not just cards

There’s another angle here. RTP payments are rails that can be used to make payments. And any payment method ideally should be able to connect to these rails, and make payments. And this is beneficial for the stakeholders. Card payments are charged at 2% (for the merchant), out of which 0.2% goes to networks. Real Time payments are charged at 1/10th of this: Pix is at 0.33%, for example. And as I had written in a previous article, if UPI is charged at 0.10 - 0.15% per transaction, that is enough for the ecosystem to break even, at today’s scale.

So if RTP is cheaper for the ecosystem, and is able to enable access to payments for a majority of the country, then it’s obviously a better option. And then ALL payment options should be able to be linked to this. Not just cards (credit, and debit). Rupay cards (India local card network) are anyway linked on UPI, it’s what NPCI seems to be betting on to scale its adoption and compete with Visa & Mastercard. And it is only a matter time before cards of ALL networks can be linked to UPI, though I see that happening a few years down the line, once Rupay Cards have scaled. And allowing Mastercard & Visa to link their issued cards on UPI can open up another angle of monetization for UPI.

What about methods apart from cards & accounts, can’t those be linked to RTP rails?

All methods don’t just include credit & debit cards. They also include payment options such as BNPL, and other affordability methods, and can also include alternate currencies such as cryptocurrencies, and CBDC. GooglePay has already started allowing these “alternate accounts: to be linked / saved on its app: Gpay now allows customers to link their Affirm and Zip accounts (BNPL players) to GooglePay. But that’s also because of how BNPL is evolving. In fact, Klarna, very recently launched a checking account type product, which allows users to store money in it, and use that money for purchases, as well as pay off their BNPL loans - very bank-esqe.

But for these methods to be linked to RTP rails, the BNPL landscape would have to evolve, where these players don’t just act as aggregators of loans, but actually operate accounts/ wallets, which can be linked to RTP rails. In its current state, this is not possible. Currently these players don’t give accounts to the end customer, as in, the end customer never really sees the money. At the time of purchase, the customer completes their purchase, and the merchant gets the money from a lender. The customer gets a loan statement detailing out their loan payment details, which they pay back to the lender at a handsome rate of interest. But as BNPL players evolve into “challenger” banks, this is quite the possibility.

This is also an opportunity for neobank’s to increase the distribution of their accounts and products. Nubank (neobank in LATAM, you can check out my article on them here) for example, already partners with Pix, and touts this as a big reason for their growth. Of course, neobanks, i.e. digital ONLY banks are not really seen in a favourable light in India by regulators as of today, but this is still an avenue of growth for international neobanks (Revolut, Chime etc).

So RTP evolves into the “checkout of the future” all payments methods will eventually come under RTP rails

Take an example of the Indian landscape. Right now if a customer comes to checkout, they have to pick their respective payment method, which then gets processed by the respective rail. Example:

1. If they pay through cards, then the payment is routed through card networks (Mastercard VISA)

2. If they pay through netbanking, then its a bank to bank transfer

3. If they pay through BNPL, then it is a transfer that is facilitated by the BNPL provider, from the lender to the merchant

These different payment methods have vastly different checkout journeys, and as consumers get more comfortable paying using RTP rails, and with a greater % of transactions being powered by RTP, the hypothesis is that they will look for standardized payment journeys, which are as close to the RTP journey as possible. And thus the natural next step: linking all payment methods to RTP rails, making RTP, and UPI the “checkout of the future” (first coined by Vijeth Pandit - Senior Director, Product at Razorpay)

Credit Cards on UPI (for Rupay) are already in play. And in the future, I see all methods: cards, lines, PPIs, BNPL, and eventually alternate currencies such as CBDC, and cryptocurrency wallets being linked to RTP rails also.

B2B Real Time Payments not innovating as fast as B2C

B2B payments are slower on the uptick. FedNow is an RTP rail that was introduced in the US in 2023, but is structured mainly for enterprise businesses. There is a monthly fee of $25 per routing number, and Fednow payments are initiated using the recipient's bank account number and routing number, rather than the mobile number, similar to RTGS or IMPS payments. What is interesting is that there are B2C focused rails: Zelle (can be accessed through the respective bank app for P2P payments), and Venmo (focused on P2P, and now also allows linking of card details for P2M payments)

So RTP for B2B payments could play out in the following ways:

1) B2B & B2C Rails: Two rails for RTP, one which is focused on B2C, and the other, which while can be used by B2C, caters more towards B2B (such as Fednow in the US). But it seems like a waste of time developing two separate rails to solve the same use case

2) B2B focused identifiers: Have identifiers set up for B2B payment use-cases, but use the same rail. Right now, the mobile number is the key identifier used for UPI payments, although you can also use IFSC codes, bank acocunt numbers etc. The key value add of RTP is that the money transfer is immediate, and settlement quick, and it may need to be marketed that way. B2B payments also happen on the laptop, while most UPI payments happen through the mobile, and it may need to be thought through in that way.

3) Fraud guardrails: Ease of payments also result in frauds. An estimated 55% of all digital frauds come from UPI. Considering bigger B2B ticket amounts, these are transactions with a lot more riding on them, unlike RTP, which is used to replace cash, and small ticket everyday transactions. As RTP payments become easier and more convenient for the consumer, things such as biometric authentication could help in adding an extra layer of security on the B2B side.

4) Limits will have to be increased. UPI transactions are limited to INR 1L per day. And although reports suggest that this limit has been increased to INR 5L per day, this still suits your SME, and unorganized sector more.

But there are are still challenges in the RTP system that need to be solved:

1. Phone dependency: What if you run out of charge?

Possible solutions:

IoT: wearables which allow for payment. But this doesn’t work in widespread adoption, and this is where prepaid cards / offline cards anyway have a use case. It’s primarily a use case for offline payments, in situations where you may not have access to charging points.

Cards are still the best use-case here, since the battery charge angle is moot here

2. Internet / network dependency: What if there is no internet

Visa, and other networks are innovating on debit cards that have some amount of stored value, and can generate a receipt of the transaction. When the internet / network is enabled, then that payment is transferred.

UPI Lite X: This operates almost like a wallet, where money can be transferred and stored from the UPI Account to the LITE X account, and transactions, which are done through NFC enabled devices. of course, while the network problem is solved, NFC enablement is still a question.

UPI 123: Do payments using missed calls / pre-set IVR numbers to set up account, set up PIN, and complete transactions

Cards again have solved this, because most cards issued now have NFC enablement, and the onus is usually on the merchant to have the NFC enablement on the device. But this is a challenge, since NFC enabled devices are usually more expensive than regular POS devices, or a QR code.

3. Allowing multiple users to use one account:

Cards can be handed, along with authentication details to family members to use for payment. There is also the concept of add on cards, where several secondary cards can be issues against a primary card. There seems to be a solve for this on UPI, through delegate payments, but there are just a few news articles on this. Nothing has been launched really.

4. Data security:

When we talk about biometric payments, we mean payments authorized by PIN (already happening), fingerprinting, or facial ID. Right now, all PIN pages are hosted by NPCI, but if payments are authorized through fingerprinting, or facial ID, how and where will be stored? Right now, all PIN details are stored with NPCI, but data such as fingerprints and Facial ID is way more personal, and will probably need a regulator to sign off on.

A solution to a lot of existing RTP problems is something that cards have solved, and could probably result in a RTP + Local Card Network strategy

This is happening in India. Rupay (India’s local card network) and UPI (India’s RTP network) are both developed, and operated by the same entity - NPCI. And many countries are also leaning towards developing / scaling their own local card network schemes. In fact, in 2023, Indonesia announced its plans to develop its own local card network. Which makes sense! Majority of the population of any country will probably not travel internationally, and mainly need facilities for local payments. Think about it, if you’re local, your bank is local, your country is local, your merchant is local, then why can’t the card payment network be local? And there is also obviously the second point of being able to have more control, and make the market more competitive. In fact, earlier this year, RBI came out with a circular in India, where banks had to mandatorily issue cards on all networks, and the customer could choose which network they wanted that card on.

And with exclusively allowing local card networks to be linked to the RTP rails, more and more customers would pick a card from the local network, vs a card from Mastercard / VISA. or at least that's the hypothesis. Thus reducing the reliance on international card networks. While international networks will still be needed for the cross border story, the local networks can atleast be brought in the ambit of the local governing country.

So maybe that is something that we’ll see, that countries who are developing their RTP networks, will also develop their local card networks, and provide that linkage as a way to power the growth of these local networks.

But there’s a problem: Mastercard & VISA are powering a lot of the RTP networks across the world!

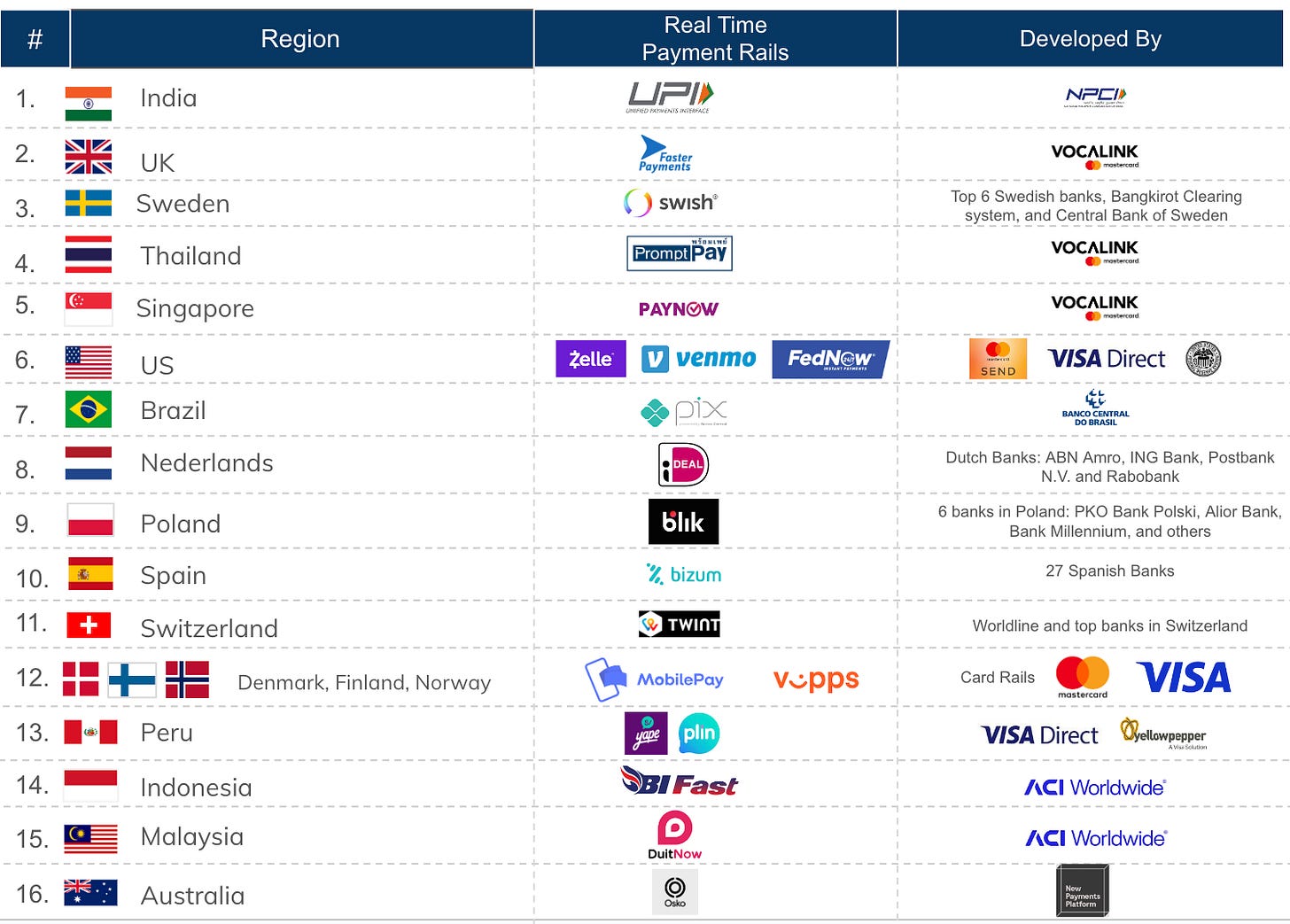

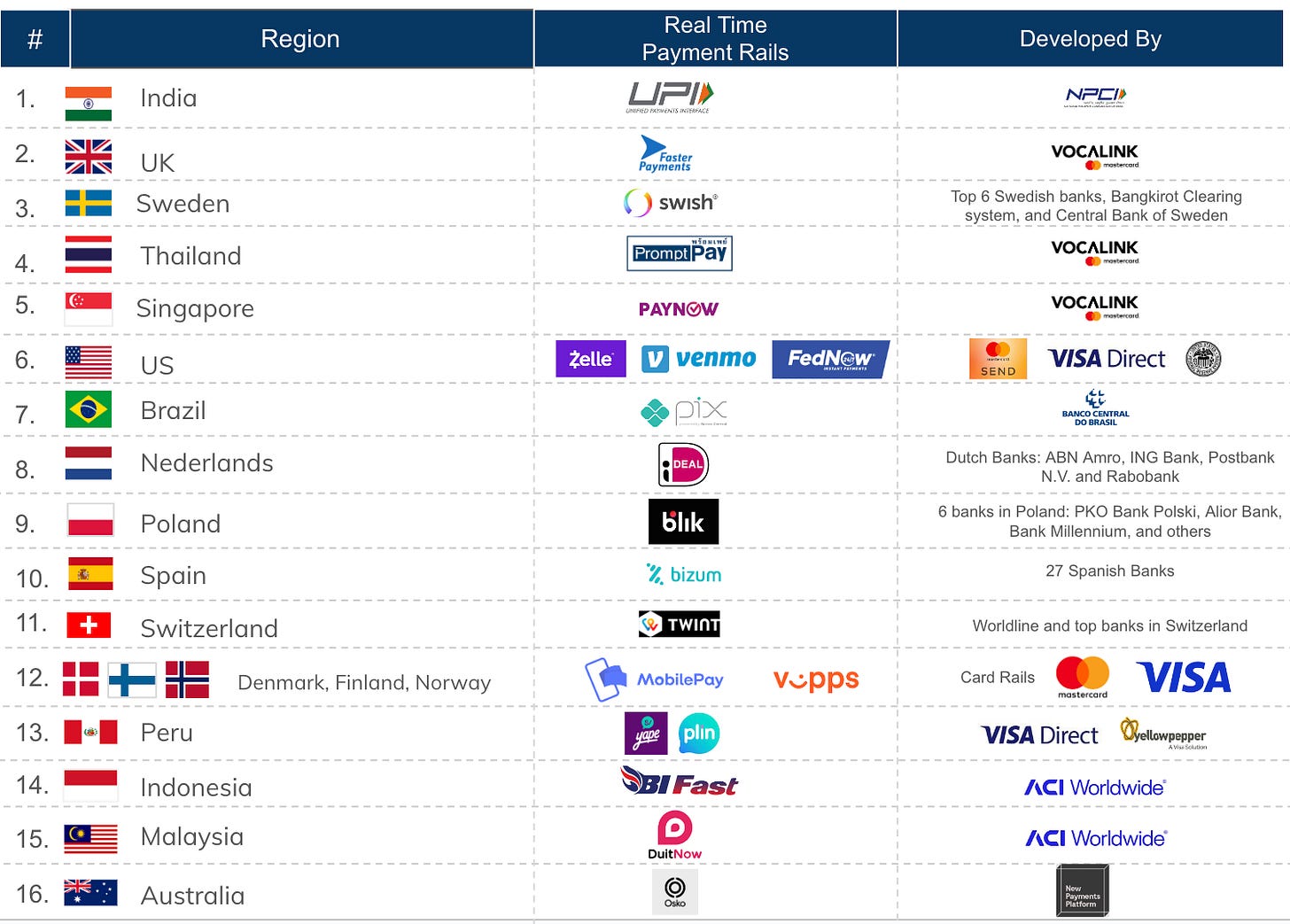

Mastercard bought Vocalink in 2016, which powers Promptpay (Thailand RTP A2A), PayNow (Singapore RTP A2A) and Faster Payments (UK RTP A2A). Visa bought YellowPepper in 2020, which powers PLIN, the RTP A2A rails in Peru. Take a look at the snapshot below.

Out of the 18 countries sampled, who have some innovations on RTP payments, either through Account to Account, or through wallets that store card details, they fit into 3 structures:

1. Developed by some sort of central entity: India, Australia, Brazil

2. Driven by a consortium of banks: Poland, Switzerland, Spain, Nederlands, Sweden

3. 3rd party Providers:

ACI Worldwide: Indonesia & Malaysia

Mastercard / VISA (including their acquired companies): UK, Thailand, Singapore, US (Zelle), Denmark, Finland, Norway (leverage card rails, since mobilePay is a wallet with card details stored), Peru

Within 3rd party providers, 80% of rails are powered by Mastercard & VISA. And out of the overall sample, 44% of rails are powered by them. So then the “independent network” story is breaking, since RTP is gaining traction, and even if independent card networks are set up, if their “secret sauce” is the ability to link cards, and other methods to RTP rails, then there is still dependency on an international network.

But maybe its just a GTM strategy. Maybe, as the RTP payment method evolves, and new features are overlaid on top of this (credit, insurance, rewards and other points mentioned earlier), another point to note is that if this whole piece is to reduce reliance, at some point, countries, while initially may GTM using Mastercard & VISA capabilities, may eventually move to own the IP of this network, or after taking learnings, build their own, similar to what we’re seeing with card networks.

As Real Time Payments evolve, cards as a form factor become less relevant, but are still needed as a second option to decouple phones and payments

As a credit card user, who then started using UPI, the convenience of carrying a card without worrying about phone connectivity, and battery is unparalleled. There have been a couple of instances where I’ve tried to pay using UPI, but for whatever reason my app isn’t working, or my phone has died, and in that case, it’s been easy to whip out a card and use that as a payment method. So I don’t think it’s going away anytime soon. AND, they’re useful for big ticket transactions. My UPI threshold is still at about ~INR 10-15K. Anything above that, and I just feel more secure paying through my card. And those ticket sizes are large enough to generate reward points of note.

Also, credit card spends are actually increasing: They increased 27% YoY from FY23 to FY24 in India, from 14L Cr to 18L Cr. Of course, UPI is outstripping this, doing more than that in a month: in July ‘24, UPI clocked INR 20L Cr worth of volumes, and grew by ~57% from FY23 to FY24.

Of course, it’s still early days. UPI in India was launched in 2016. Mastercard has been around since 1966. Visa, since 1958. RTP - A2A is still relatively new. There are many things to be figured out in RTP 2.0. It’s also still early days for RTP cross border transactions, and while interlinked RTP networks are being set up in ASEAN, we’re still a ways away from global interlinkage, with Mastercard and Visa way ahead of the game here still.

But as RTP 2.0 innovations come in, the delta in the advantages of cards vs RTP is decreasing rapidly, and RTP will not just power majority payments, but will also be the first choice of payment method, across all ticket sizes and categories.

![[#22] How is the world (not just India) innovating on real time payments?](https://substackcdn.com/image/fetch/$s_!nEQS!,w_280,h_280,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F0e6071c4-b476-4df6-9b4e-22a826404046_1016x1158.png)