[#3] OTT platforms are competing against each other when they should be competing against Youtube

By Ambika & Devki Pande

Last year, according to the MPA Indian Online Video Report 2022-2023, out of 6.1 trillion minutes consumed on Video on Demand, OTT comprised 12% and Youtube consisted of 88% of the minutes watched. Let that sink in.

If we put it into numbers, OTT is consumed by 50 - 60 million people in India. But Indians are the highest consumers of Youtube globally, coming to 467 million users. This means, essentially, that OTT platforms are fighting with each other for a very small part of the streaming world. The streaming wars, and the play for the regional user, as we’ve written about in a previous piece, have already been won - by Youtube.

How did this happen? Well - Social media changed the way we interacted with content, but it is the short-video phenomenon, the Vines and Reels and Youtube Shorts which have changed the media landscape forever. Because what the rise of short-form video has done is reduced preference and mind space for long-form content - OTT - in favour of ‘bite-sized’ or snackable content. Simply put, people don't spend hours on hour-long content anymore. They spend their hours on second-long content. And this is what OTT is competing against.

The Volume Game

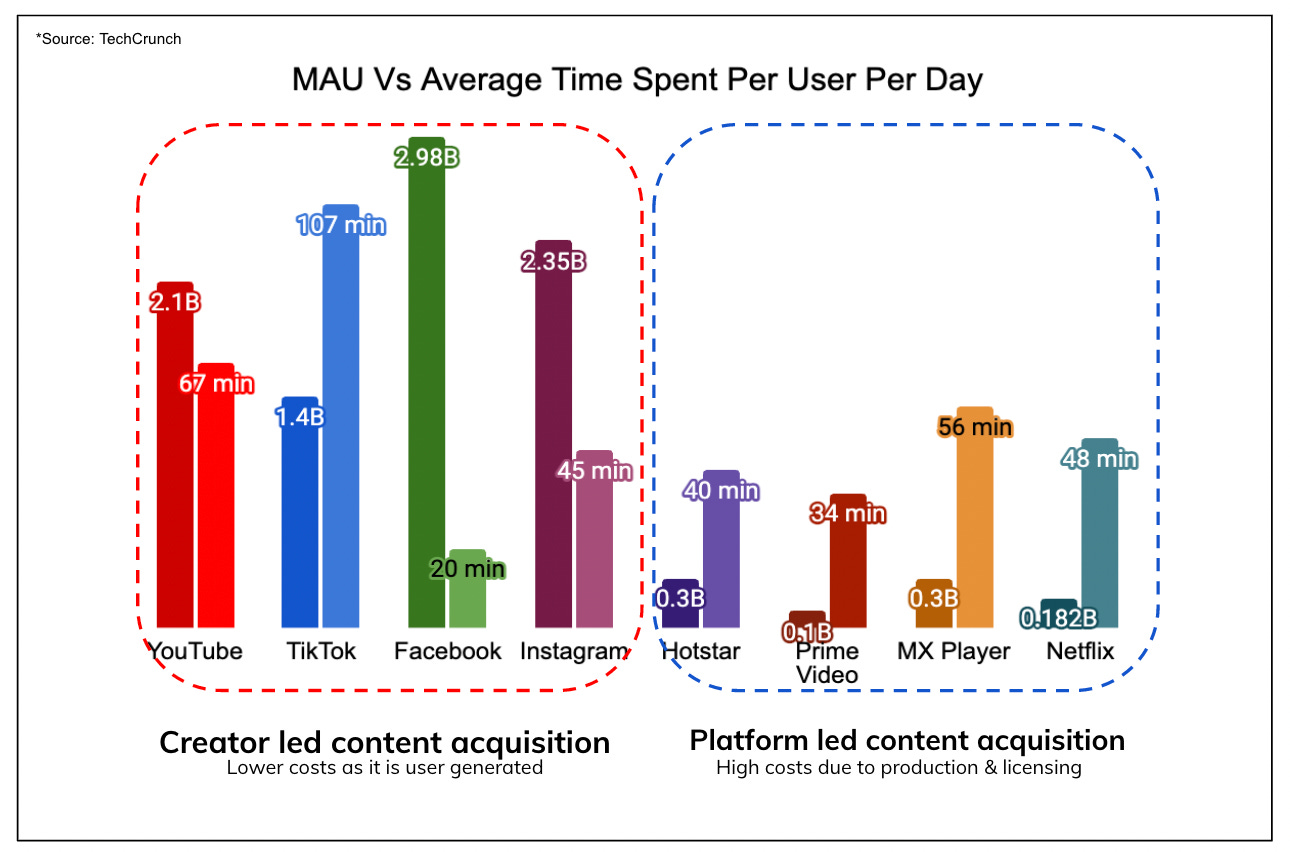

Look at the image below (MAU & average time spent)

Content/Streaming Platforms usually exist in two ways:

First: they play the volume game, where they have a large user base, where even if there is low engagement, there are enough engaged customers on an absolute basis for the model to make sense.

Second: they have a small user base, but with a high engagement rate.

An expectation here would be that OTT, despite having a smaller pool signed up, would have a higher engagement rate, because the nature of the content on the platform is high commitment, with characters and sweeping story arcs. And that short-form content would have a larger user base, but a lower engagement rate, because of how easily you can flip through the content.

But that’s not the case. If you look at the graph, not only does Youtube have one of the greater user bases, denoted by the greater Monthly Active Users (MAU), but out of these people, they also have a per-day greater engagement - the average time that a user spends per day on Youtube is one of the highest among all the content platforms.

Creator Acquisition Led Vs Content Acquisition Led

If we look at the MAU vs Average Time Spent comparison, a key insight emerges. It’s not just Youtube that has a greater audience and engagement. All the Creator-Led Platforms, on average, have a greater user base and a greater engagement rate, than the Platform-Led Content Models.

(*A Creator-Led Content platform when the platform enables users to create content and doesn’t directly create/acquire content - basically, the Instagrams, Tiktok’s, and Youtubes. A Platform-Led Content model is where the platform directly invests in licensing or producing content - which are the OTT platforms like Hotstar, SonyLiv).

It’s not that Creator-Led platforms haven’t attempted to commission and acquire content. They did, but they let go of these verticals when they didn’t fit in with their larger model. In 2016, Youtube and Facebook made a brief foray into content licensing and acquisition, with Youtube creating Originals to compete with VOD streaming, which it discontinued in 2018. In 2021, Facebook chose not to renew a 3-year deal with the Champions League and La Liga to air their games, citing ‘non-compatibility’ with existing business models.

Now, after their brief stint with content commission and acquisition, both YouTube & Facebook are focusing even more on creators, implying that in their view, a creator-led model is a more efficient way of pulling in subscribers. Youtube has put aside a $100 million Creator Fund for Shorts, while Meta has reallocated resources from its Facebook News Tab & Bulletin to the creator economy, and as per a 2021 report, was planning to invest $1B in creators.

These are substantial sums of money, and one could think - well, isn’t this a very large amount to spend on creators? Wouldn’t it be easier if they just spent all this money on producing a show? But the thing is, Youtube has figured it out. The problems that all B2C facing apps face, and that OTT is trying to solve for: that of personalization, accessibility, skyrocketing costs, are problems that Youtube, by nature of what it is, never had in the first place.

OTT versus Youtube

Personalization through solving for the language long tail: When OTT talks about regional penetration, they talk about building a presence in Tier II, Tier III cities, and about content dubbing and subbing - which is the strategy for Netflix, Prime, Hotstar. OTT movies are dubbed and subbed in 8 languages to draw in the regional consumer. Youtube, on the other hand, is already localised in 100 different languages

Customised Content - What OTT is currently struggling with is acquiring the niche consumer. In an effort to keep the subscribers they have, and to pull in new ones, the content churned out has started to seem formulaic, with similar tropes and plot twists, according to what’s already worked. But Youtube has already solved for personalisation by virtue of being creator led, and due to limited restriction on what sort of content can be posted, not only is there something in every language for everyone, but there is also content that appeals to all tastes.

The ‘Anyone can create’ philosophy: Netflix has 13,000 titles on its platform. Youtube has 3.7M videos uploaded EVERY DAY. In creator-led platforms, anyone can watch and create - Instagram and Spotify’s RADAR program even offer tools to creators. But in OTT, watching comes at a price (subscriptions), and a very small percentage can create.

What are the different content formats?

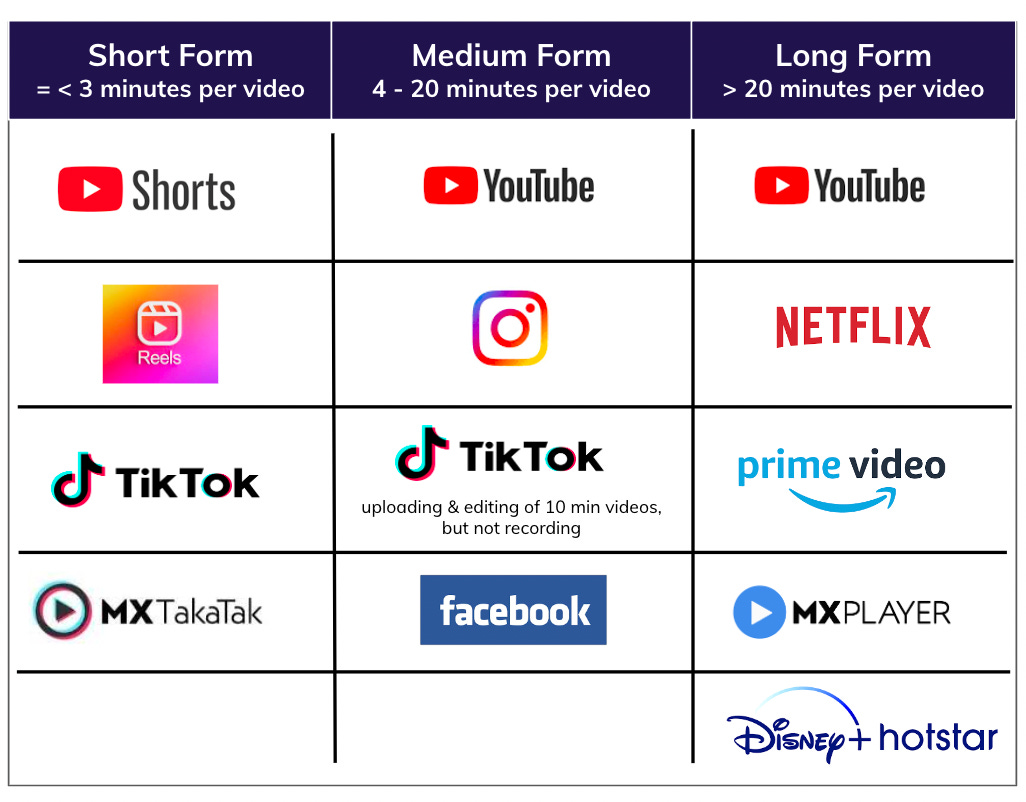

The VOD sector can be slotted into three kinds of formats which have been defined in the image below:

Short form video: Content length < 3 minutes. This consists of Instagram Reels, Youtube Shorts, which is 60 seconds, and Tiktok, which can go up to 3 minutes.

Medium Form video: (Content length 4 - 20 minutes) Youtube, Tiktok, which now goes on to 10 minutes, and Instagram. The sweet spot for short - medium video is somewhere between 1 - 10 minutes.

Long-form Video: anything > 20 minutes, which is approximately the length of a shortish episode. This consists of Youtube, Hotstar, Netflix, and OTT in general.

Why is YouTube winning?

1. YouTube is present in all content formats. The interesting thing is the Platform Led Content models are present only in 1 out of 3 formats. (Prime Video acquiring MX Takatak is a recent exception). Instagram and Tiktok, as Creator Led Platforms, are present in 2 out of 3 formats. But Youtube is present in all formats.

2. Youtube has low-commitment content.

It’s not that Youtube doesn’t cater to long formats - Youtube has licensing rights to entire movies, which you can watch either free or on a pay-per-view basis. It’s that Youtube caters immensely to what we’ve termed ‘low commitment content”. Content you watch on your way to work, on your 10-minute break in office, along with movies, along with ted-talks that you can half-listen to. Basically, Youtube is an ever-evolving being that aims to get into every situation and space where there is a possibility for content.

OTT, on the other hand, is high-commitment content that you carve out time for, usually at the end of a workday. OTT is trying to solve this by cutting down episode length, in order to prioritise attention and reduce dropoff rate. But reduced episode length really has nothing to do with it. Let’s look at it this way - from Youtube’s POV, it isn’t competing with OTTs. It’s competing with social media platforms. But what makes Youtube a unique beast is that it has been creator-led right from the beginning.

What does OTT need to do?

To survive in a landscape where all media is content, OTT platforms could look at incorporating some creator-led elements in their models. There are a couple of ways this could happen.

Short-form content: Platforms could either build their own vertical for short-form content, (like what Youtube has done) or buy (like what Prime Video has done with MX Takakak). Platforms can look at offering the content they possess for fans to make content out of, and increase the interaction between consumer and platform.

Have a “creator-led” vertical: To ramp up content generation, carve out a creator-led vertical. An example could be something like a Netflix Discovery Vertical, where anyone can create a movie and upload it (subject to certain QC), which will help solve for the long tail.

a. OTT could take it one step further, like the Spotify radar program, and actually create tools enabling this, offering stock footage, editing software, soundtracks, and incentivise creators by putting the best movies on their platform, or by giving brand deals to the most viewed content.

Niche indie OTT content: Another way to compete is to go the opposite way. Do what Mubi has done, and focus only on niche, indie content that may not be well known. This cuts down content acquisition costs. This strategy seems to be working for Mubi - GetLaka reported that their 2023 revenues were $134M, and they were cashflow break-even.

Basically, what is now clear is that while social media platforms evolve along with the creator, who evolves because of direct feedback from their fanbase, OTT platforms have remained in stasis since their founding.

As a result, they have become like their ancestor, Cable TV, to the point of going against the binge format that made streaming popular and dropping weekly episodes. Bundling services, exactly like Cable TV packages, are being reintroduced by data service providers. This month, Verizon, a telecommunications company in the US, announced a streaming bundle of Netflix, Paramount +, and Showtime.

To break out of the mould and avoid repeating the past, OTT will have to incorporate an evolving element to its model - something that grows along with the consumer. It will be interesting to see how OTT chooses to move forward in a landscape where all media, irrespective of length and format, is considered content.