[#35] Do the new NBFC-P2P guidelines signal the beginning of the end for BNPL?

P2P lending standalone in the grander scheme of things is small, but how does it impact BNPL?

After the risk weights increase from 100 - 125% in 2023, credit supply from NBFCs seems to be drying up. And now, RBI came out with new regulations on P2P (peer to peer) lending this week.

But what are P2P NBFCs?

Hold on. Let’s take a step back. What are P2P NBFCs? Well, think of these NBFCs as a marketplace that matches borrowers with lenders. Lenders could be any individual, but the high level needs are:

Be 18 years old and above

Should have an Indian/NRO Bank Account

Produce Proof of Identity( Pan, Aadhar, Passport, Voter id)

Produce Proof Of Address(Passport, Voter id, Aadhar)

Produce Income Proof (Business/Personal ITR or Self Declaration)

So essentially anyone who is 18, an Indian citizen, and looking for greater than FD returns can “invest” in this product, and get “returns.” And because it is touted as “investment” and not lending, people seemed to be taking to it.

Sounds a little sketchy. And that’s what RBI aims to remove. So their new guidelines, want these NBFCs to very clearly call out that this is a lending initiative, not as an investment and make the operations more stringent,

To sum up the new NBFC P2P Guidelines from RBI

1. The P2P NBFCs cannot assume credit risk: Earlier these NBFCs were taking some of the risk, and thus, making the returns look better than they were, instead of putting the onus on the lenders.

2. Match borrowers to lenders as per a board approved policy: Earlier there was a pool of borrowers in a closed user group, and lenders lent to them basis whatever algos the P2P platform had. The ask is now to match the borrowers to lenders through a board approved policy to bring more responsibility to the platform, and more transparency to the lender.

3. More timely disbursals through escrow accounts: While the maintenance of accounts remains the same: the NBFC needs to maintain two escrow accounts: one for the lender funds that need to be disbursed, and another for the collections from the borrowers, earlier there was specific timeline for fund transfers. The guidelines are now stricter, and state that the funds in these accounts need to be transferred within T+1 day of transaction

4. Restriction on cross selling products: Only loan specific insurance can be sold now. Previously other products were being cross-sold, such as credit enhancement products etc, which RBI sees as “muddying the waters” and confusing the borrower.

5. Cannot be promoted as an investment product: Earlier, these NBFCs were promoting this as an investment product, and guaranteeing returns (see point 1).

6. Cap on amount lent: This cannot exceed INR 50L across all NBFC platforms

7. NPA disclosure norms to be standardized: Earlier this differed according to the P2P platform. P2P platforms shall now have to disclose actual losses in terms of principal and/or interest lost every month. This will be beside the non-performing asset (NPA) numbers and the pre-NPA delinquencies.

But NBFC P2P Lending standalone is small in the grander scheme of lending, so why is it such a big deal?

ABFL for example, has AUM of 1 Lac Crore. Compare that to Liquiloans and LenDen. According to the Liquiloans website, their total disbursements till date have been 1200 Cr , which is ~1% of ABFL. (it was founded in 2018). Lendbox was founded in 2015, and has done ~8000 Cr+ worth of disbursements (~8% of just ABFL).

A fair amount of the lending that is done by BNPL providers is through P2P NBFCs such as Liquiloans, Faircent, Lendbox, Lenden, and others.

Take for example the below BNPL players ( I got the details from their website)

Juspay HyperCredit: 11 lenders, 1 P2P: Liquiloans

CRED Cash: 7 lenders, 1 P2P: Liquiloans

UNI Cards: Liquiloans, and in 2021 bought a P2P NBFC called OHMY technologies.

Postpe: 6 lenders, 2 are P2P: Liquiloans & Lenden

BharatPe: 18 lenders, 2 P2P LenDen & Liquiloan

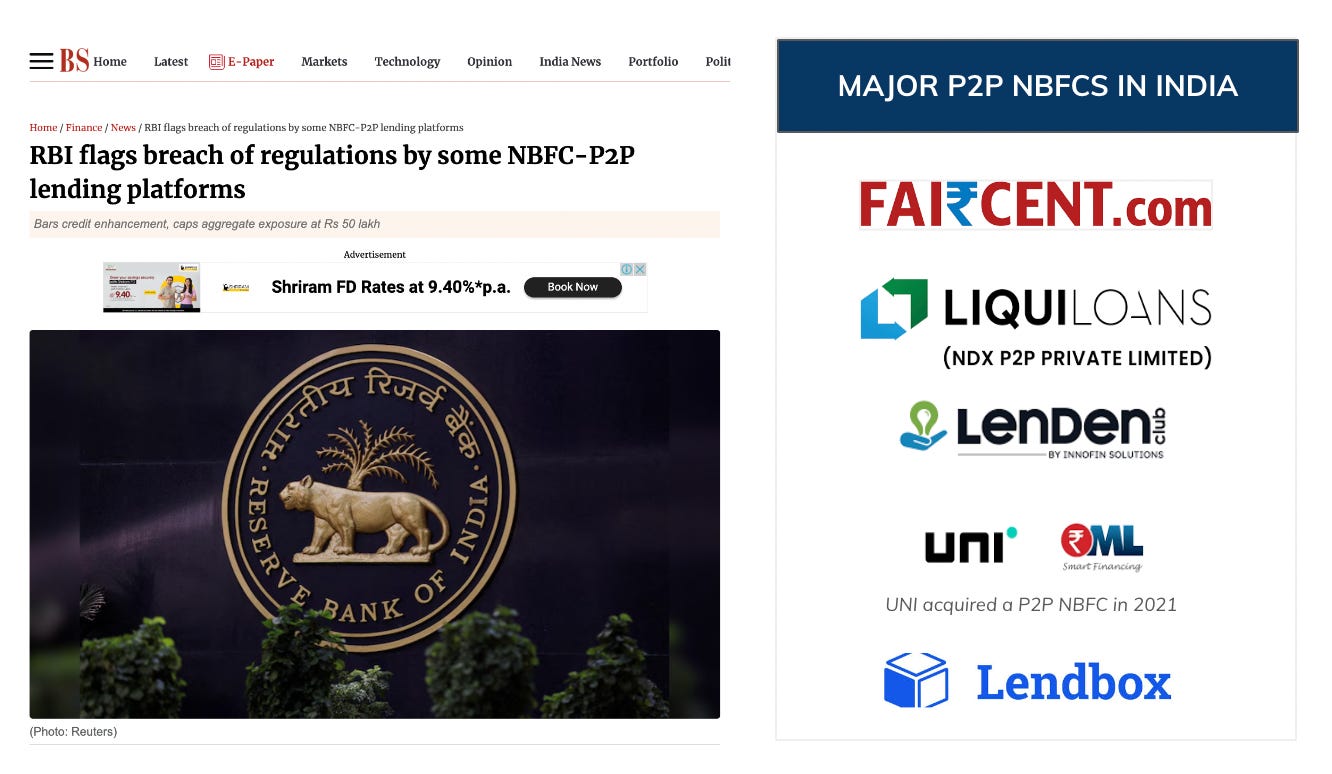

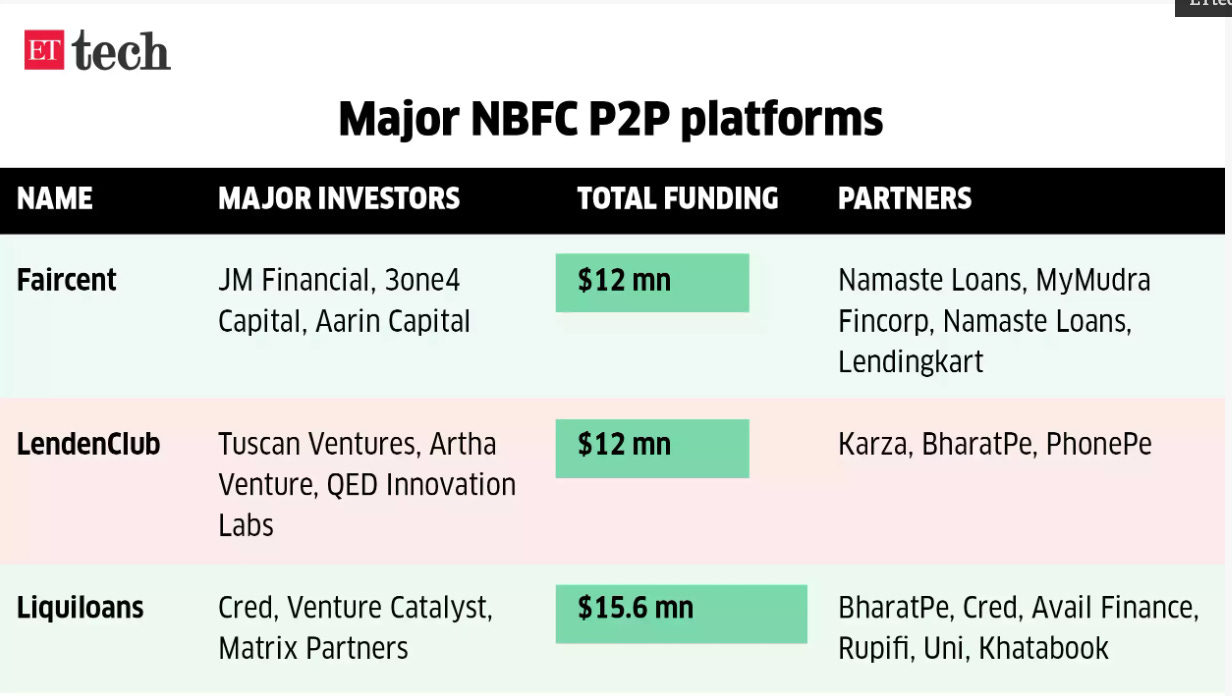

This is a snapshot from an ET article in August 2023, calling out the major NBFC P2P platforms, and their key partners. BharatPe, PhonePe, Cred, Rupifi, Uni are all prominent B2C apps / BNPL players.

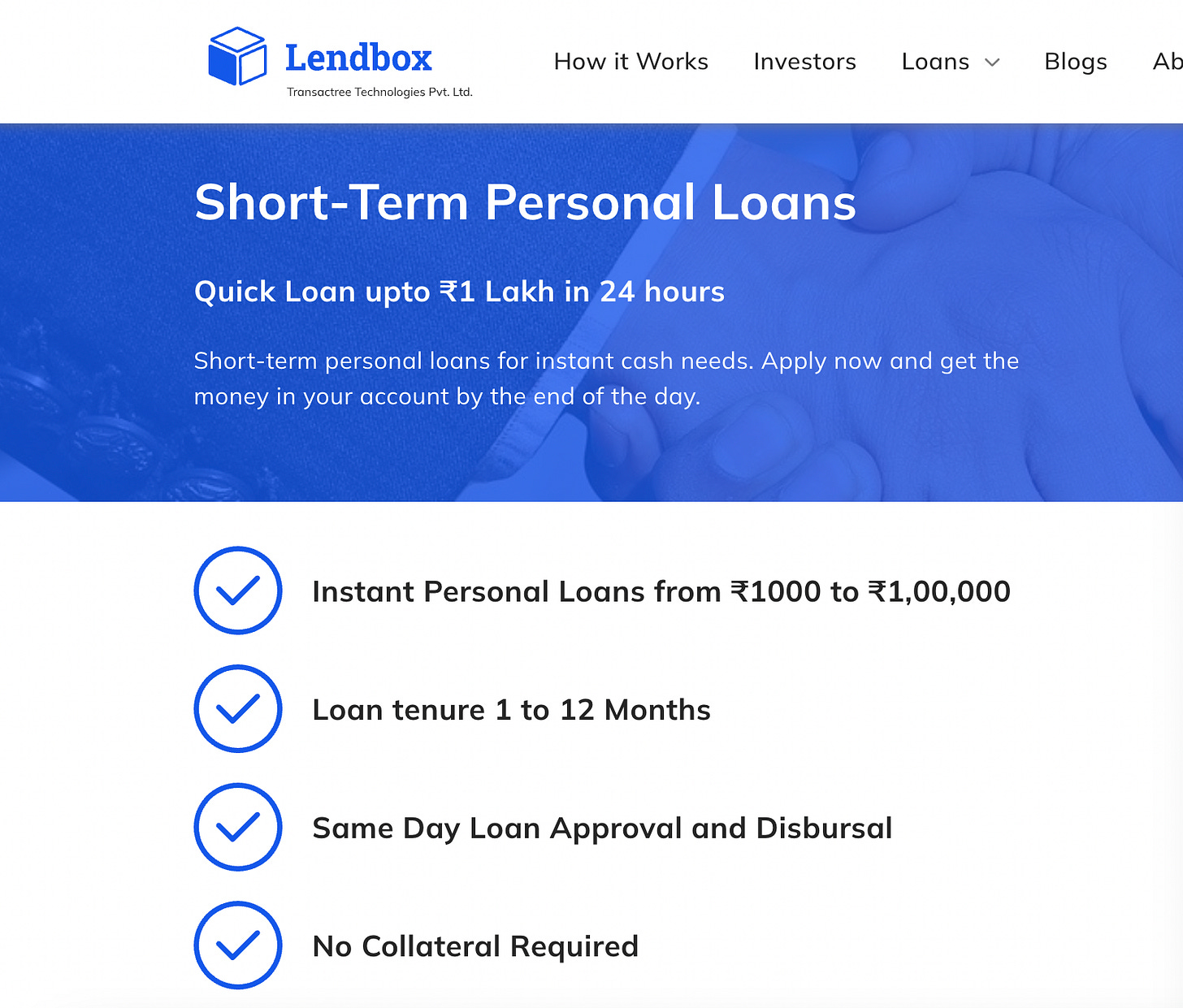

And the ticket amounts given out by P2P NBFCs seem to suit consumer lending as well, ranging from as low as Rs 1000, upto Rs 1L. Below is a snapshot of Lendbox, and while Rs 1000 seems quite low, the sweet spot for this would be anywhere between Rs 10k - 50k.

But why do BNPL players partner with P2P NBFCs?

Because, overall, P2P NBFCs seem to be better partners for BNPL fintechs because:

For lenders (the individual / business lending the money):

They promote a better return than putting it into a bank. FD provides ~6% return. P2P promises lenders or “investors” 10-12% - an additional 600 bps to pad the income with.

For the borrower:

An alternate source of funds. And because the committed rates to lenders are lower than banks (10-12%), the assumption here is that because of this they could also give lower rates to the borrower. Usually banks ask for a minimum return of ~13-14% (if not higher) when they lend through fintechs. This is then passed on to the end customer, with a % commission, resulting in higher rates of interest. P2P NBFCs reportedly also disburse faster, and its easier for consumers with limited credit history to get a loan. Liquiloans for example, reportedly charges interest of between 12 - 25%. BNPL on average is significantly higher:

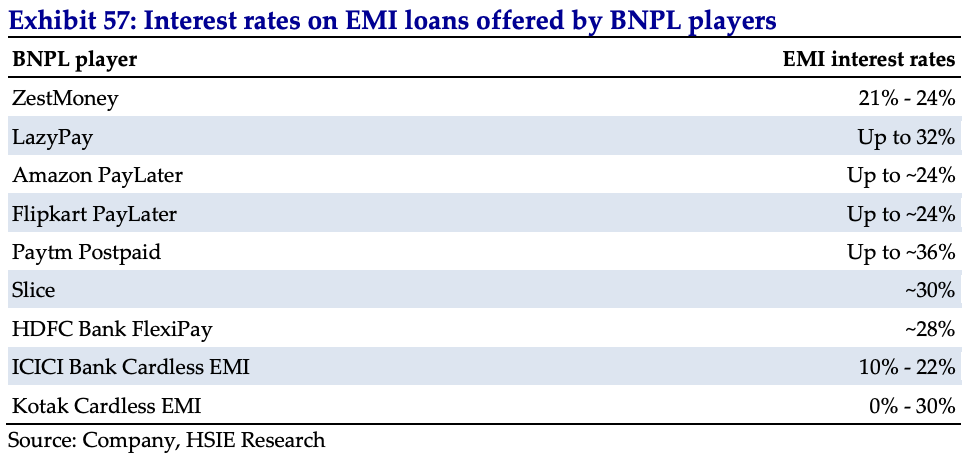

Take the EMI interest rates reportedly charged by BNPL players to the end customer

Source: HDFC report

Now, take the interest rates charged by P2P NBFCs to the end cutsomer (From the Liquiloans FAQ)

So. NBFC P2Ps have definite advantages in terms of a lender partner, if BNPL company was looking for a wider coverage of customers, and emphasizing customer experience.

With these new guidelines for P2P Lending, this is not very good for BNPL which is anyway reeling after the risk weights that were upped on banks and NBFCs.

A quick refresher on the risk weights increased on NBFCs (and you can check out the RBI circular here)

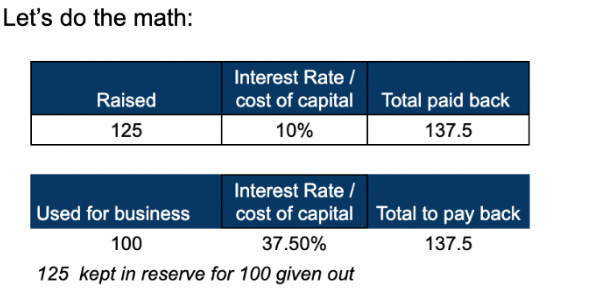

In 2023, RBI came out with a circular that increased the risk weights on banks and NBFCs from 100% to 125%. This risk weight refers to the minimum amount of capital that has to be kept aside while giving a loan. This ensures potential losses can be absorbed without financial stability being affected. So to put it in an example, earlier, if a Bank / NBFC was giving a personal loan of Rs 100, and its risk weight was 100% which means it had to keep Rs 100 in reserve. Now because it is 125%, this means that to give out Rs 100 as a loan, it needs to keep Rs 125 in reserve.

If more capital is taken for the same amount of business, then the actual cost of funds I’m paying for the business becomes higher. Example. If I want to lend Rs 100, I will have to raise an extra Rs 125 to keep as reserve, instead of an extra Rs 100 as reserve. So I will have to give a return back on the amount raised (which is Rs 125), but I can only use 80% of the money raised to give that return. So in actuality, my cost of capital (as an NBFC) becomes quite high, because I am being charged on the amount I can use (which is Rs 100), versus the amount I have

Unlike in the case of banks where RBI has increased risk weight requirements on certain categories of loans, risk weights have been increased from 100% to 125% for banks lending to NBFCs across ALL sectors. Because of this banks could limit credit exposure to NBFCs due to increased capital requirements.

While in the NBFC P2P Lending market is small, a big impact will be felt by BNPL companies, a additional hit to consumer lending after the risk weight increase

So first risk weights on NBFCs & banks, to reduce unsecured consumer credit exposures in late 2023. Now, in mid 2024, more stringent NBFC-P2P guidelines , which will probably impact this BNPL business more. But in the grand scheme of things, P2P Lending is too small to matter. ABFL for example, has AUM of 1 Lac Crore. P2P lending creates unnecessary systemic risk and is definitely not an investment product, so increased RBI oversight is warranted .

But as more of these regulations kick in, checkout financing may just dry up. BNPL at its peak was doing upwards of 500 Cr a month, just online - and I’m being conservative here. . (across multiple fintechs). This is leaving a big open space in the market for consumer lending. I wonder who will swoop in and grab the opportunity.