[#24] Decoding Fintech IPOs - what does the market say about fintechs?

With all the buzz about the big Fintech IPOs expected in India and in the world between 2024 - 2026, I was curious about how the Fintechs which IPO’ed in the 2015 - 2021 era are doing. (Adyen, Robinhood, Affirm, Zip, SoFi, Block, Nubank and others). And what are some insights / learnings we can take away which could be relevant for the new batch of Fintechs expected to IPO in the next 2-3 years, and the overall Fintech industry.

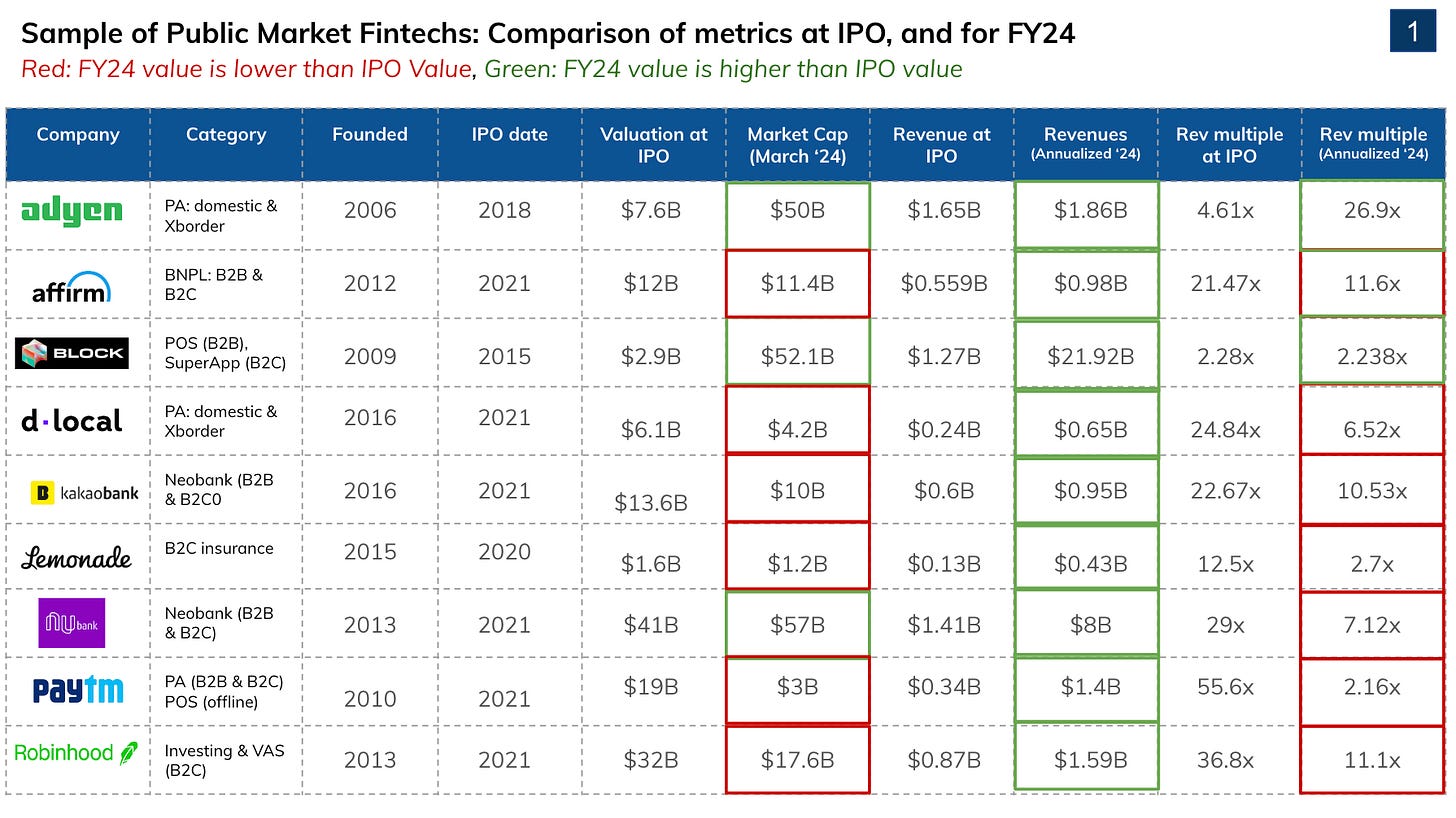

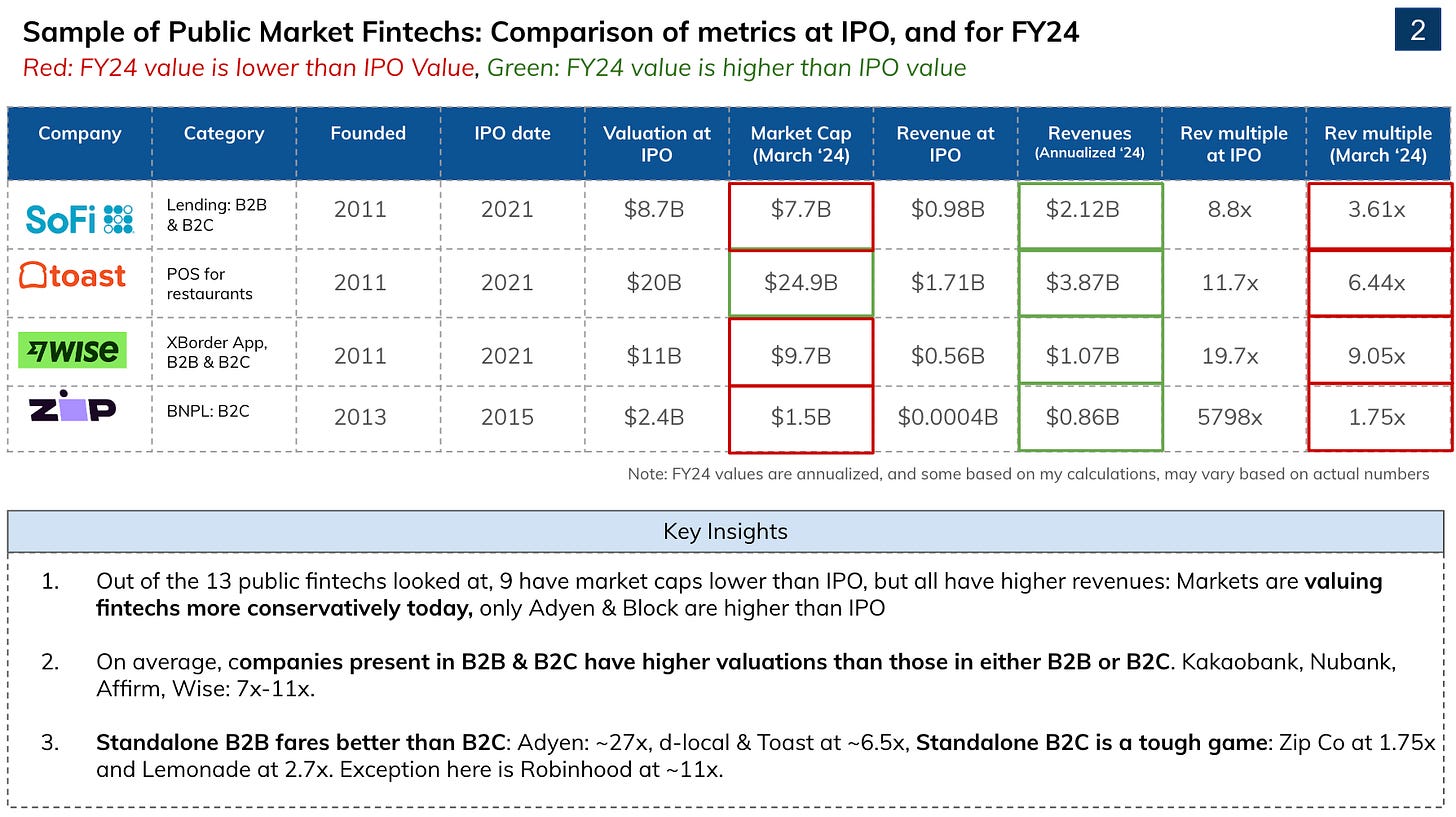

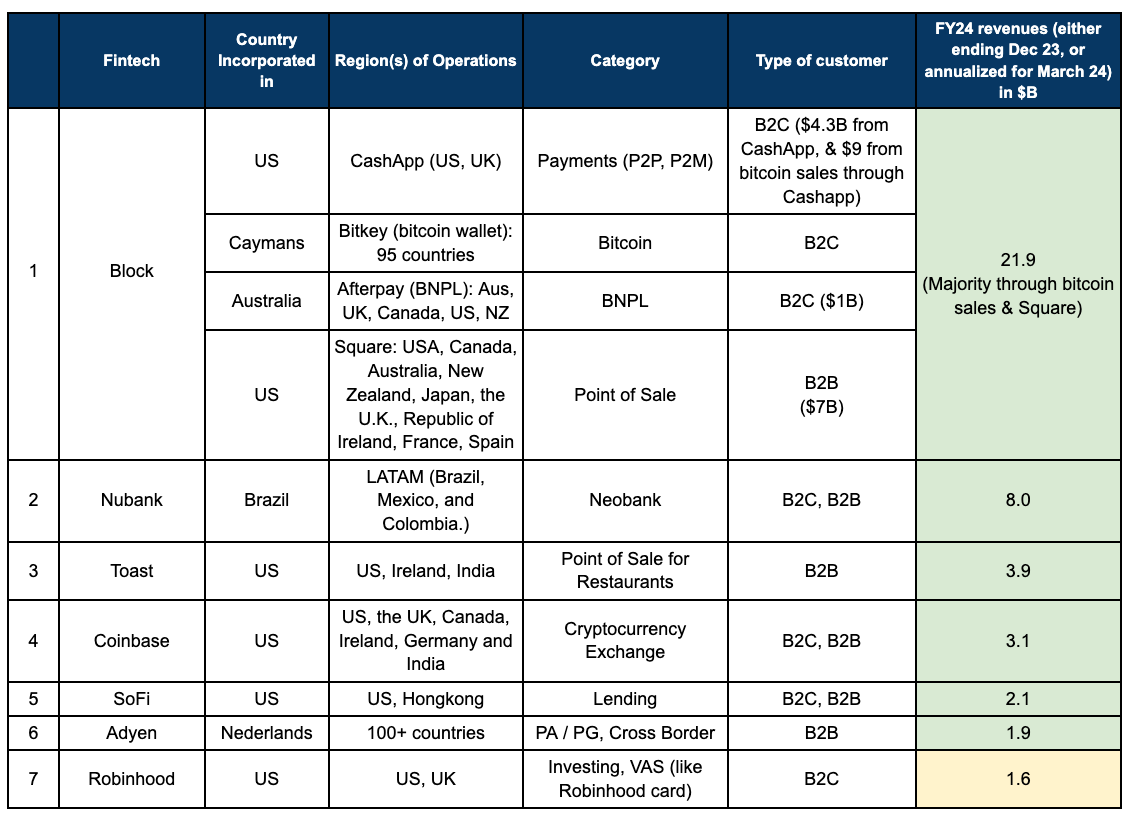

So what does the data say? Well, first of all, I’ve taken a look at 17 fintech start-ups which IPO’ed between 2015 - 2021. You can see a snapshot of the data below (arranged in chronological order of IPO):

I’ve summarized the insights below:

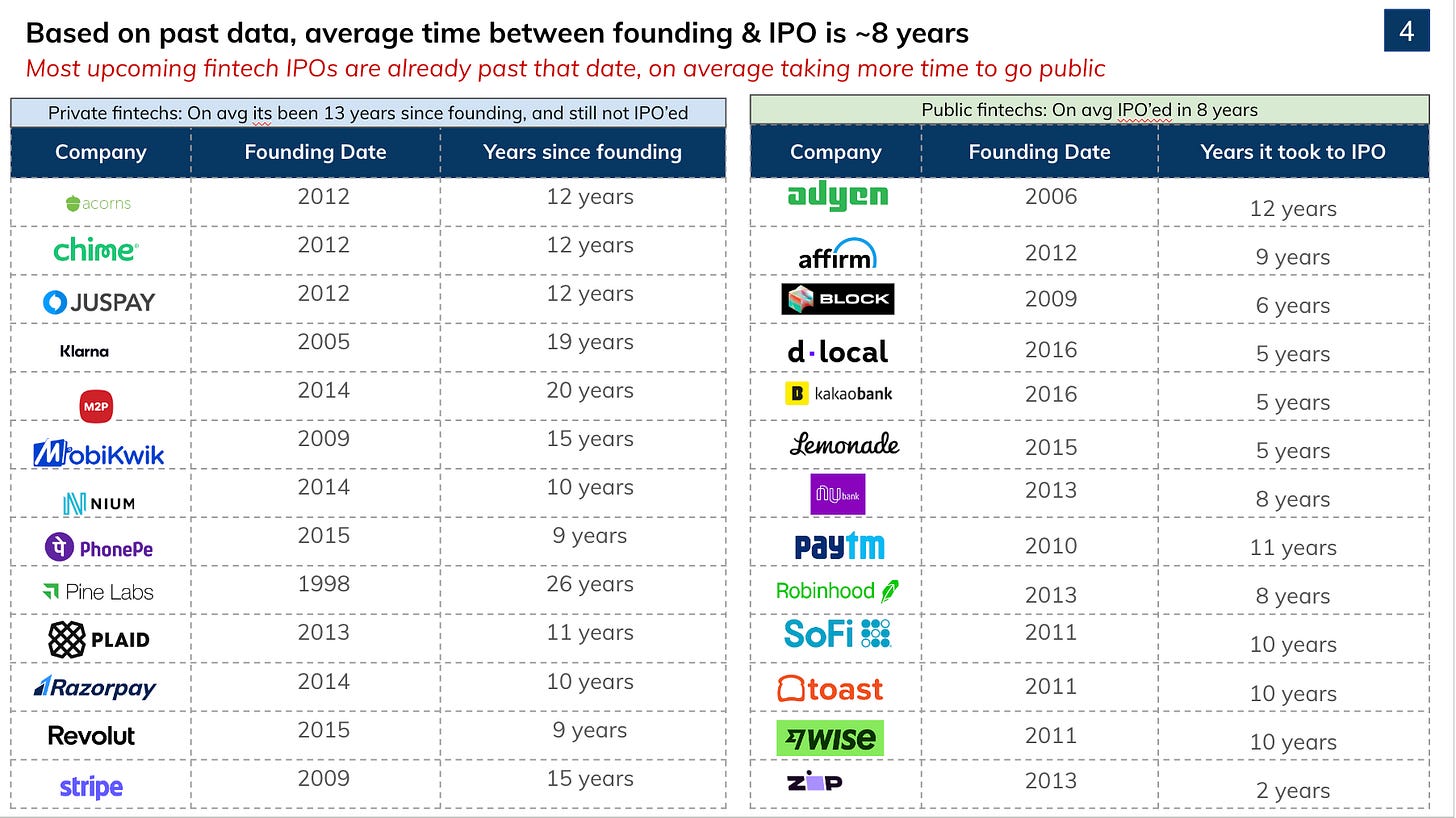

1. Average & median time between Founding & IPO was 8 years, current fintechs have already breached that landmark

Both the average and the median time between founding year and IPO year is ~8 years. The minimum years from founding to IPO is 2 years (in the case of Zip, a BNPL player based out of Australia, and an investor in the erstwhile Zestmoney), and the maximum is 12 years in the case of Adyen (a global payment aggregator & cross border player). However, according to an interview, the Zip founder mentioned that they IPO’ed perhaps earlier than they wanted to, purely for fundraise reasons, and not some much for an exit. Shares at IPO reportedly were priced at $0.2 per share.

If we look at start-ups who are expected to IPO in 2024 - 2026, these technically have already passed the 8 year mark. Even if we look at it from the perspective of IPO-ing 12 years after inception, only Razorpay, PhonePe, Revolut and Plaid seem to have not broken that deadline.

2. Fintechs are being valued at more modest revenue multiples now, as compared to 4-5 years ago

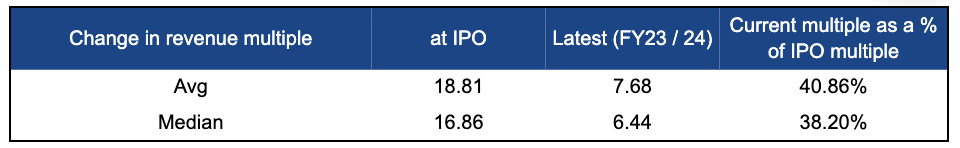

I have evaluated this based on the valuation of the company as it went to IPO, and its revenues at that point, vs what its valuations are as of 2023 / 2024, and their revenues. Here are the stats:

Lower valuation today as compared to IPO: 12 out of 17 companies have lower market caps in 2024, as compared to their valuation at IPO. And for an apples to apples comparison - out of the 12 who IPO’ed in 2021, only 2 have market caps trending above their IPO valuations - which are Nubank (a LATAM Neobank), and Toast (a point of sale software and payments processing company focused towards the restaurant industry). The rest of the companies, which include Robinhood (investments app), Wise (Xborder), dlocal (Uruguay based PA) and Affirm (BNPL, competitor to Zip Co) are all in the red

Majority companies have seen revenue increase: 16 out of 17 companies profiled have seen a revenue increase. So valuations are down, but revenues are up. Only Coinbase has seen a decrease, but that is probably because of the crypto market being at an all time high in 2021, and that’s when they IPO’ed, so the revenue numbers would be a bit skewed.

So. Market cap decrease + revenue increase = decreased rev multiple for valuation purposes. Removing outliers such as Zip Co, the revenue multiple on average that these start-ups got at IPO was 16-18x, while now it’s between 6-7x. In fact, in terms of revenue multiples, only 3 start-ups show increased multiples, which are Block, Adyen (Coinbase also but because revenue has decreased more than valuation).

So for future fintechs who are predicted to IPO soon, it is a revenue game. And that is probably why some of them are taking more time to IPO - going to the market now is going to cause a huge dent in valuation.

But is there any correlation between the type of customer, regions of operations and valuation / revenues?

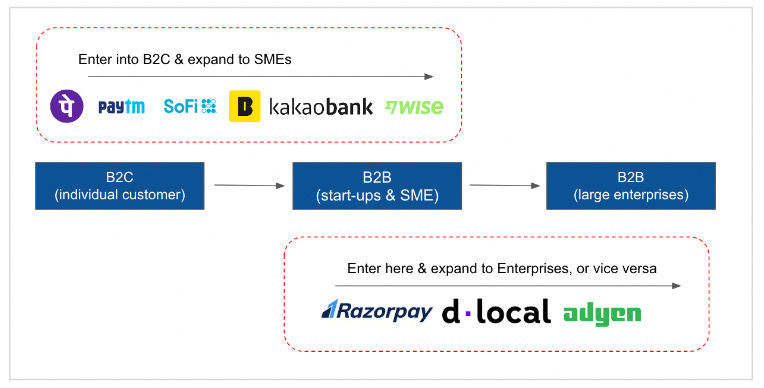

So broadly, there seem to be two business models / product types that have emerged globally:

1. B2C & SME customer base: These are usually companies (Cue Paytm in India) that start off with a B2C offering, and see synergies to expand with similar products into the SME space (cue sole proprietorships, employee count < 10 etc). Other examples are Kakaobank (neobank in Korea), and SoFi (Lending).

2. B2B & Enterprise Base: These companies have started off with a B2B thesis. While they are also very strong in start-ups, they remain in B2B, and have expanded into the Enterprise Segment (ex: Razorpay).

Here’s a visual representation of what that would look like:

So then, is there any skew of increased revenue / valuations of fintechs that operate in B2B, B2C or B2B + B2C segments?

Primarily it seems like companies that operate in both B2B & B2C segments (or rather, B2C & SME) are able to command higher revenues, and thus higher valuation multiples. In fact, out of the top 6 revenue generating companies, 4 operate in B2B & B2C segments, and the other 2 operate in B2B.

Next comes companies operating only in the B2B segment: These are companies that cater to the SME & Enterprise base of companies

At the last is the B2C segment only: This segment seems to command the lowest revenue, and the lowest valuation multiples.

The same can be seen in the data below:

Scale: Green: Top 33% segment in terms of ARR | Amber: Middle 33% for ARR, | Red: Bottom 33% for ARR

What about current / potential regions of operations for these start-ups? Do they affect valuation / revenue potential?

Well firstly it is a well known data point that the Indians and South Asian customers do not like paying for ANYTHING. So revenues will be limited from any B2C only facing product in these regions. And hence that is why they may always have to expand to the SME segment.

The second interesting piece of insight seems to be that a B2B company seems to expand to more locations much more easily as compared to B2C companies. (according to the data they are present in many more countries). Which increases the TAM, and puts less pressure to be the market leader in its original country of operations. And maybe that’s why B2B customers seem to be the lever to higher revenues and thus valuations. B2C only companies operate in limited regions (ex: PhonePe, Paytm in India, Nubank in LATAM.) This seems intuitive - local apps are built based on local context and local needs. It becomes tough for a foreign player to come in and win a piece of the market.

However, a key point to note is that (obviously) revenues & potential for international expansion also depends on the type of B2B company. While there is a lot of hype around online companies, it seems that offline is also where a huge chunk of revenues still lie. According to Block’s annual report $7B of its $21.9B in revenues in 2023 came from Square (its Point of Sale product). Toast reported revenue of $3.9 for FY23 (year ended Dec ‘23). BUT despite high revenue potential, offline first companies are valued differently.

While Toast & Block are both in the top 33% with regards to revenue in FY23 / 24, in terms of valuation multiple comparison, Toast is in the middle 33%, while Block is in the bottom 33%. (probably because it is B2B offline, and B2C, both tough segments to crack, which it has done admirably). Who are in the top 33% of revenue valuation multiples commanded? Adyen, Coinbase, Affirm, Robinhood, & Kakaobank, which are online players.

Note: Block had majority of its revenues (close to $9B) from the sales of bitcoin to its CashApp customers, that is a different sector altogether.

But why is valuation multiple different for online vs offline fintechs? Here’s my hunch:

1. B2B Online: Easier to expand to other countries and hence, a bigger TAM, but this easier to enter and operate for newer players also, so there is probability of taking less share of the market. Since growth is easier, these are companies that will be probably valued at higher multiples, due to the “market potential.”

2. B2B Offline: Less countries of operation, initial outlay & capex is high, but if it works, it is a strong moat where only a few players may be able to operate sustainably. These will be valued at lower multiples, because of the “lower opportunity TAM.”

Another insight that has emerged is around Neobanks. The global success of Neobanks (Nubank, Revolut, Kakaobank) is probably why Neobanks were all the rage in India a 4-5 years ago

Nubank, Kakaobank, and Revolut have all emerged as pretty successful. Nubank & Kakaobank trade publicly, and Revolut operates in the European Economic Area (EEA), Australia, New Zealand, Singapore, Japan, Brazil, Switzerland, the United Kingdom, and the United States, valued at $33B as per the latest data available, and expected to IPO soon.

Nubank started off as a credit card provider, but then expanded into becoming the largest digital bank in Brazil (and secured a banking license to operate in Brazil, a license to operate as a finance company in Columbia and has applied for a banking license in Mexico). Kakaobank was founded in 2016, got a final full banking license from the Financial Services Commission of the Republic of Korea in April 2017, and then started operations. Revolut holds a banking license for the EEA, which was granted by the Bank of Lithuania.

Jupiter (valued at $710M in 2021), Fi (Valued at $700M as of 2023) and Open (valued at $1B in 2022) - the three big neobanks in India were founded in 2019 and 2017 respectively, after Nubank (founded in 2013), Revolut (founded in 2015) and Kakaobank (founded in 2016), and probably raised funds based on the success of neo-banking models in other countries.

But, in India, the government does NOT look favorably at neobanks (digital only banks), and instead prefers banks with physical branches to also have digital presence. Hence these companies are now pivoting to some type of credit offers / cards which are powered by banks, and in some cases the Rupay network, to tap into the UPI ecosystem.

Another insight is that LATAM & SEA seem to have emerged as the next place where disruption will take place

US, UK, Australia are all somewhat mature markets, with a high penetration of population that is banked, so as I had discussed in a previous article (link here), the payments innovations will happen accordingly, with other hooks (such as BNPL & other types of credit, and Neobanking, and card based payment innovations). But LATAM, with Pix in Brazil (for real time payments), Yape & PLIN in Peru (real time payments), Nubank which is a neobank serving Brazil, Columbia & Mexico, and dLocal - a cross border PA, are all operating / originating in LATAM. These are regions with more dependance on cash, and less % of the population is banked. There are more unmet needs here and thus these are regions where we will see more fintech innovations coming through.

SEA is obviously another place (but I’ve talked about it in detail in previous articles, so I won’t get into it here). Infact, Kakaobank, the neobank based out of Korea is reportedly evaluating expansion of operations to 2-3 countries in SEA. Digital wallets are one of the leading methods of payment, and there is a high dependency on cash (which any one of us who visited Thailand, Vietnam, Cambodia in the last couple of years can attest to). With the introduction of Real Time Payment Rails, and interoperable QR codes, there is a big opportunity for fintech innovation. And this is probably an opportunity for B2C apps to expand geographies, and has already started happening. Ex: real time UPI payments in UAE can happen through the PhonePe App through certain terminals. This means that users in UAE can download and use the app - giving PhonePe the opportunity to tap into and build for new markets.

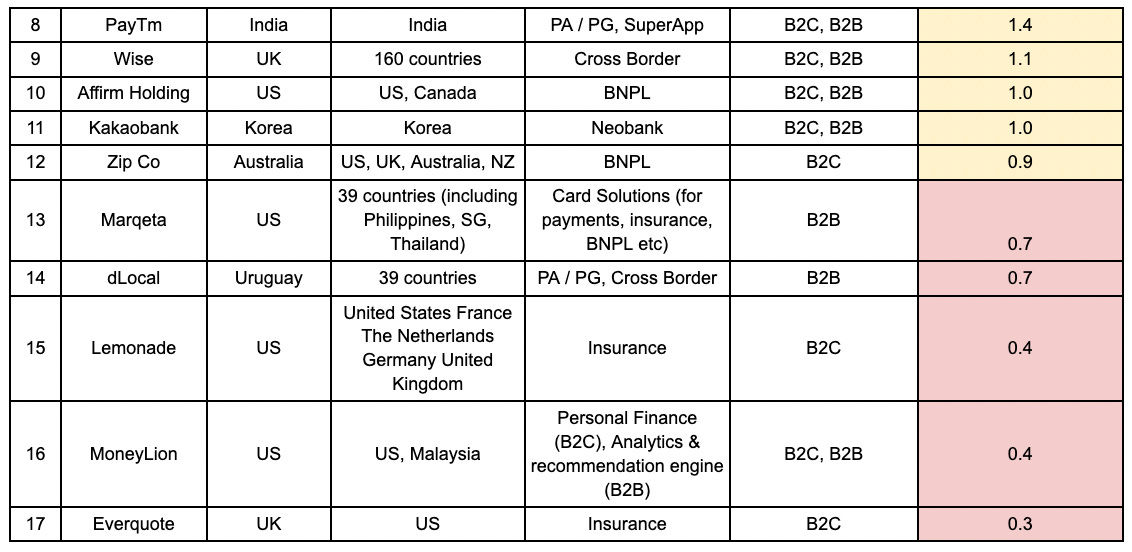

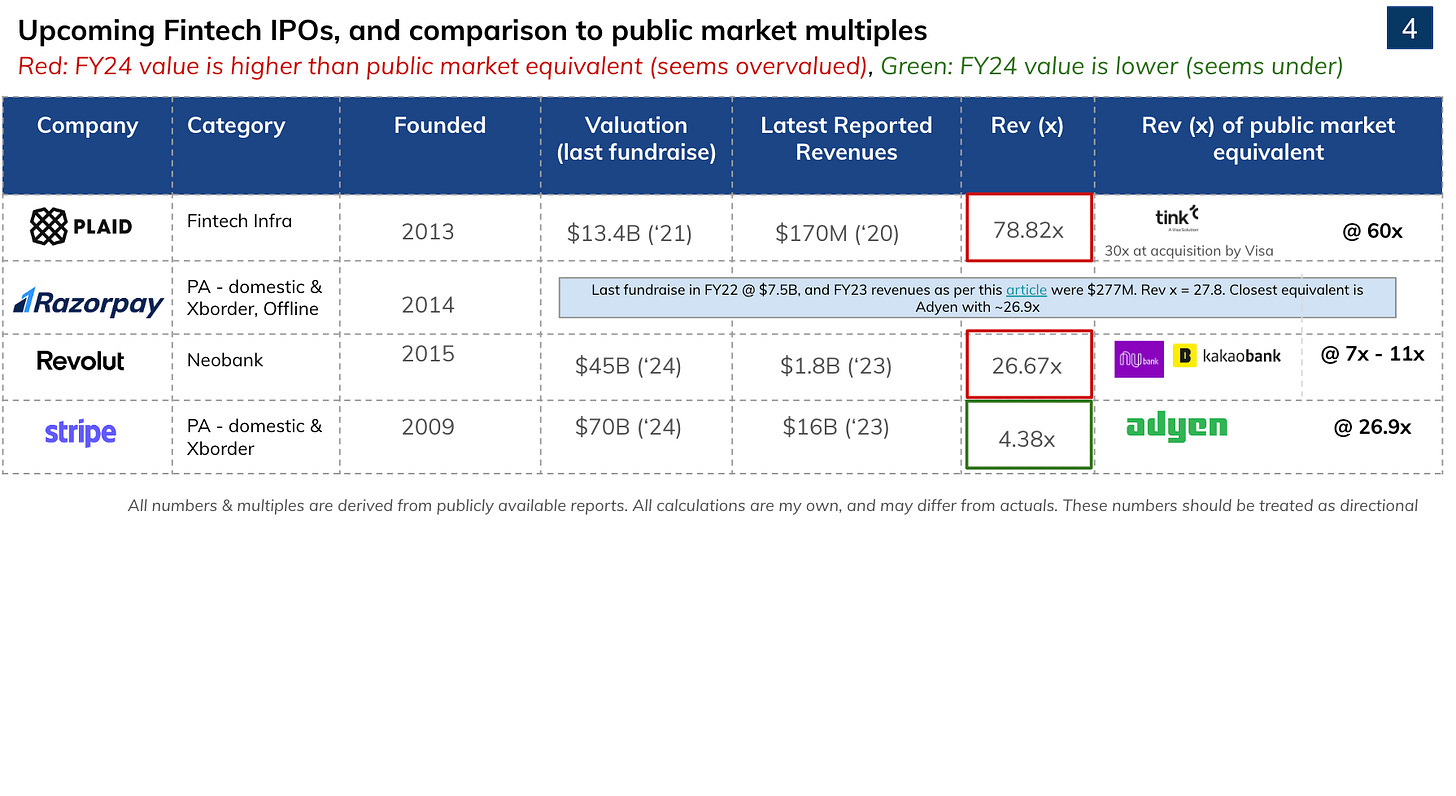

So what seems to be the case for private fintechs, when compared to public fintechs?

Well, I’ve taken a look at the multiples that they are currently trading at, and compared it to

1) the average fintech multiple currently in the market and

2) the multiple that their closest public competitor is currently trading at. (table below).

The market is currently at 6-7x. Based on current reported numbers, while Stripe, Razorpay & Chime seem to be trending at multiples that are lower or at par with competitors, many others are not. Klarna valuation currently seems to be trending in line with the markets view, but this is after its valuation dropped from $45B in 2021 to $6.7B in 2022.

Other factors will also have to be considered, such as the “size of the opportunity i.e current countries of operation and expansion plans” the non IPO'd start-ups are playing in, in comparison to their public market competitors, apart from things such as profitability. Revolut for example operates in way more regions than Nubank and Kakaobank, and hence commands a higher multiple. Similarly, Stripe operates in 46 countries currently, while Adyen reportedly operates in 100, and hence Stripe has a lower multiple (4.5x) as compared to Adyen (20.85x)

An analysis of the same is below for a sample of 13 fintechs expected to IPO in the next 2-3 years.

These are some insights from the data:

1. Segment: Payment Aggregator: Public market equivalent is Adyen

Adyen: operates in 100 countries, March 24 revenue multiple (market cap / rev) = 26.88x

Private market comparison

Stripe: operates in 46 countries, revenue multiple = 4.51x. Lower revenue multiple, but operates in 50% less countries (according to reports)

Razorpay: operates in 2 countries (India, Malaysia), revenue multiple = 27.08x.

2. Segment: B2C Super App, and Payment Aggregator (B2C, and SME). Public market equivalent is Paytm & Block.

Paytm: rev multiple = 5x (2023 multiple taken, before payments bank shutdown, current is 2.2x).

Block: rev multiple = 2.4x. Subsidiaries present in multiple countries (Square which is their POS segment is present in 9 regions, CashApp which is their B2C offering for Payments is in UK & ireland)

Private market comparison

Mobikwik: Operates in India, latest rev multiple = 14.71x. However, reports suggest that the anticipated IPO valuation will be ~4500 Cr - 5100 Cr, which is a valuation of $500 - $600M. At this valuation, with their FY23 reported revenues, the revenue multiple comes to be ~7.5x. Assuming that revenues have increased, this seems to be within range of what the public market equivalents are trending at.

(Update from Dec 2024): Mobikwik IPO is planned for 11th December 2024, and its valuation has been cut further to ~$256M, which is on par with the 2x - 4x range of public market equivalents.PhonePe: Operates in India, latest rev multiple = 33.8x. Higher than the market, but PhonePe has also launched UPI international payments (Singapore, UAE), and while domestic UPI payments are free, international UPI payments will have a forex charge, of which I assume PhonePe will make a cut. PhonePe is also in insurance, and stockbroking, and expected volumes from these initiatives is what it’ll expect to justify its valuation

3. Segment: Neobank. Public market equivalents are Nubank and Kakaobank

Nubank: March ‘24 Rev multiple: 7x. Operates in Brazil, Columbia & Mexico. Present in B2C & B2B.

Kakaobank: March ‘24 Rev multiple: 10.5x. Operates in Korea, evaluating expansion into some parts of SEA. Present in B2B & B2C

Private market comparison

Chime: Latest multiple is 2.53x. Operates only in US & Canada in the B2C segment. Present in fewer regions, which have high banked penetration (US & Canada have 90% + banked population), hence why it commands a lower valuation

Revolut: Rev multiple is 30x. Operates in 10+ regions including EEC. Present in the B2B & B2C segment. Operates in many more regions compared to public market equivalents

4. Segment: Investing App. Public market equivalent is Robinhood

Robinhood: March ‘24 rev multiple: 11x. Operates in the US only and is B2C

Private market comparison

Acorns: Latest rev multiple: 20.65x. Also operates only in the US and is B2C. May be overvalued based on these numbers

5. Segment: BNPL Public market equivalents are Zip & Affirm

Zip: March ‘24 revenue multiple: 1.75x. B2C and operates in US, UK, Australia & NZ

Affirm: March ‘24 rev multiple: 11.59x. US & Canada only, but B2B & B2C

Private market comparison

Klarna: Latest rev multiple: 3.5x. Operates in 10+ regions including Scandinavia, Netherlands, Germany, UK & US. Only B2C. Seems to be on par in comparison to public market valuations

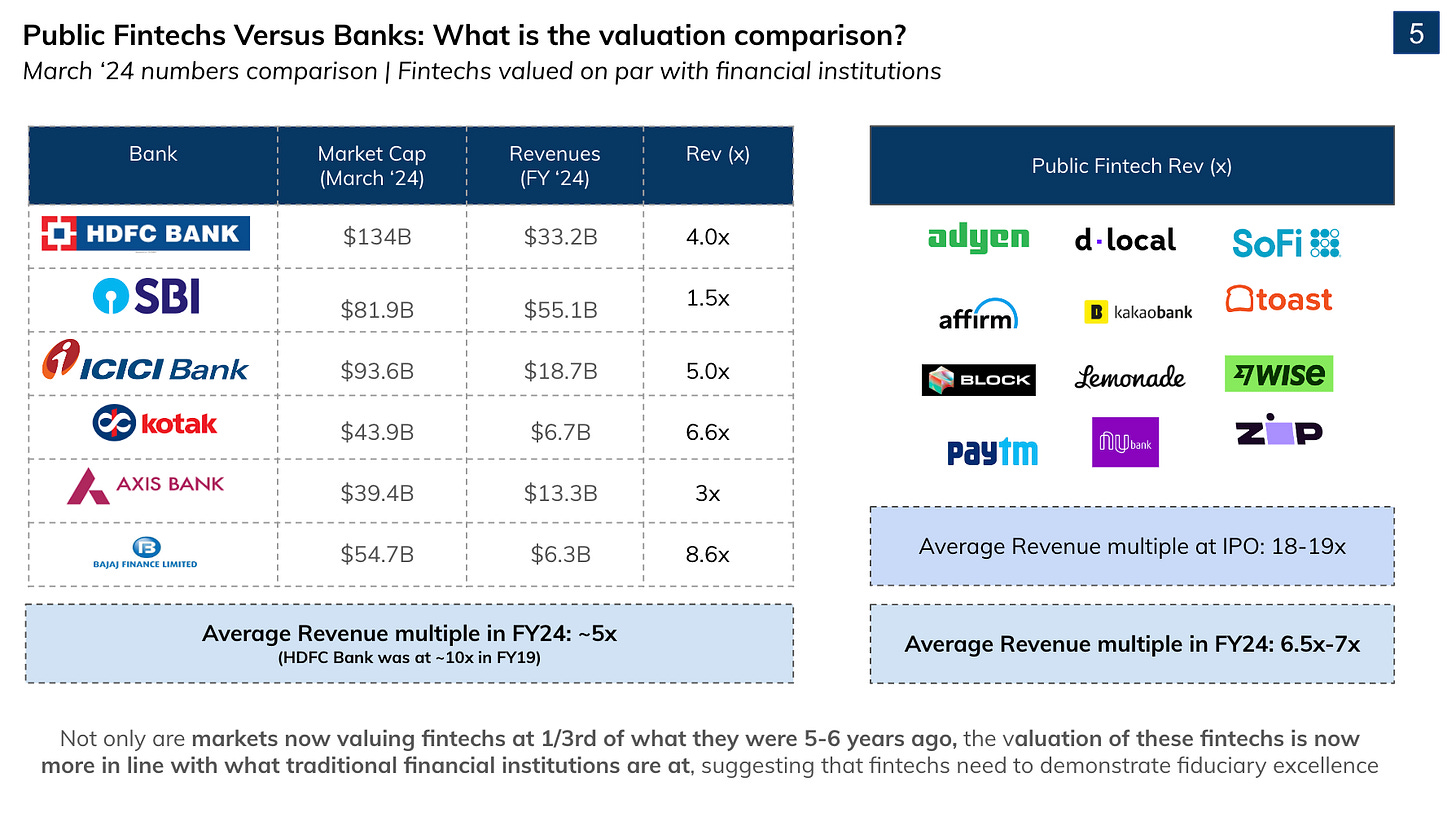

But the biggest insight is that fintechs still need to prove themselves.

The public market seems to value fintechs at similar revenue multiples such as legacy financial institutions such as banks & NBFCs.

We all know private market valuations are a different ball game. The public market is where we see the “proof of the pudding.” And the public market seems to value fintechs at 6-7x of their revenues. What is REALLY interesting is if we compare this to the revenue multiples that legacy financial players are at (market cap / revenues). The banks & NBFCS - your traditional financial institutions on average are valued at similar revenue multiples as compared to public fintechs (~6x)!

What this seems to say is that the market thinks that fintechs are the same old financial institutions held together by “tech” and smart code. So the game isn’t over for fintechs. They still have to prove themselves. Fintechs cannot just depend on “innovative tech.” At the end of the day, a business is a business. And they have to demonstrate a fiduciary appetite for running businesses well & responsibly to get the valuations they think they deserve.