[#19] Celebrities & start-up investment - what’s the trend?

There has been a new, growing trend in early stage investments. And it’s to do with who is investing in early stage start-ups. It is not just early stage funds anymore. Now an increased number of celebrities are investing more of their wealth into start ups. Earlier, while this was limited to funds, HNI’s, and angel networks, the list has grown to include celebrities. Not to say that it is new. Some celebrities turned into angel investors quite early. But this trend of celebrities actively choosing to invest in start-ups has only really picked up since 2022. And often, this makes more sense for early stage brands, as they’re able to not just leverage the funds that are invested, but the marketing power, and the reach of these celebrities to grow exponentially.

Here’s a quote from the founder of the plant protein start-up Shaka Harry, which MS Dhoni invested in in 2022.

“When celebrities choose to invest, they bring their reputation, influence, and network to the table. This can result in increased brand recognition and value, attracting attention from stakeholders including industry talent, distributors, retail partners, and customers. Celebrities’ involvement can offer start-ups a unique platform to showcase their offerings and stand out in a competitive market,” said Anand Nagarajan, co-founder and CEO, Shaka Harry

And this is spurred more by successful exits that celebrities have made: For example, Alia Bhatt got a 10x return on investment when Nykaa went public, she invested ~5 Cr in 2020, which grew to 53 Cr in 2021. Meanwhile Katrina Kaif, invested ~2 Cr to set up a joint venture called Nykaa - KK beauty in 2018, which went up to 22 Cr when Nykaa IPO’ed. And it’s not just Nykaa. Sachin Tendulkar invested 5 Cr in Azad Engineering in March 2023 (Azad Engineering - manufacturer of aerospace components and turbines and supplies its products to original equipment manufacturers in the aerospace, defense, energy, and oil and gas industries), which IPO’ed in December 23, turning that 5 Cr into 26.5 Cr. Although Azad Engineering isn’t really a start-up per se, it was incorporated way back in 1983. But the point remains the same. After the slew of successful exits, more and more celebrities are turning to start-up investing to grow personal wealth.

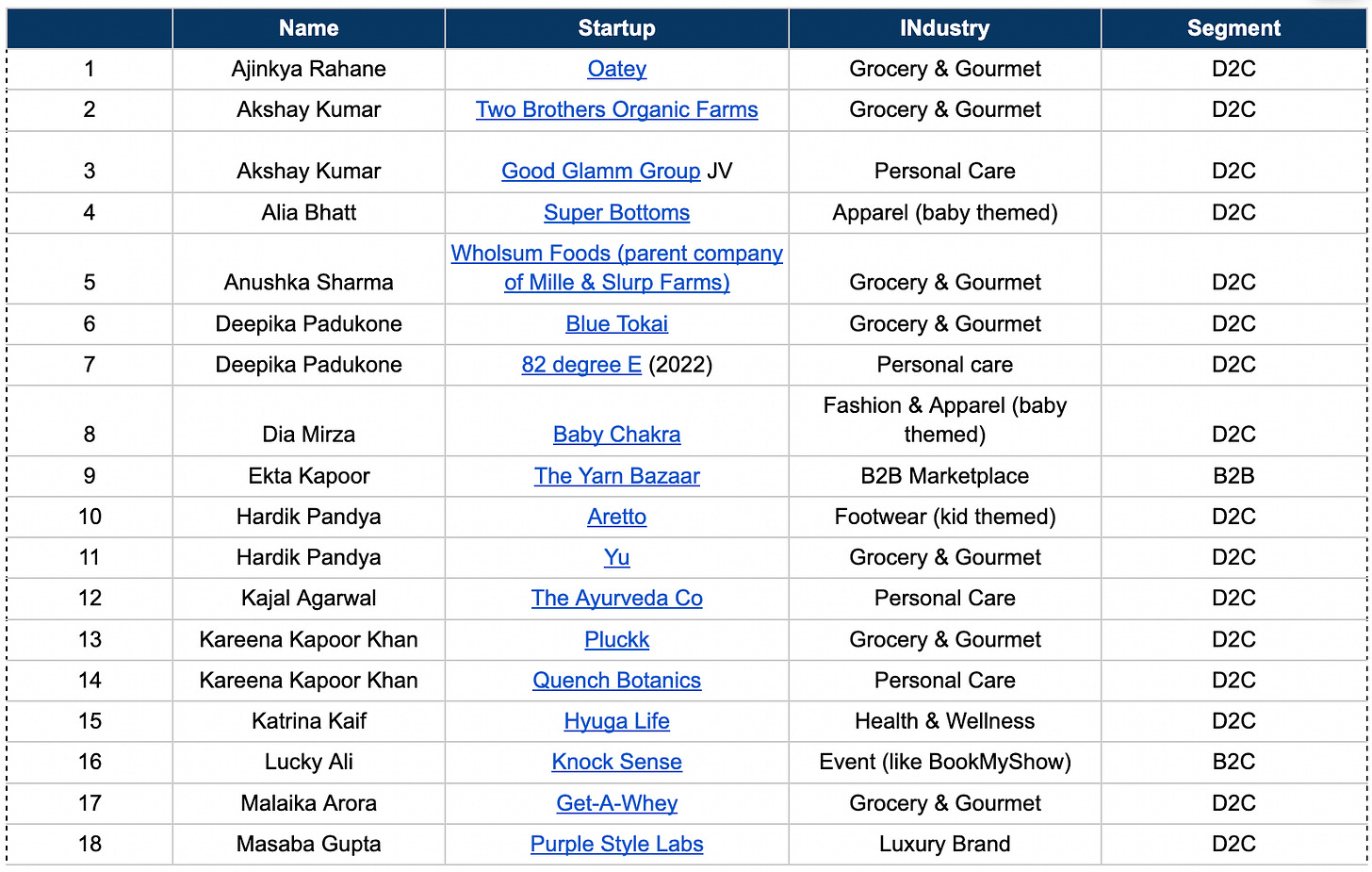

So what was the trend in 2023? (note: this is not exhaustive) I’ve taken a look at a sample set of celebrities who invested in start-ups in 2023, and looked at cuts by industry segments, and the end consumer segments.

Overall, there have been 35 start-ups that have been invested in, and in the case of this sample set, by 36 celebrities. (Two Brothers Organic Farms have been invested in by both Sehwag and Akshay Kumar).

Start up investments by celebrities in 2023

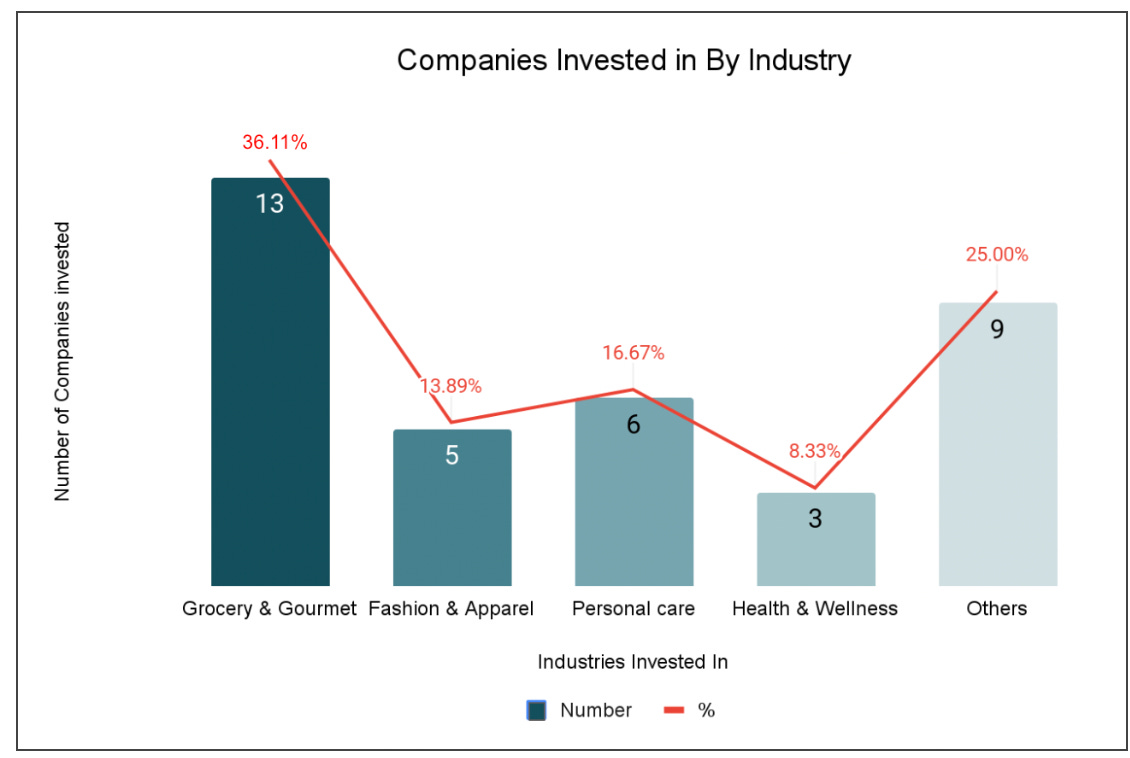

Some interesting observations, at least from this set. Take a look at the graph below. The numbers refer to the number of start-ups invested in, in that segment, and the % is the % of total investments in that segment.

Out of the investments done, here are some stats:

Industry wise breakdown

The top category invested in is the grocery & gourmet segment with ~13 out of 36, or ~36.11% investment. This includes both D2C products such as Oatey (An Oat Milk brand), Get-A-Whey (which is a healthy dessert brand), and companies such as Pluckk, which deliver fresh vegetables, as well as healthy meals to consumers.

Personal Care has 6 investments, which includes mostly skincare, haircare, and sexual health products (Boldcare)

Fashion & Apparel has ~5 investments. Interestingly, 3 out of these 5 investments are baby / kid themed, while 1 is luxury fashion.

Health & Wellness has ~3 investments, which include The Biohacker, Hyuga Life & Fitspire, which sell supplements, health & wellness services and advice.

Others include edtech, OTT, Alcobev, and B2B marketplaces among others.

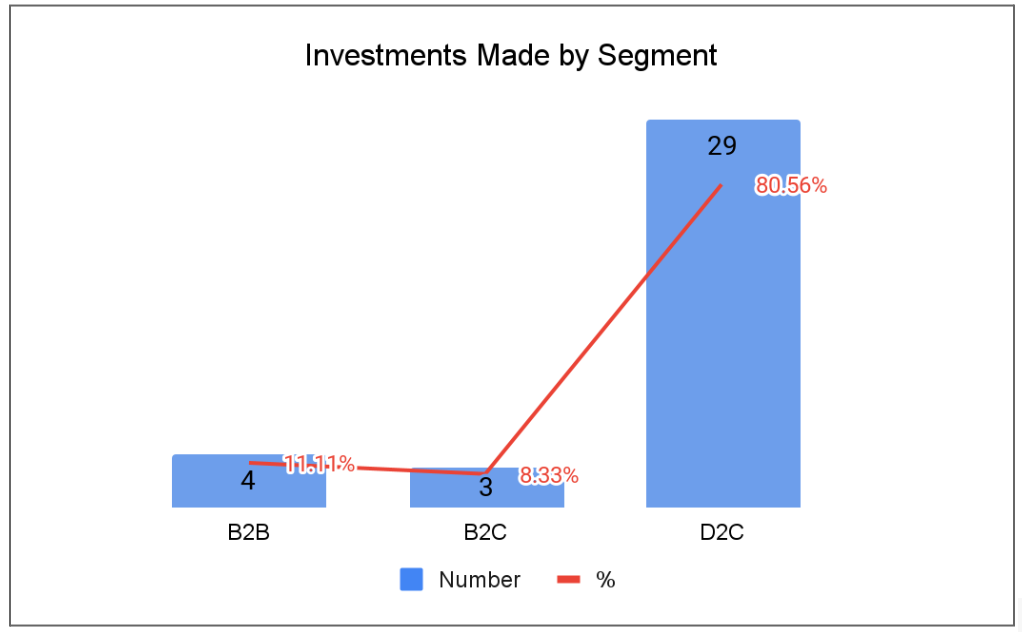

We can also look at it another way, by customer segment type. (Note: B2C pertains to start-ups in the OTT, creator economy, and events , while D2C is more to do with products)

This is pretty straightforward: the investments made by celebrities are overwhelmingly D2C. And this makes sense also. The brand and the marketing appeal that celebs have is very end consumer focused, as expected. And so, their investments would lean where they can leverage some of their consumer reach. That’s probably why apart from investing, a lot of celebs are getting into the business of founding their own D2C start-ups. And this has to be something that is closely tied to their own personal brands, making their followers more likely to “click with it.” A common theme is skincare & make up brands by Indian actors (female). Case in point: Deepika Padukone - founder of 82 E, a skincare brand. Kareena Kapoor, apart from taking an investor role in Quench Botanics, is also a co-founder. Kay Beauty by Katrina Kaif. Anomaly by Priyanka Chopra. And LoveChild by Masaba Gupta to name a few. There are also examples of influencers, or ‘digital celebrities’ all getting into the beauty industry, like Diipa Khosla, an influencer who has founded a skincare brand called IndeWild.

Alia Bhatt seems to have gone deep into the baby themed apparel brands, with Ed-A-Mamma - an environmentally sustainable children’s clothing brand being acquired by Reliance Retail, and now her investment in Super Bottoms, which sells sustainable and reusable cloth diapers for children. As per an interview, she said that during her pregnancy she faced issues with finding trendy clothes and that’s why she launched it. And that’s probably why it clicked with users also, it tied in with her public image at that point, and the numbers prove that as well: Ed-A-Mamma is a 200 Cr brand. While Sara Ali Khan has invested in Souled Store, which is India’s largest brand for official licensed merchandise.

But there are other fundamental reasons why certain D2C segments & celebrities as investors click, and it’s mainly got to do categories which are at the intersection of:

1) Ability to create a captive audience

2) Ability to leverage the personal brand of a celebrity

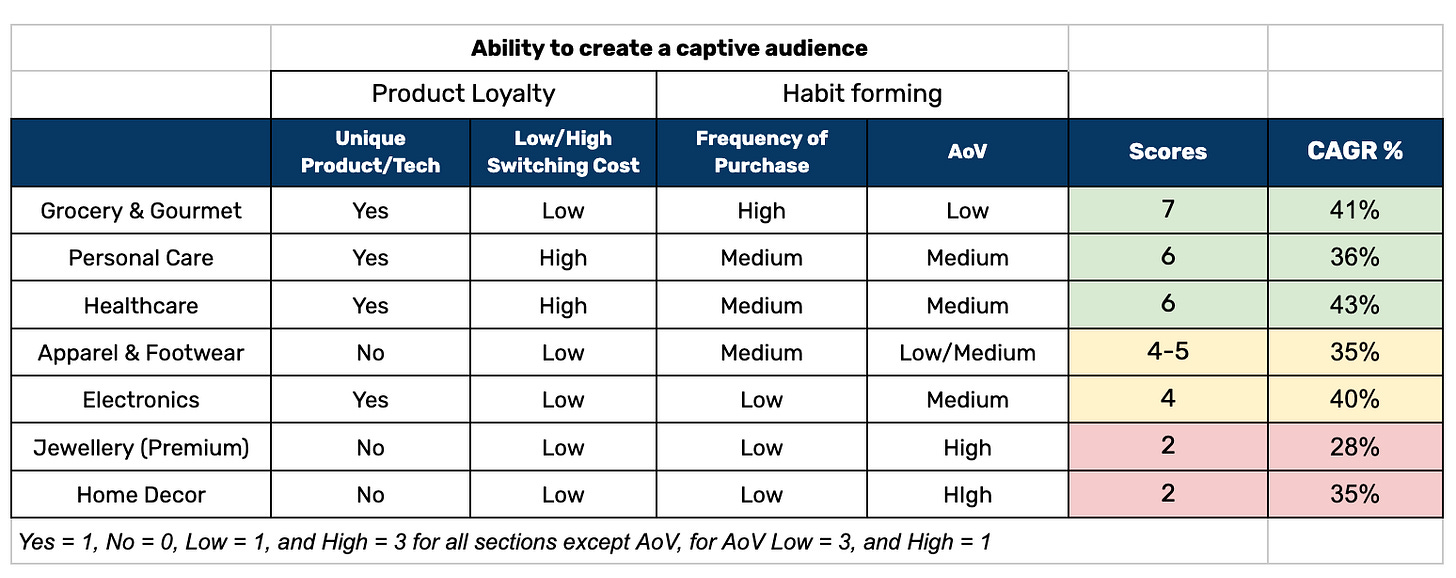

Let’s look at this table below. I’d done this analysis back in 2023, of what D2C brands would be more attractive. I had evaluated them on 4 metrics, with a higher score = more attractive segment to start a brand in, and a lower = less attractive. You can check out the linkedin post here. I’ve updated this a bit basis how my own understanding of the segments have grown:

Scoring methodology

Unique product / tech: Yes =1, No = 0

Switching Cost: High = 1, Low = 0

Frequency of Purchase: Low = 1, Medium = 2, High = 3

AoV (Average Order Value): Low = 3, Medium = 2, High = 1. The reasoning for keeping a low AoV as a more favourable score is because if the AoV is high it reduces the chance of repeat purchase, and if the AoV is low then it’s more likely to be a high frequency, almost habit forming brand. There is a CAC point of view here also, which I understand is more weighted towards higher AoV being more favourable, as the customer CAC can be made back in through 1 purchase, but I’ve looked at this model more from a loyalty perspective & habit forming perspective, assuming that this makes a product more sticky, and eventually results in positive LTV / CAC economics.

It’s a pretty straightforward analysis. Grocery & Gourmet ranked as number 1 with a score of 7 / 8, as the most attractive segment. Personal care & Healthcare score 6/8, Apparel & Footwear came next with ~4.5/8, Electronics with 4/8 and home decor & jewellery ranked 2/8, as the least attractive segments.

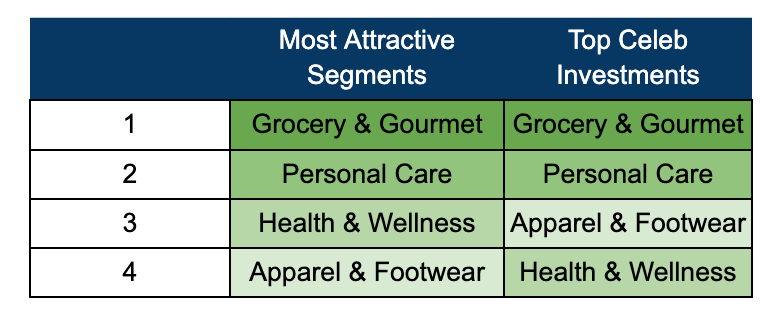

Interestingly, this matches with the distribution of celebrity investments that happened. Grocery & Gourmet, Health & Wellness, Personal Care, and Apparel all featured on the list. And except for apparel & footwear, which was 4th in my model, but 3rd in terms of number of investments in 2023, the order broadly remained the same. Here’s the comparison:

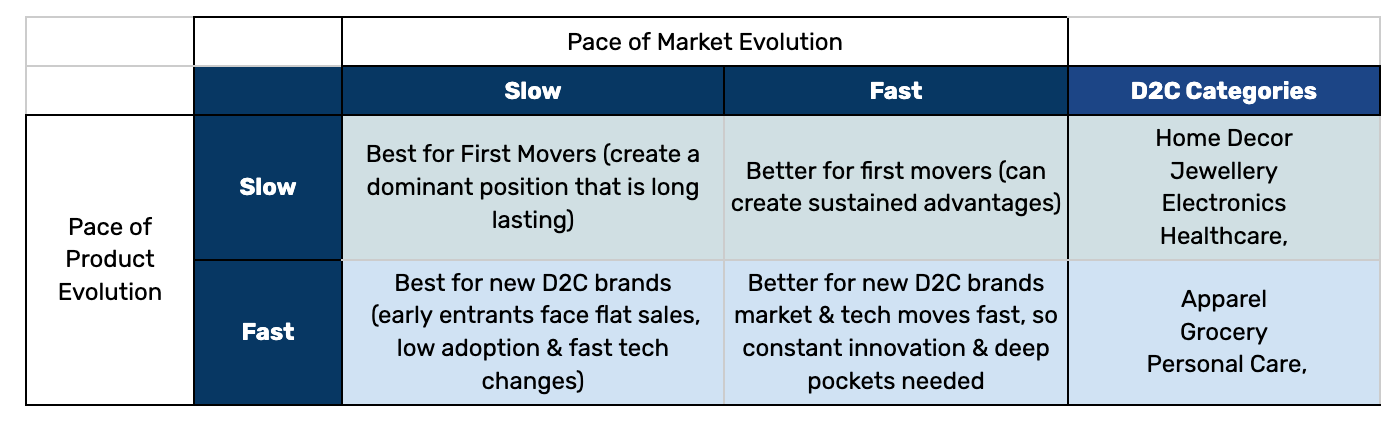

There’s another way to understand which segments could possibly be more attractive than others. Take a look at this table. There was an article in Harvard Business Review back in 2005, where they talked about the first mover advantage. I’ve co-opted it to evaluate D2C brands, since the way I see it, D2C brands are actually challenger brands to your incumbents / brands that currently exist.

The way to read this table is: wherever the pace of product evolution is slow, it is better for incumbents / first movers. Wherever the pace of product evolution is fast, it is better for insurgents (challenger brands, and in this case, D2C), as first movers / incumbents could be affected by fast tech changes, and the requirement of constant innovation. I’ve categorised Apparel, Grocery, Personal Care & Healthcare in the categories which have fast product evolution, simply because of the pace at which new products are being developed, with new formulations, different ingredients etc. Home decor, jewellery, healthcare, and electronics are relatively slower in innovating because of the cost of R&D, raw materials, and in the case of healthcare, clinical trials, and hence time to market is a moat which makes it tougher for challenger brands to come in and disrupt, and celebrities to anchor.

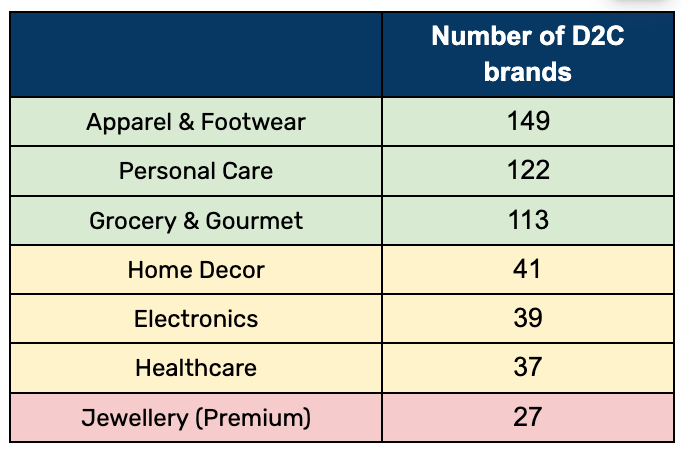

And that’s probably why there are more start-ups in the apparel, grocery, and personal care sectors. These are categories that inherently support the new challenger brands. Take a look at the data below (source: 2022 D2C Shiprocket report)

So, if I had to put the above analyses together, this is what I’d infer:

Weighted towards Captive Audience Vs LTV / CAC economics: From a personal investment / personal brand point of view, the fact that the “attractiveness” model seems to match the celebrity investments sample seems to imply that celebrities also are indexing on ability of the category to create a captive audience (the product loyalty & habit forming aspects of segments), and not so much on the LTV / CAC view. If they favoured LTV/CAC, then it is possible that we would have seen more investment in the larger AoV categories, as the CAC in this case has more chance of being made up in just one transaction.

Combination of category attractiveness & personal brand appeal of celebs: There are 2 segments within D2C categories here, which could be attractive to celebrities. One is - those, which by their very nature have the ability to create a captive audience (grocery, personal care, apparel (edge case) and healthcare). And then there is a segment which can be influenced through personal brand appeal, which is apparel, personal care, and health & wellness. So broadly, this makes up your entire set of D2C categories that majority celebs would see as attractive, with personal care, and apparel showing up in both.

Apparel has a big celebrity brand fit: While apparel was 4th in my list in terms of category attractiveness, I’m not surprised that apparel & footwear is heavily invested in by celebrities. Especially with the clothes one wears, brand appeal matters a LOT. For celebrities a tleast that's something that comes with their brand names. Even from a kid themed perspective, children especially are driven by their heroes. I may be more cynical, but a kid watching his favourite cricketer endorse a brand makes him more likely to want it, and his parents to buy it.

But the biggest takeaway is. There’s a new kid on the block - Celebrity Investment. Early stage VC’s might need to drastically beef up their value add on the marketing & distribution side, especially when looking at D2C companies to invest in. On the face of it, celebrity investment solves for funds, and their brand & followers solve for awareness & marketing. And as more celebrities get into things such as franchise & team ownership, this is something that they can build an ecosystem and business around. For example: Ryan Reynolds & the Wrexham Football Club. He owns the team. His brands Aviation Gin, and T-Mobile sponsor it. (On the face of it, it’s a win-win: The team gets sponsorship, and the brands get marketing). We’ll probably see more bundling like this as the market matures, and the expansion of this business model in India, once our non-cricket sports leagues mature.

But whatever it is, this trend of celebrities investing in start-ups is only going to gain more traction going forward.

Nice report. It does seem to be a major trend in the making. But as more celebrities jump in some of them will lose their money and cool down the ardor of the rest of them. Like how angels invest or VCs. You didn't mention one of the biggest celebrity investments in terms of returns. Shilpa Shetty in Honasa. Massive gain.