[#72] UPI App Valuations: UPI App valuations seem to range between $60 - $100M depending on scale and a path to profitability

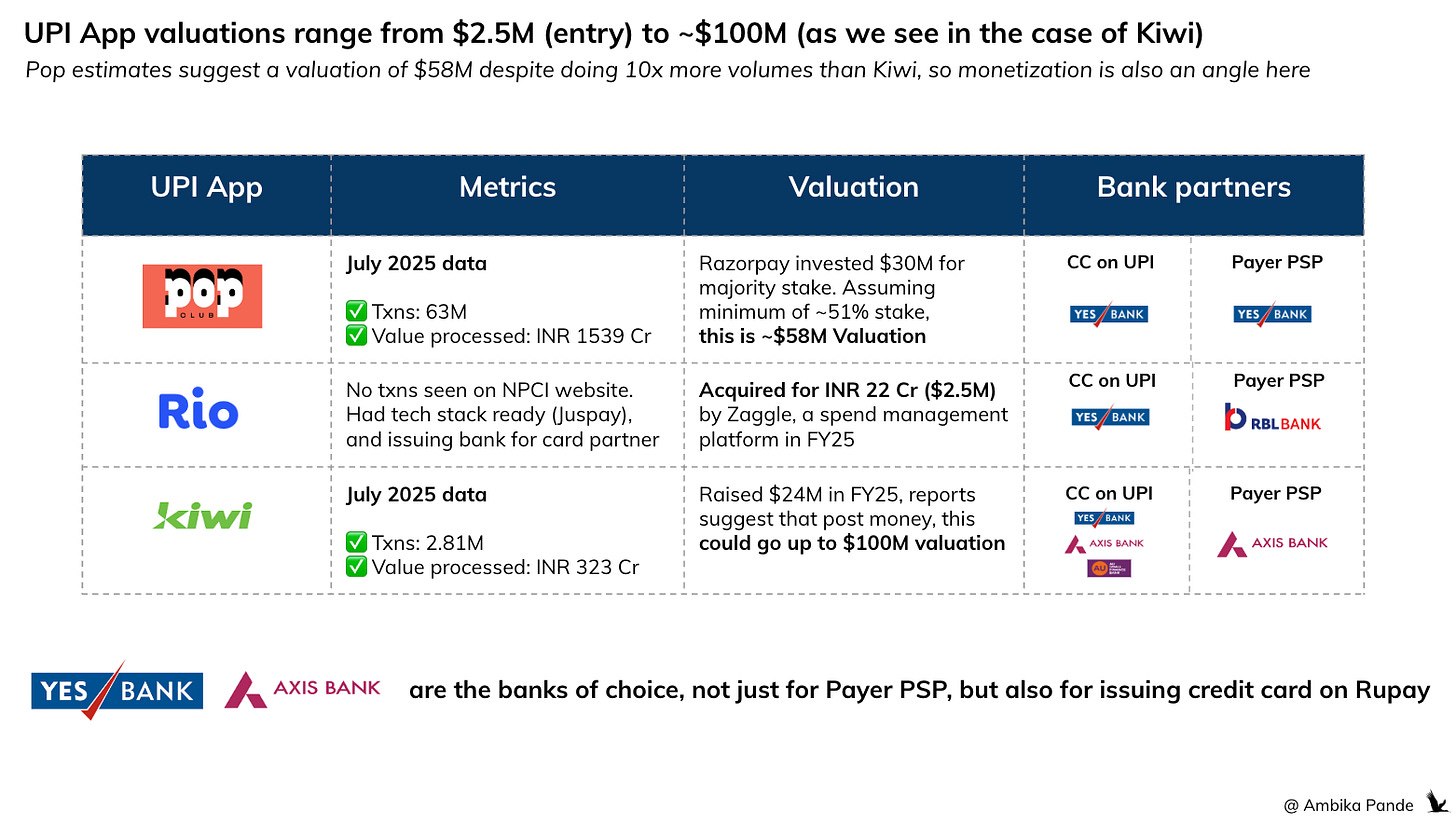

Rio Money (with 0 live txns but a tech stack set up) was acquired earlier this year for $2.5M, Kiwi with its recent fund raise seems to be valued around ~$100M, and Pop estimations are around $60M+.

A theme that I’ve been covering time and time again in the past is the future of UPI, and what it looks like. And increasingly, the future of fintech (not just UPI), atleast in India is full stack, where fintechs & banks try to gain as much ownership as possible over the different legs in the transaction. I’ve talked about this in a lot of detail in past pieces, so I won’t get into this again, but the point here is that you’ve got acquisitions happening left, right and centre here, with smaller apps & TSPs being snapped up by the bigger players, which have both scale & the money for it.

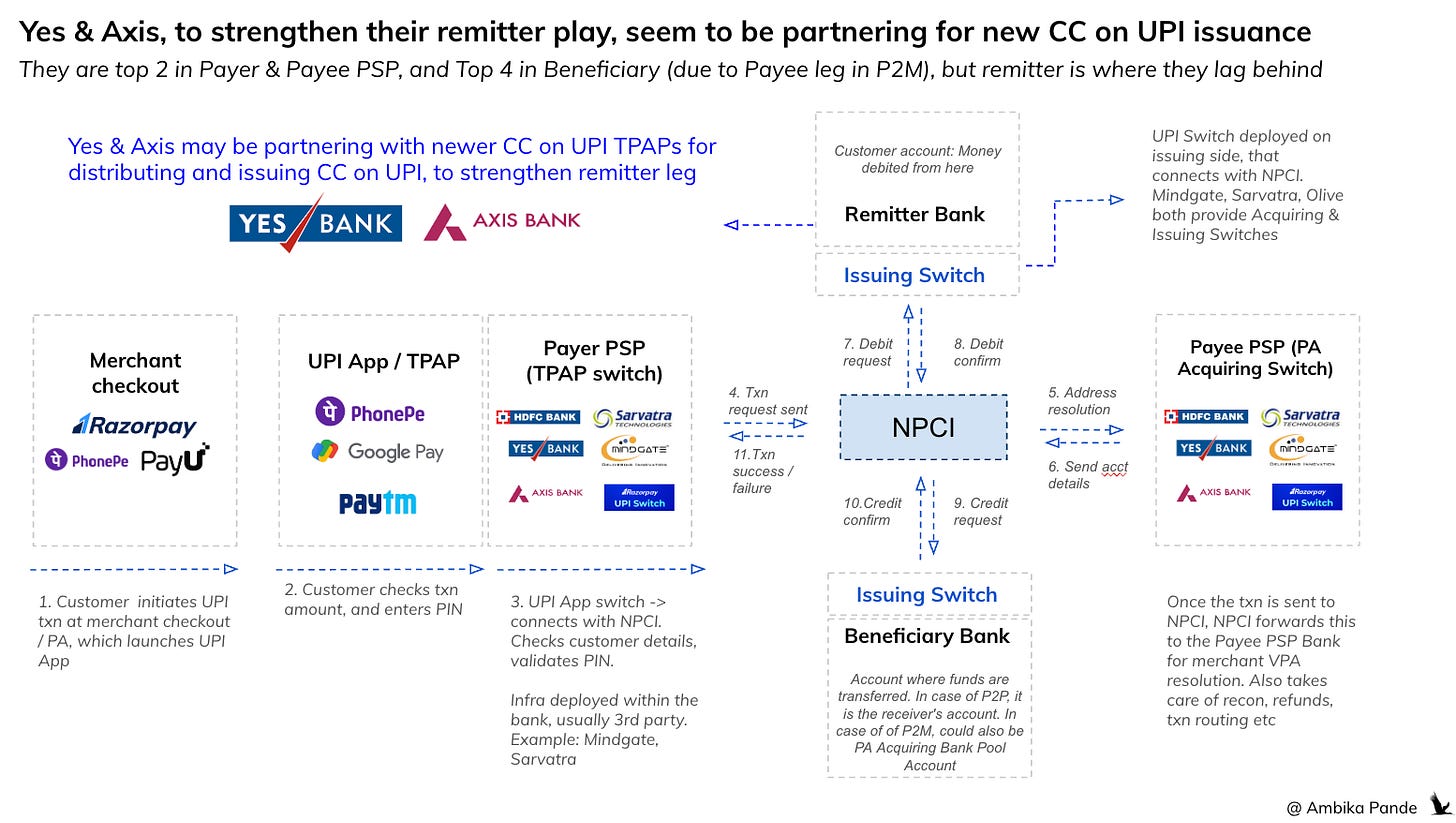

In the case of the UPI full-stack, this becomes the: Payer Leg → Payee Leg → Remitter Leg → Beneficiary leg. To read the deep dive on this, you can check out the below link. If you want to understand in detail what each leg does, I recommend you check it out.

[#71] Yes & Axis Bank: The banks powering India’s UPI flywheel

We talk a lot about UPI. And the top UPI Apps in India. And which apps are doing how many volumes, and how they’re progressing, and market concentration. But in this edition, I wanted to put on a different lens.

There’s also another important leg here, which is the UPI App itself, which is a part of the Payer Stack

Now, in the case of UPI Apps, especially for newer ones, there are multiple issues that they have to deal with:

The market is saturated, and incumbents have ~95% share. Take a look at current market share, the top 4 control 90%. PhonePe has ~46%, Gpay has ~35%, Paytm has 7%, and Paytm has ~2% (this is in terms of number of transactions, if you look at value processed, then it’s even more skewed). So how do newer apps stand apart, aside from doing crazy cashbacks?

Limited monetization: UPI Apps don’t make money because UPI is “supposed to be free.” PA’s may still be able to make some money by offering value added services, and experience layers on top of this, but for a UPI App, they cannot charge the end customer. UPI Apps can make some money from the issuing bank on P2P transactions, but this also depends on the leverage these apps have, and newer ones have 0 leverage. A PhonePe / Gpay / Paytm may still be able to pull something off here. So how does a new UPI App scale sustainably?

For a new UPI App to get that scale, either they offer cashbacks - which isn’t sustainable. Or they offer some sort of financial incentives to the customer. (like credit, and maybe thats the CC on UPI play). Or they have to be present at the point of sale, which requires them to partner with existing fintech / checkout players. But in all of these cases, I don’t see a standalone UPI App working, especially for newer players. There’s also a reason why the OG UPI Apps expanded into PAs, lending, offline POS, and a whole bunch of adjacent services. With payments in India being commoditized, you need to own the experience, and that requires you to own as many pieces of the puzzle as possible

I’ve written in the past about what I see the strategy being for newer UPI Apps - either start with a niche use case and get acquired, or go for a full stack play

I’ve written in detail about this, and you can check out the below article, but TLDR → I don’t see the full stack play being viable for newer apps, the market is just too competitive. Which brings us to point 1) Start with a niche use case and get acquired

[#60] The UPI Dilemma: What happens when the infra and the apps are commodities?

Recently there’s been a lot of buzz about Super.Money & Navi, both outpacing Cred which had been the #4 UPI App, in terms of number of transactions, and total value processed for the past few years. Now Navi, and Super.Money are the #4 & #5 UPI App respectively, although this is in terms of number of transactions. In terms of value, Cred is still #4 (IN…

Both these plays seem be happening. Some things that happened in the last few months are:

Razorpay invested $30M for a majority stake in Pop in June 2025

Zaggle, a spend management app, bought Rio Money, a CC on UPI focused app in July 2025 for INR 22 Cr ($3.5M). Note: from what I could see, there aren’t any transactions on Rio’s UPI App as per the NPCI website, but I could see Payer PSP details, so I assume its tech stack, NPCI sign offs, and bank partnership for credit card issuance was done, it just wasn’t like at scale. I’m assuming some CUG testing was done.

Kiwi, a CC on UPI App founded in November 22 raised its Series B of $24M from Vertex Ventures South East Asia & India, with participation from Nexus Venture Partners, Stellaris Venture Partners, and Omidyar Network in August 2025

Kiwi: a CC on UPI App, valued post money at $100M after its FY25 funding round of $24M, with a revenue multiple of ~100x!

Kiwi is a CC on UPI focused app that was founded in 2022. It raised $24M in its Series B fundraise, which follows its Series A round in November 2023, when it secured $13M. It’s July 2025 metrics were ~2.85M txns & ~INR 323 Cr in value processed in July 2025. And it was #35 in terms of UPI App ranking (for volumes).

If we had to look at its annual data: Its revenues in FY23 - 24 were ~INR 5.38 Cr, and in November ‘23 it was valued at ~$65M. (which is a 100x revenue multiple, and seems really high if I compare it with other fintechs, where valuation multiples are capping out around ~15- 20x. You can check out more details here: [#67] The great fintech valuation correction: When IPO’s loom, valuations shrink.

It’s FY23 - 24 (calculated as April ‘23 to March ‘24) revenues as a % of GMV through the UPI App (It did INR ~691 Cr in UPI App volumes, and I’m assuming that it had no other revenue streams), was ~0.78%. Assuming the same %, at a FY24 - 25 GMV of ~INR 1091 Cr, this comes to ~8.51 Cr revenue (these are my own calculations, this could be more), and multiple stays around 100x.

I’m assuming Kiwi makes money through being the TPAP leg + some negotiation it’s done on the MDR cut with the issuing bank(s) as a distribution partner.

Credit Card MDR on Rupay is around ~2%, so there is an opportunity to monetize on these volumes, as compared to regular UPI transactions. And this could be one “niche” that I talked about earlier: the opportunity for a UPI App to carve a niche out for itself and get acquired. Although from Kiwi’s fundraise and reported valuation, it looks like its going after scale right now.

Moving to Pop: A scaling UPI App which was founded in FY24, and got $30M investment by Razorpay in FY25 for a majority stake (estimated valuation ~upto $60M)

In FY25, Razorpay announced that it picked up a majority stake in Pop, for a $30M investment. Now, I’m doing some back of the envelope calculations here. Assuming that a majority stake here means anything above 50% ownership, and also assuming at its most conservative that this stake is around ~51%, this brings Pop valuation to $60M. And in terms of metrics, Pop was at #15 in terms of number of transactions in July 2025. It did 63M in txns, and INR 1539 Cr in value processed.

Some interesting points here. I couldn’t find anything on Pop revenue. But just in terms of metric comparison to Kiwi:

July 2025 for Kiwi:

2.81M transactions

INR 323 CR value processed

Kiwi did FY24 - 25 GMV of ~INR 1091 Cr

July 2025 for Pop

63M transactions

INR 1539 Cr in value processed

Pop doing as much GMV in a month that Kiwi is doing in a year!

And just comparing monthly metrics here, it’s doing ~22x per month more in transactions, and 4.7x more in value processed. Where Kiwi does have Pop beat on metrics is on AoV (average order value) - Kiwi has an AoV of ~INR 1607 (I’m assuming on account of it being a CC on UPI App), while Pop has an AoV of INR 244.

..but maybe doesn’t have a clear or sustainable path to monetization, and hence has reportedly lower valuation than Kiwi

Kiwi post its Series B fundraise, and despite having lower scale as compared to Pop, will be reportedly valued at $100M. Compare that to Pop, at ~22x scale in terms of number of transactions, and is valued at a maximum of $60M. My hunch here is that Pop probably isn’t making much money (since UPI is supposed to be free, and despite having a Rupay Card - PopCard, launched in partnership with Yes Bank in November 2024, I’m assuming majority of its volumes still come through regular UPI transactions, just by looking at its AoV). From the promotions and the Pop branding as a UPI rewards app, I assume it is burning a ton on cashbacks. Kiwi has probably got a premium valuation on account of some path to profitability

So, it looks like the valuation of UPI Apps with some scale will be around $60 - $100M. With everything set up, but no live transactions this seems to be ~$2.5M

The going rate for a pure-play UPI app (excluding full-stack players like PhonePe and Paytm, these aren’t just UPI Apps anymore) seems capped at ~$100M today.

Entry valuations start around $2.5M if you’ve got the tech, compliance, and partnerships in place (but no transactions yet), which seems to be the case with Rio. It has it’s tech stack ready: Payer PSP as RBL Bank (it’s most probably using the Juspay stack, since this is a bank that Juspay uses to offer its TPAP as a service product). I also assume it has got the compliance sign offs from NPCI. And from Rio’s website, I can also see that it has tied up with Yes Bank for credit card issuance.

It can go up to $60M+ if you have scale (like we see in the case of Pop), but it may cap out here if monetization is unclear, despite the scale.

With a clear monetization path, like in the case of credit card on UPI, where MDR is earned on the transaction, and there is opportunity to make money as the distribution partner, this seems to go up to $100M (as we can see with Kiwi)

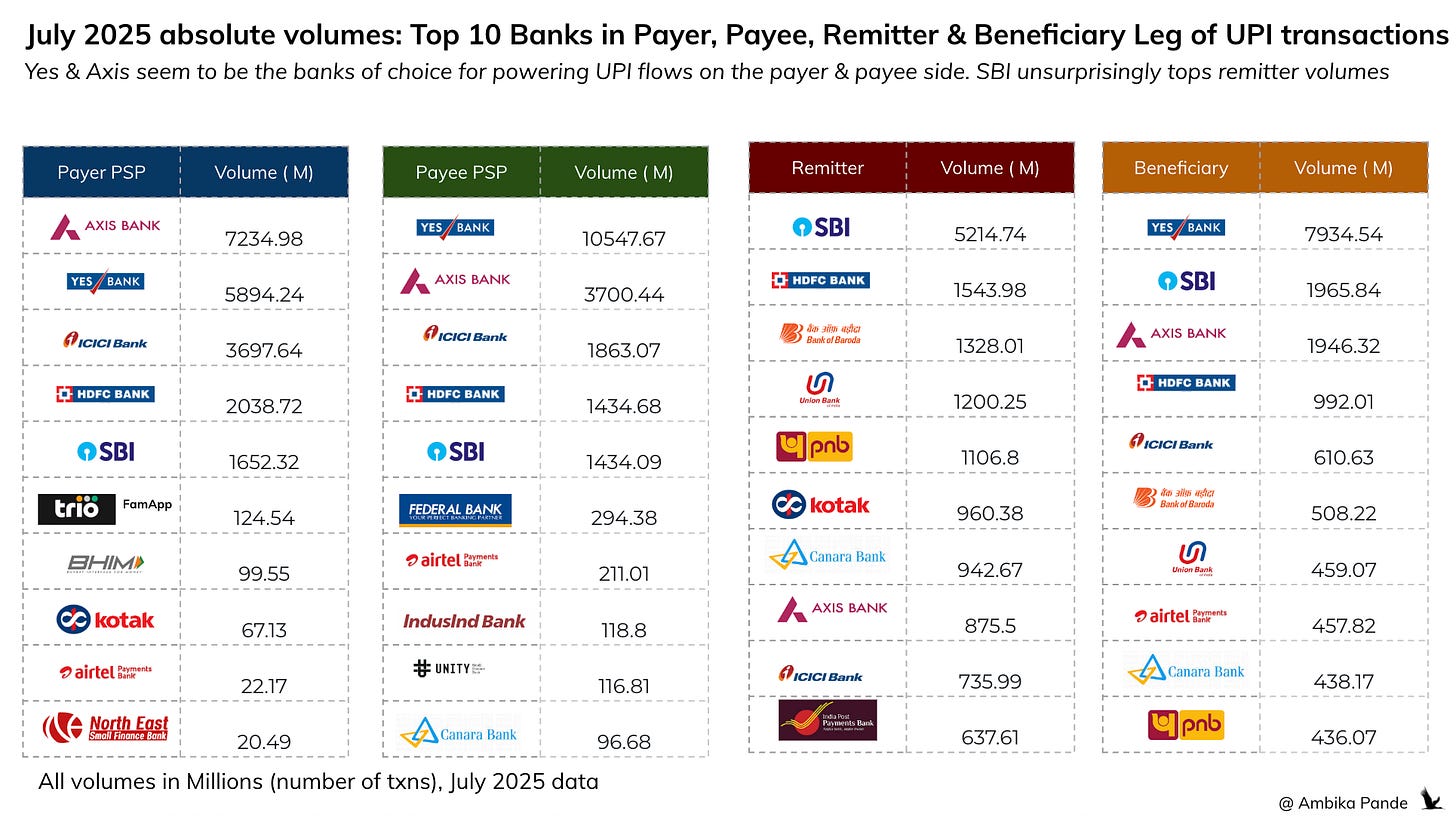

The CC on UPI play also seems to be how Axis & Yes are going after remitter volumes in the 4 party UPI model

Currently, while Axis & Yes Bank are top 3 in Payer PSP, Payee PSP and Beneficiary volumes (although this is probably not P2P, it’s more due to the Payee + Beneficiary leg in P2M tramsactions), they don’t have that much volume on the remitter side of things. What this means is, they don’t have as many customers, and customer accounts. Take a look at the below table. Axis is #8 in terms of remitter volumes processed, and Yes Bank doesn’t even feature in the Top 10.

But if we take a look at the 3 new age UPI Apps that we’ve talked about, they have Axis & Yes not just as the Payer PSP, but also as the banks which will issue credit cards

Kiwi’s Payer PSP is Axis, and its tied up with Yes, Axis & AU SFB for issuing cards

Rio Money’s Payer PSP is RBL (probably the Juspay stack), and it’s tied up with Yes for issuing cards

Pop’s Payer PSP is Yes Bank, and from what I can see, it offers a PopCard in partnership with Yes Bank, which is a Rupay CC on UPI card.

Maybe this is the strategy for them: become the bank of choice for these newer apps which are scaling, not just as the PSP partner, but as the issuing partner, which will increase # bank accounts and strengthen their dominance in UPI

![[#71] Yes & Axis Bank: The banks powering India’s UPI flywheel](https://substackcdn.com/image/fetch/$s_!TpT6!,w_280,h_280,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fc72f39b1-4852-43ca-a227-c2360ac60abf_1456x815.jpeg)

![[#60] The UPI Dilemma: What happens when the infra and the apps are commodities?](https://substackcdn.com/image/fetch/$s_!lwZZ!,w_280,h_280,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fa696dca4-050f-4c95-80a7-c6e9129ce3ee_1906x1070.png)

Finally installed substack and subscribed to your newsletter after months of following it on LinkedIn. Incisive as always!

Great deep dive! I had a question: PopClub has a reward point system where you can redeem their points in their inhouse marketplace. Kiwi doesnt have that going on as of now from what I can see, so its a pure play CC on UPI. Would that affect scale/ customer retention? Would LazyPay be a better comparison to Kiwi so that we arent comparing apples to oranges?