[#69] Do all roads in fintech lead to license aggregation (Part 5): From payments to everything

From PA to NBFC, TPAP to PA-CB, every player B2B / B2C is chasing a full-stack strat to stay relevant, scale, and own the entire payments, credit & data journey across online & offline

🎉 Firstly, milestone alert! We’ve crossed 1,500 subscribers on The Painted Stork! This began as a small passion project to explore fintech strategies & products, and I never expected this to have the readership and engagement it does. Grateful to all of you for reading and sharing along the way.

Now, onto Part 5 of the theme I’ve been covering in the Indian fintech ecosystem: Do All Roads in Fintech lead to License Aggregation. To read the previous pieces I’ve been covering in this theme, please do check out the below links:

Do all roads in fintech lead to license aggregation (Part 1) - May 2024

Do all roads in fintech lead to license aggregation (Part 2) - October 2024

Do all roads in fintech lead to license aggregation (Part 3) - February 2025

Do all roads in fintech lead to license aggregation (Part 4) - April 2025

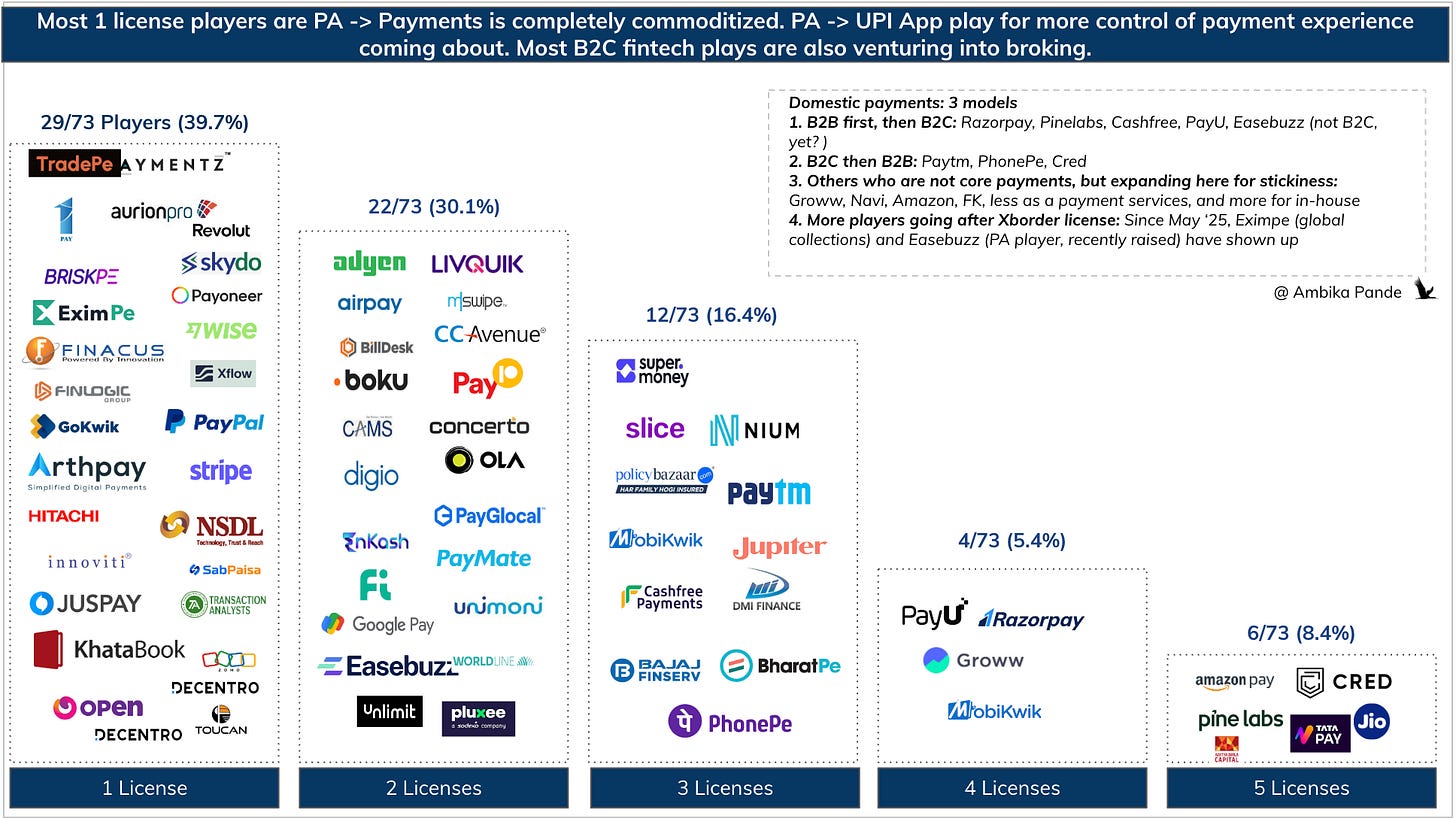

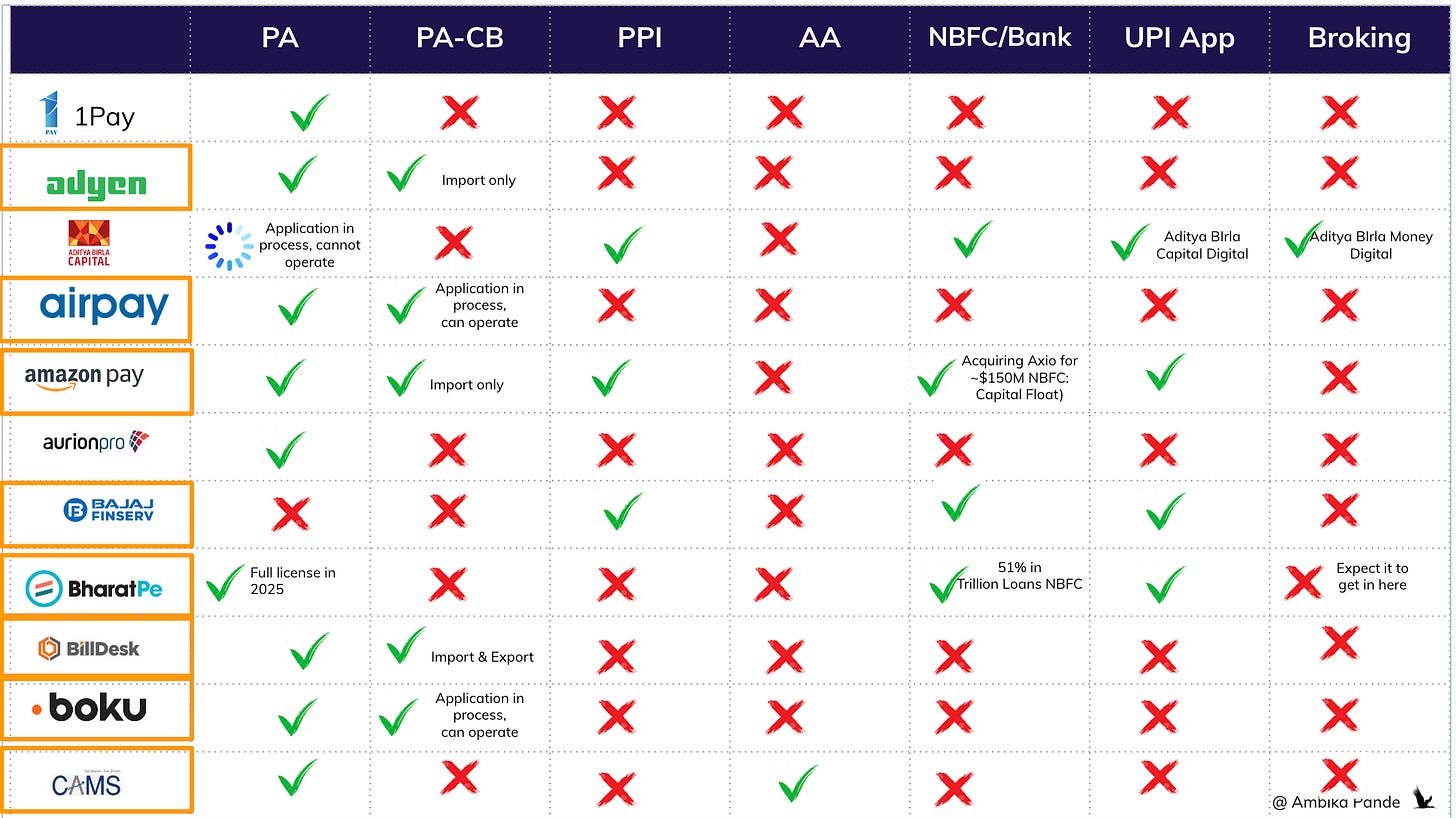

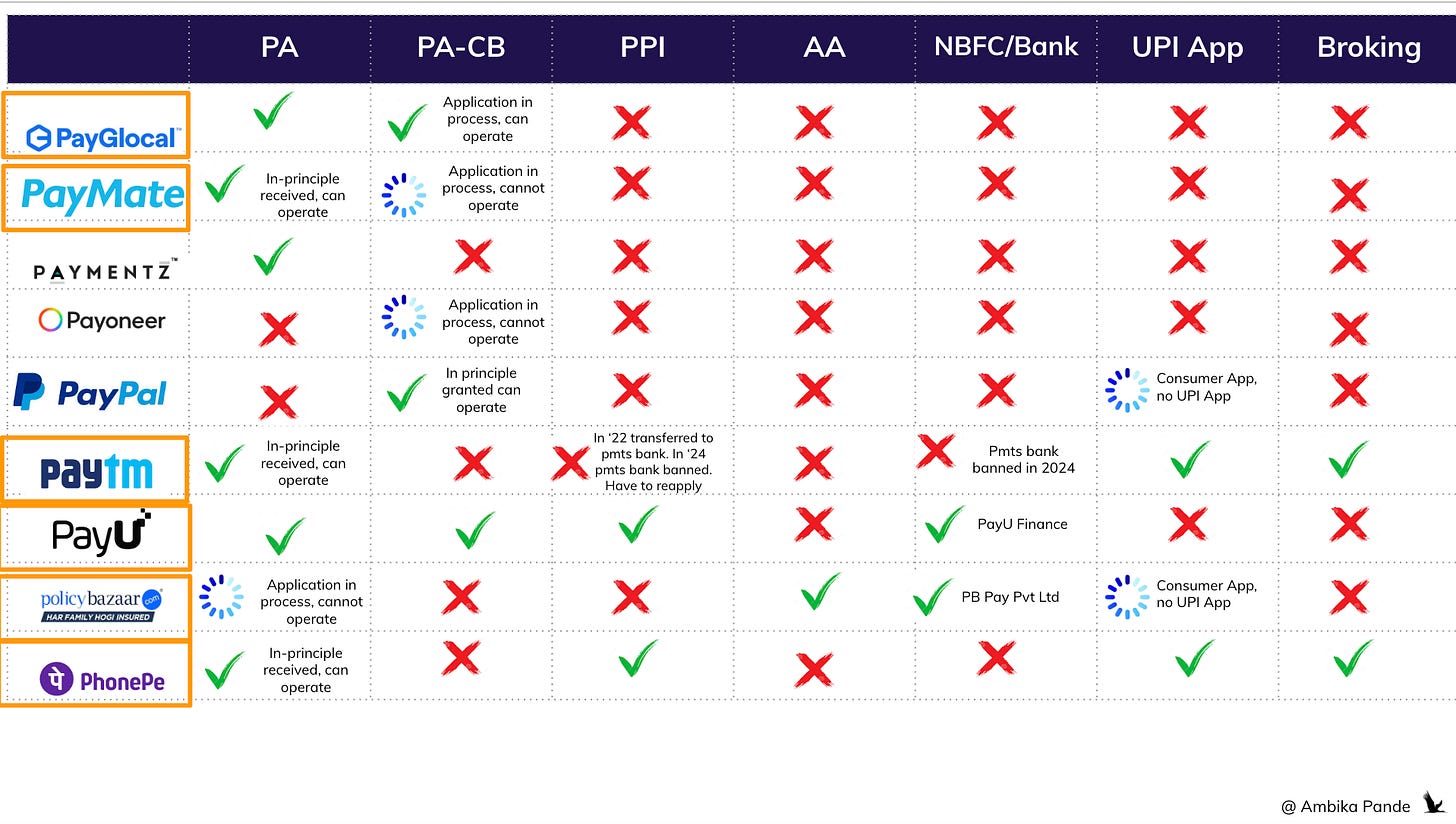

In the April 2025 edition, I looked at 71 fintechs to see what licenses they have, and what patterns are emerging. Now, I’ve taken a look at a list of 73 fintechs in July 2025. (Note - this is basis the license status on 16th July 2025). Some key observations:

1. The PA & PA-CB model will continue to scale, with Easebuzz throwing its hat in the ring, and there are continued applications for a standalone PA-CB play, with Eximpe showing up as a new application in RBI’s list

From around 40% of fintechs and fintech-adjacent players holding just a single license (majority being PA), the number has only slightly shifted to ~39.7%. This stability is largely due to two notable developments:

Easebuzz: After raising $30M in FY25 at a $200M valuation, Easebuzz has thrown its hat in the ring for a PA-CB license. It’s now a fresh name on RBI’s July 2025 list of fintech license holders, moving beyond its earlier status of having just a PA license.

Supermoney: With its UPI app announcement and entry into broking, combined with Flipkart’s NBFC license in FY25, Supermoney is positioning itself as a serious upcoming fintech player. It seems to be following the Amazon model, where a strong e-commerce platform naturally expands into fintech because of its distribution advantage and platform leverage.

I’ve written a detailed piece on this platform-to-fintech play, which you can check out below.

A new entrant has joined the licensing race: Eximpe, a global collections and payouts player, has applied for a PA-CB license. This feels similar to TradePe, which focuses on export-oriented cross-border payments. Both specialize in cross-border flows and are pursuing PA-CB licenses to streamline operations and compliance. Beyond new players like Eximpe and Easebuzz, there’s also notable movement among existing fintechs that had already applied for PA-CB status, which I’ve highlighted below.

Some other updates are related to updates in license status

Khatabook: Received a full PA license in June 2025

PayU: Received a full PA license in June 2025

Xflow: From having a PA-CB license with the status “Application in process - cannot operate” they now seem to have moved to an “In principle license” status. Now this is basis public news reports, at the time of writing this, the license status on the RBI website was updated as of July 16th 2025.

TradePe: Moved from “Application in process, cannot operate” in May 2025, to “In principle authorization, can operate in July 2025)

Wise: Moved from “Application in process, cannot operate” in May 2025, to “In principle authorization, can operate in July 2025)

PayPal: Moved from “Application in process, cannot operate” in May 2025, to “In principle authorization, can operate in July 2025)

Here is what the licenses say about how the fintech ecosystem is evolving (which is line with what past editions in this theme have predicted)

The full stack play, starting out as B2B / B2C first & the convergence, the NBFC + PPI + UPI App play & the Xborder play are all where I see movement happening or players doubling down

1. Full stack payments play, across online, offline, infra & consumer payments is table-stakes

This seems to be the strategy everyone is converging on. No matter where a fintech starts, whether as an online payment aggregator (PA), an offline POS player, or a B2C UPI app, the endgame is the same: building an integrated online + offline (omnichannel) stack that spans both B2B and B2C to create a self-reinforcing flywheel.

The ecosystem has matured and most players have achieved scale in at least one vertical, be it online payments, POS, or consumer apps. Now they’re aggressively expanding into adjacent areas, either through acquisitions or by building in-house.

But, the strategies still diverge depending on whether a player is B2B-first or B2C-first, shaping how they approach monetization, partnerships, and customer engagement.

Below: I’ve taken a look at the top B2B & B2C players in fintech in India with regards to scale, and segregated by licenses to see if I can spot any trends in terms of what they’re trying to do

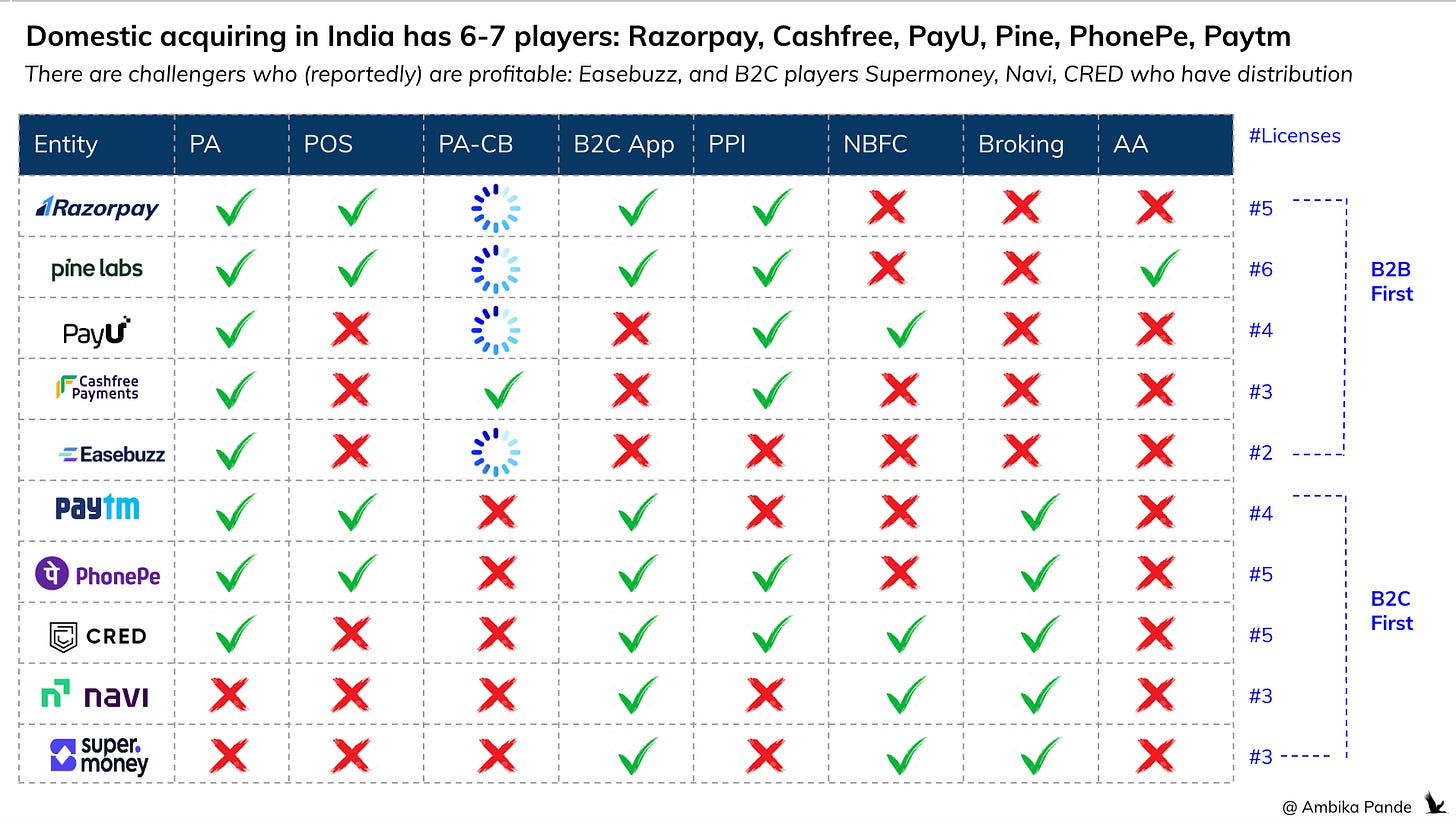

To better understand the strategies at play, I’ve broken this down into B2B and B2C models. I’m also categorizing the “PA play” into online PA (Payment Aggregator) and offline PA (POS), to very clearly differentiate between who is doing what

In B2B, you’ve got the usual suspects:

Razorpay: #5 licenses. The online PA license, the POS play with the acquisition of Ezetap in 2022, their PA-CB, which is process, the B2C App (which they now have through a $30M investment into Pop in FY25), and the PPI license, which they got in 2022

Pinelabs: #6 licenses. strongest POS player in India and has launched its online PA platform, Plural. It also owns the B2C app Fave, a Southeast Asia-based app acquired in 2022, though it has not yet launched on UPI. Pine Labs’ PPI license came through its acquisition of Qwikcilver in 2022, while its AA license came via Setu, also acquired in 2022. Notably, 2022 was a watershed year for Pine Labs and many fintechs, marked by significant acquisitions and license expansions, likely fueled by the funding boom of FY21–22. The company’s DRHP highlights a strategic shift toward Digital Checkout Points (DCPs), where it defines checkout infrastructure as not just POS but any point of payment, online or offline, and is focused integrating payments, credit, loyalty, and stored value, highlighting its focus on the omnichannel play

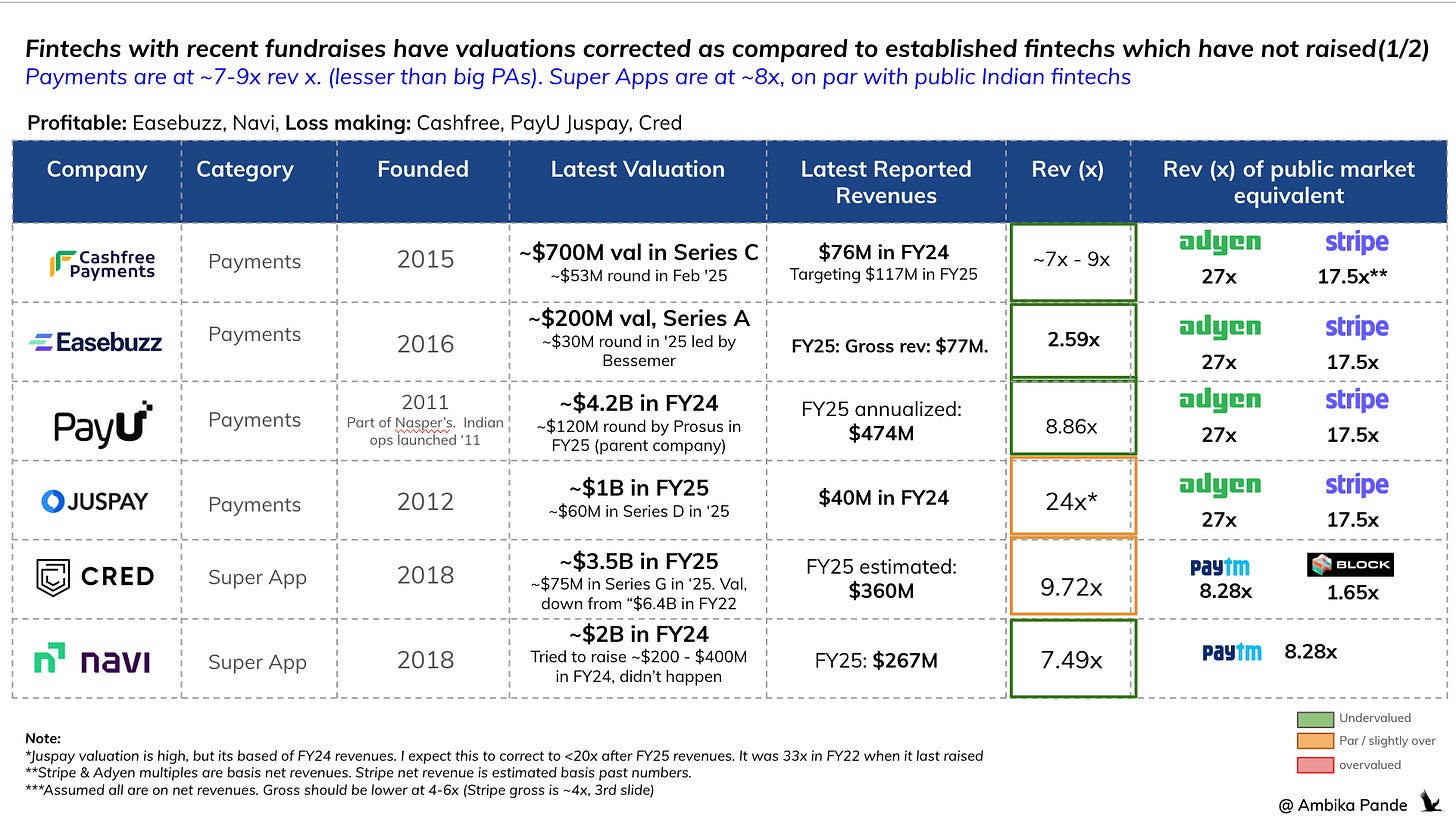

PayU: #4 licenses. With a PA, and a PA-CB (application in process, although Briskpe which is a company they have invested has a license in the “in-princple and can operate” status. They also have a PPI license, and a NBFC license (PayU Finance). Now, I couldn’t find too much about PayU Finance AUM details, but I did find a link to some sort of FY24 annual report, which doesn’t really have too much of information, but if you’re interested in digging more, you can check out this link here. I don’t think too much has happened here ever since LazyPay (PayU’s BNPL offering offered by PayU Finance) was scaled back, but in the light of the favourable regulatory landscape regarding lending (repo rate cut by 1% from 6.5% to 5.5%, and RBI bringing back reserve requirements for unsecured lending back to 100%), I expect this to scale back up. In fact, PayU raised ~$35M in FY2025 from its parent company Prosus for exactly this reason - to scale its credit offerings

Cashfree: #3 Licenses. A PA license, a fully licensed PA-CB (both import & export) and a PPI license. They’re going heavily after cross border and international expansion, and raised a $53M round in FY25 at a valuation of $200M for this exactly.

I find it interesting that Cashfree doesn’t have a POS play OR a B2C App play - like how Pinelabs & Razorpay have. There could be a chance that they go after Mswipe / Innoviti as offline players, to absorb the POS play. However, with these new fintechs, there is also a focus now on sustainable growth. POS is a very different business - scaling is not as easy as online, and my own view here is that apart from biometric payments (if that ever takes off), I don’t think there is too much of innovation left here, apart from the omnichannel view. But this still remains a catchphrase - I don’t think anyone has really managed to solve this (yet).

I also feel there could be an outside chance that they consider building / acquiring a B2C App - especially after all the hype of Razorpay investing in Pop. Again though: actual value add & sustainable growth trade-off will have to be figured out. Apart from PhonePe which is almost breakeven if you remove ESOP expenses (and basis recent news Paytm - which posted a quarterly profit for Q1 FY26 of ~122 Cr due to its lending business), other UPI App first businesses are not, because of no MDR on UPI. Paytm, PhonePe, Gpay etc have made money through cross-selling, lending and the QR soundbox rentals, but those are adjacent plays that these players COULD do because of scale. Not easy for newer B2C Apps to do this, hence my view that for existing bigger fintechs - PAs in India, they’ll probably choose to acquire, and UPI apps with on scale will be open to explore this

I will say though: when Razorpay & Pinelabs went after online / offline & the B2C play, they had significantly more scale. Razorpay acquired Ezetap after it’s Series F fundraise in 2021 / 2022. Cashfree had its Series C in 2025, and Easebuzz had Series A, so its still relatively early for them.

Easebuzz: # 2 licenses. A fully licensed PA, and the update from May to July 2025 is that it has applied for a PA-CB license. It raised ~$30M in April 2025 for cross border & international expansion. They’re reportedly profitable, expecting net profit of INR 25 Cr in FY25 (~$3M). Again, I have similar expectations on their future growth as I do with Cashfree.

For B2B-first fintechs, apart from the standalone cross-border players I’ve covered below, payments have become a pure commodity. Innovation here is limited unless it involves emerging rails like stablecoins which is essentially next-gen settlement tech. Being full-stack is no longer a differentiator; it’s simply table stakes. The real avenues for growth now lie in international expansion (via PA-CB), credit (through NBFC models), and data (AA frameworks or proprietary transaction data). These are the levers that will allow players to deepen their core offerings and create meaningful value for merchants. This perspective is echoed in the Pine Labs DRHP, which, while a dense 600+ page read, offers a clear view of how they envision the evolving fintech ecosystem.

What is very telling in the Pine Labs DRHP is that it refers to checkout points as DCP - digital checkout points, and this refers to any point the user makes a payment - be it online or offline, strengthening the omnichannel value add

In the DRHP, Pine Labs introduces the idea of DCP, Digital Checkout Points. This is an important shift in how the company tells its story. A DCP isn’t just a POS machine, it’s any checkout point, online or offline, where Pine Labs enables payments, credit, loyalty, or stored value. This includes:

Offline POS terminals and QR

Online checkout via Plural

Affordability & EMI at checkout (offline + online)

BNPL and Credit+ issuance

Loyalty & rewards integration via Fave

Prepaid cards and gift cards via Qwikcilver

The goal? Unify online and offline merchant payments into a single infrastructure layer, one dashboard, one reconciliation process, one checkout stack. And hence, this strengthens my view that Cashfree, Easebuzz, PayU will all eventually get into the offline side of things also

Below: screenshot of Cashfree & Easebuzz revenues. For the detailed article on Decoding Fintech Funding & IPO’s in India, check out this link. The snapshot below is taken from the article

In B2C, I’ve taken your players such as PhonePe & Paytm, which are part of the OG fintech apps. I’ve excluded GooglePay here - even though it is a UPI App & has a PA license, it not an Indian based entity, and probably a lot of the decision making for this sits out of India.

PhonePe: #5 licenses. PA online, POS play, although this is mainly QR & Soundboxes, PPI license, UPI App & Broking. Interestingly, not in NBFC or PA-CB.

Paytm: #4 licenses / plays. PA online, POS, UPI App & Broking. It had to reapply for a PA license after it was rejected in 2022, this is now in process, and they can operate. They did used to have a PPI license as a part of their Payments Bank, which was cancelled after the payments bank was restricted. I do expect them - like they have reapplied for the PA license, to gradually start scaling up their Payments bank again, once they’re able to get the restrictions off, and make the appropriate declarations. What is interesting to me here is that they haven’t gone after a PA-CB, since they seem to have strong interest in expanding internationally. In FY25 they made a $1M investment in Brazilian fintech Dinie, (an embedded finance app for B2B lending) for 25% stake. As investments go, it’s not a large ticket size, so I’m assuming this is strategic to start understanding the LATAM landscape. And that right now the focus is on getting their PA, and stabilizing the businesses. I expect them to go after a PA-CB eventually.

As an aside: The LATAM fintech scene is booming: Pix is a RTP payment rail comparable to UPI, you’ve got neobanks such as Nubank (neobank), Pomelo (card issuing, HQ in Argentina) and dLocal (payment aggregator out of Uruguay). It’s driven by similar factors that drove fintech growth in India: underbanked population, smartphone penetration, and frameworks such as Pix in Brazil, DiMo / CoDi in Mexico for cash to digital shift. And from a Xborder play, while remittances still happen from developed to developing economies, and hence, it’s important to have a stronghold in US / UK etc, there is limited scope for innovation there.

CRED: #5 licenses. PA, B2C App, PPI, NBFC & Broking. (through investment in Newtap which owns Parfait Finance - now called Newtap finance). They did try to do P2P lending, but that didn’t work, and especially after the RBI directly last year where they came down quite heavily on P2P lending platforms, banning these platforms from advertising this as investment, it’s not really scaled. They seem focused on the B2C play, and being a super-app, especially after the launch of Cred Money, their money management play.

There are different strategies afoot - depending if you’re B2C first or B2B first: some observations

It’s surprising to me that only Razorpay & Pine have online & offline plays. I expect others to also get in here: but the challenge here also is that it is a very different business. I’m also unsure of how much innovation is left in offline, and hence this play becomes less of a “differentiator.” With margins anyway being razor thing here, it is possible that smaller players may not see the value of getting in here, and especially those which are looking to scale profitably. (Easebuzz). That being said, I do expect PA online players that are scaling here to provide the full stack play - an example is Cashfree. Also - as another reason for the full-stack play: as a merchant, if I have an online / offline business, I don’t want to have to deal with multiple players. One should solve all my problems, across the one customer view, online & offline, reconciliation and so on. And that’s why for the B2B first players, I do expect them to eventually get here - in the long term it’s not a differentiator, its the bare minimum expected.

The B2C first players have not even touched the PA-CB play. For Paytm specifically, since it had to reapply for its PA license its possible that it is biding its time, and will go after the PA-CB also. For others - the superapp play may not really need a PA-CB license. I’ll be interesting to see once the cross border UPI payment piece really takes off, if there will be additional licenses / regulatory requirements from UPI apps facilitating this. Right now this happens through the AD 1 bank tie up, and via NIPL (NPCI International) partnerships. But I’d expect additional regulatory burdens here.

PPI is way more common in B2B as compared to B2C - I am assuming this is because of “issuing as a service” to merchants. For B2C, PPI is actually a threat and redundant in the face of the UPI biz.

3 out of 5 B2C apps now have an NBFC license. Paytm’s payments bank didn’t work out, and PhonePe is likely holding off until its IPO before entering lending, it’s only a matter of time before it does go after a NBFC. In contrast, only PayU (via PayU Finance) has an NBFC on the B2B side. But for B2B players, an NBFC isn’t always essential. (Why? They already have access to float, the merchant funds held during the payment settlement cycle. This float can be strategically used to power instant settlements or short-term working capital credit for merchants without needing a full NBFC setup.) What these B2B players truly lack is banking capability, an acquiring and settlement layer similar to Paytm Payments Bank, or what Slice (neo-bank) is building on the B2C side.

My view: To enable true financial inclusion, the RBI should introduce dedicated neobank licenses. Traditional banks, with their outdated infrastructure and slow innovation cycles, simply cannot deliver the kind of embedded, tech-first banking experiences modern fintechs can. You can check out my piece on this below:

Every UPI app today is chasing the Super App dream, there’s almost no clear way to differentiate. UPI payments are just the entry point. From money management and investments to broking and net-worth tracking, everyone is building the same suite of offerings. The one white space I still see is an integrated payments + travel platform. Imagine a seamless blend of Atlys (though it has a long way to go in rebuilding trust, I had a terrible experience), Scapia, and MakeMyTrip, layered with cross-border payments. A single platform that handles payments, travel bookings, forex, credit card issuance and cross-border spends could be a true differentiator in this crowded market. I think this is what a Scapia could become eventually. It did raise $40M in FY25, so maybe we can expect to see some acquisitions / new launches / international growth ambitions here.

There’s a third model here apart from B2B first & B2C first. It’s the non fintech / non payments player that’s getting into payments for stickiness

Amazon: #5 licenses. PA, PA-CB (import), PPI, NBFC (Axio), TPAP

Navi: #3 licenses. UPI App, NBFC & Broking (and their own AMC). Again, I expect it to be a superapp play, there hasn’t been any indication otherwise.

Groww: #4 licenses: PA, NBFC, UPI, Broking

Supermoney (a Flipkart company): #3 licenses - UPI App, NBFC & Broking. Part of the Flipkart group, possible that they get into the PA & B2B play to power Flipkart group companies.

This is more of what I’ve started calling an “experience” integration. You get in here to make it more sticky for the end customer, and own more of the experience, but it’ts not the core offering. Supermoney - yes, it is a separate play, but Flipkart has had payment ambitions for a while (FK initially owned PhonePe, and then they separated). I see this as something that will serve FK group companies as a part of their fintech / payments arm.

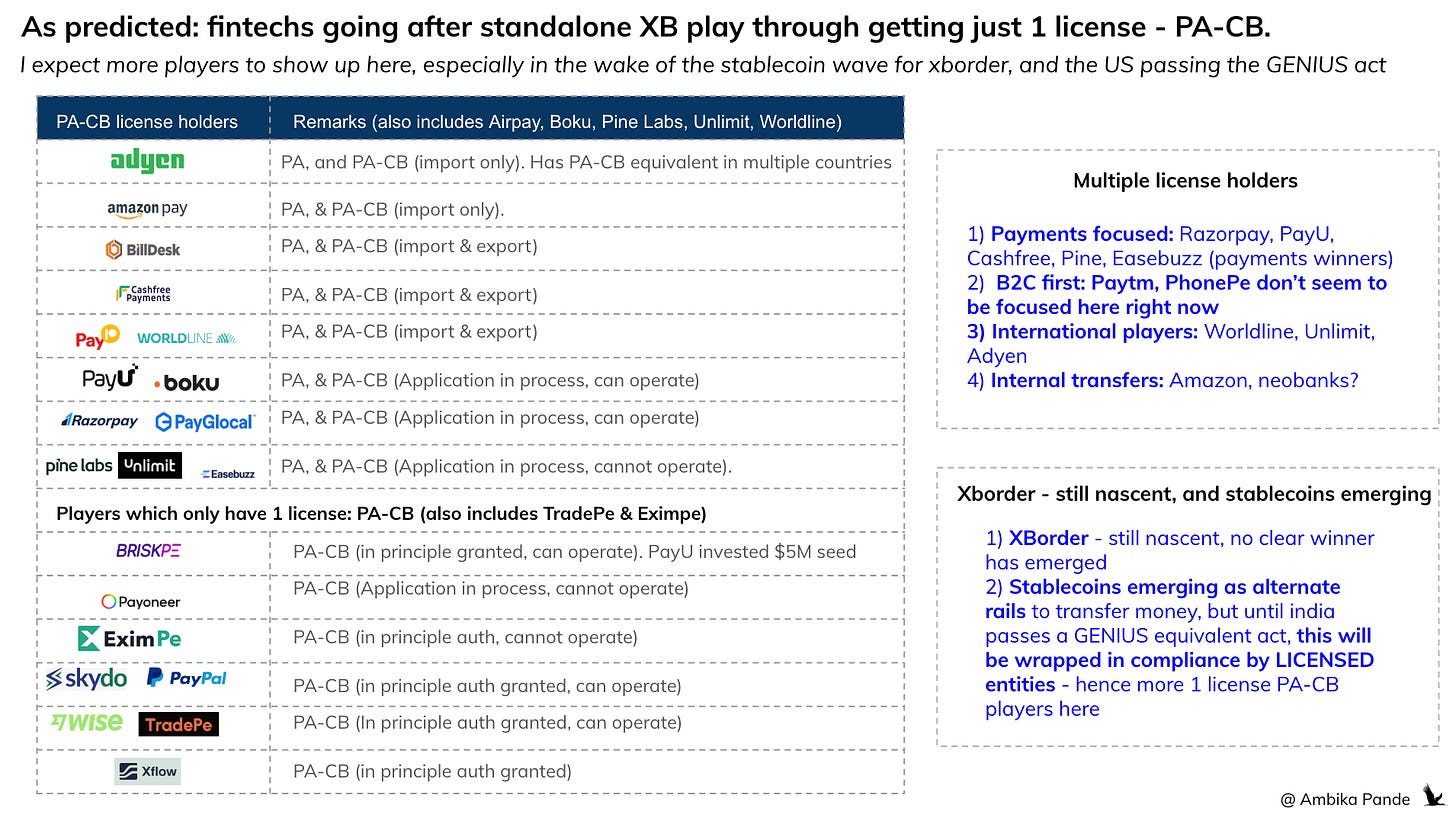

2. The standalone Xborder play continues to grow

Existing players are of course expanding here, but also new standalone players getting in. In all other cases, I don’t think just a standalone license will suffice, because of domestic margins, UPI volumes etc, but in the xborder the space is still nascent, the global TAM is massive, and the margins are 2-3x more that domestic payments, so a standalone play could work.

If you’re a PA player, you’re going to go after a PA-CB play as well, it is natural. Adyen, Boku, Unlimit are the international players here, but the top PA’s in India - Razorpay, Cashfree, Easebuzz, PineLabs are all getting in here.

However, there are a lot of standalone players here: not players who are scaled fintechs across domestic, but just standalone xborder players

BriskPe: In principle auth granted, and can operate. PayU invested a $5M seed round in 2024.

Payoneer: Application in process cannot operate

Skydo, Paypal, Wise, TradePe, Xflow: In principle Auth granted, can operate

What I also expect is that, especially after the US passing the GENIUS Act for stablecoin regulation, players focusing on cross border remittances, but especially through stablecoin flows will also go after the PA-CB licenses. The regulations around stablecoins in India are still unclear, but a licensed entity offering this wraps them up in a layer of compliance - where entities say: “Hey - stablecoins aren’t licensed but we are.”

3. The NBFC + TPAP + PPI play for new age NBFCs

I had talked about this in the previous edition of this theme that I’ve covered. ABFL (Aditya Birla), Bajaj Finserv & DMI Finance are all players that seem to be making a play here. TATA Capital is another. The play here seems to be: give the end customer a loan, disburse it into the PPI Wallet or an account, and then link the account on UPI rails and allow spends. Now, while incumbent NBFCs have gotten in here, I actually think there is more potential for new age NBFCs to do this, just in terms of infra, speed of innovation and so on.

Case in point: Stashfin, a new age NBFC which raised $9.3M in FY2025 acquired a TPAP license in FY2024. Other new age fintechs that raised recently with some sort of B2C play: Techfino, FincFriends, Mahaveer Finance - it is very possible that they get in here. I’m actually excited about this, and I think that a lot more NBFCs are going to go after the TPAP license. But again, this is more of an experience play - my view always has been that a customer seeking credit is a high intent customer. Yes, this play helps to lock-in customers, but to first get the customer still depends on first principles execution in lending: 1) distribution - how do you get to the customer and 2) underwriting - how can you actually give the customer the credit. Usage is secondary.

In today’s fintech landscape, a full-stack play and seamless experience are table stakes. Success is no longer just about the breadth of products you can offer, but about how well you can weave these offerings together into a unified, high-quality journey for the customer. True differentiation lies in this integration, where every touchpoint feels connected, consistent, and built around customer needs

![[#66] E-commerce to fintech: A proven path. Fintech to e-commerce: Still a question](https://substackcdn.com/image/fetch/$s_!oTeq!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fa10e830e-ce48-4e67-a504-3293d312fd00_1924x1084.png)

![[#64] Innovation at the edges, stagnation at the core: Why India needs neobanks for true financial inclusion](https://substackcdn.com/image/fetch/$s_!mm8d!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F59900c72-7141-4304-bc8a-ce8c3fd63865_1688x944.png)

How soon can we get the 6th part :)